Kodak 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

65

Rochester, New York and the graphic arts and x-ray film sensitizing opera-

tions in Mexico to other Kodak locations.

The total restructuring charge for continuing operations recorded in

2002 for these initiatives that were implemented was $116 million, which

was composed of severance, inventory write-downs, long-lived asset

impairments and exit costs of $55 million, $7 million, $37 million and $17

million, respectively. The severance charge related to the elimination of

1,150 positions, including approximately 525 manufacturing and logistics,

300 service and photofinishing, 175 administrative and 150 research and

development positions. The geographic composition of the 1,150 positions

eliminated included approximately 775 in the United States and Canada

and 375 throughout the rest of the world. The charge for the long-lived

asset impairments includes the write-off of $13 million relating to equip-

ment used in the manufacture of cameras and printers, $13 million for

sensitized manufacturing equipment, $5 million for lab equipment used in

photofinishing and $6 million for other assets that were scrapped or aban-

doned immediately. The reduction of 1,150 positions and the $72 million

charge for severance and exit costs are reflected in the Fourth Quarter,

2002 Restructuring Program table below. These amounts exclude the

fourth quarter elimination of 150 positions and the restructuring charges

relating to the shutdown of Kodak Global Imaging, Inc., as these charges

were reflected in the loss from discontinued operations for the year ended

December 31, 2002.

During 2003, the Company recorded additional severance charges of

$21 million in continuing operations relating to 675 positions that were

contemplated under its Fourth Quarter, 2002 Restructuring Program,

including the relocation of Mexican sensitizing operations and the U.S.

one-time-use camera assembly operations. The 675 positions that were

eliminated included approximately 500 manufacturing and 175 admini-

strative positions. The geographic composition of the 675 positions includ-

ed approximately 425 in the U.S. and Canada and 250 throughout the rest

of the world. The reduction of 675 positions and the related severance

charges of $21 million are reflected in the Fourth Quarter, 2002

Restructuring Program table below. All actions anticipated under the

Fourth Quarter, 2002 Restructuring Program were completed in the third

quarter of 2003. A total of 1,825 positions were eliminated under the

Fourth Quarter, 2002 Restructuring Program.

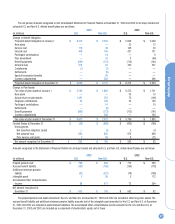

The following table summarizes the activity with respect to the sev-

erance and exit costs charges recorded in connection with the focused

cost reductions that were announced in the fourth quarter of 2002 and the

remaining balance in the related reserves at December 31, 2003:

(dollars in millions) Number of Employees Severance Reserve Exit Costs Reserve Total

Q4, 2002 charges 1,150 $ 55 $ 17 $ 72

Q4, 2002 utilization (250) (2) — (2)

Balance at 12/31/02 900 53 17 70

Q1, 2003 charges 450 16 — 16

Q1, 2003 utilization (850) (24) (2) (26)

Balance at 3/31/03 500 45 15 60

Q2, 2003 charges 25 1 — 1

Q2, 2003 utilization (500) (11) (4) (15)

Balance at 6/30/03 25 35 11 46

Q3, 2003 charges 200 4 — 4

Q3, 2003 utilization (225) (8) (2) (10)

Balance at 9/30/03 031940

Q4, 2003 utilization 0 (19) (1) (20)

Balance at 12/31/03 0 $ 12 $ 8 $ 20

The severance charges taken in 2003 of $21 million were reported in

restructuring costs and other in the accompanying Consolidated

Statement of Earnings for the year ended December 31, 2003. The sever-

ance and exit costs require the outlay of cash, while the inventory write-

downs and long-lived asset impairments represent non-cash items.

Severance payments will continue into 2004 since, in many instances, the

employees whose positions were eliminated can elect or are required to

receive their severance payments over an extended period of time. Most

exit costs are expected to be paid during 2004. However, certain costs,

such as long-term lease payments, will be paid over periods after 2004.

As a result of initiatives implemented under the Fourth Quarter, 2002

Restructuring Program, the Company recorded $24 million of accelerated

depreciation on long-lived assets in cost of goods sold in the accompany-

ing Consolidated Statement of Earnings for the year ended December 31,

2003. The accelerated depreciation relates to long-lived assets accounted

for under the held and used model of SFAS No. 144, and the full year

amount of $24 million was comprised of $15 million relating to equipment

used in the manufacture of cameras, $6 million for lab equipment used in

photofinishing and $3 million for sensitized manufacturing equipment that

was used until their abandonment in 2003.

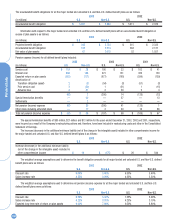

2001 Restructuring Programs

At December 31, 2002, the Company had remaining severance and exit

costs reserves of $67 million and $18 million, respectively, relating to the

restructuring plans it implemented during 2001. During the first quarter of

2003, the Company completed the severance actions associated with the

2001 Restructuring Programs and recorded a reversal of $12 million of

reserves through restructuring costs and other in the accompanying