Kodak 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

51

payable and other current liabilities in the accompanying Consolidated

Statement of Financial Position at each respective balance sheet date.

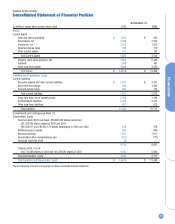

NOTE 3: INVENTORIES, NET

(in millions) 2003 2002

At FIFO or average cost

(approximates current cost)

Finished goods $ 818 $ 831

Work in process 302 322

Raw materials 317 301

1,437 1,454

LIFO reserve (362) (392)

Total $ 1,075 $ 1,062

Inventories valued on the LIFO method are approximately 41% and

47% of total inventories in 2003 and 2002, respectively. During 2003 and

2002, inventory usage resulted in liquidations of LIFO inventory quantities.

In the aggregate, these inventories were carried at the lower costs prevail-

ing in prior years as compared with the cost of current purchases. The

effect of these LIFO liquidations was to reduce cost of goods sold by $53

million and $31 million in 2003 and 2002, respectively.

The Company reduces the carrying value of inventories to a lower of

cost or market basis for those items that are potentially excess, obsolete

or slow-moving based on management’s analysis of inventory levels and

future sales forecasts. The Company also reduces the carrying value of

inventories whose net book value is in excess of market. Aggregate reduc-

tions in the carrying value with respect to inventories that were still on

hand at December 31, 2003 and 2002, and that were deemed to be

excess, obsolete, slow-moving or that had a carrying value in excess of

market, were $75 million and $65 million, respectively.

NOTE 4: PROPERTY, PLANT AND

EQUIPMENT, NET

(in millions) 2003 2002

Land $ 116 $ 123

Buildings and building improvements 2,680 2,658

Machinery and equipment 10,211 10,182

Construction in progress 270 325

13,277 13,288

Accumulated depreciation (8,183) (7,868)

Net properties $5,094 $5,420

Depreciation expense was $830 million, $818 million and $765 mil-

lion for the years 2003, 2002 and 2001, respectively, of which approxi-

mately $70 million, $19 million and $52 million, respectively, represented

accelerated depreciation in connection with restructuring actions.

NOTE 5: GOODWILL AND OTHER

INTANGIBLE ASSETS

Effective January 1, 2002, the Company adopted the provisions of SFAS

No. 142, “Goodwill and Other Intangible Assets,” under which goodwill is

no longer amortized, but is required to be assessed for impairment at

least annually. Goodwill was $1,384 million and $981 million at December

31, 2003 and 2002, respectively. The changes in the carrying amount of

goodwill by reportable segment for 2003 and 2002 were as follows:

Photo- Health Commercial Consolidated

(in millions) graphy Imaging Imaging Total

Balance at December 31, 2001 $ 669 $ 169 $ 110 $ 948

Goodwill related to acquisitions 19 1 6 26

Goodwill written off

related to disposals — — (17) (17)

Finalization of purchase accounting (1) 4 3 6

Currency translation adjustments 15 2 1 18

Balance at December 31, 2002 702 176 103 981

Goodwill related to acquisitions 30 350 — 380

Goodwill written off

related to disposals/divestitures (21) — (6) (27)

Finalization of purchase accounting 13 (2) — 11

Currency translation adjustments 17 15 7 39

Balance at December 31, 2003 $ 741 $ 539 $ 104 $1,384

The aggregate amount of goodwill acquired during 2003 of $380

million was attributable to $350 million for the purchase of PracticeWorks

within the Health Imaging segment, $16 million for the purchase of

Applied Science Fiction within the Photography segment and $14 million

related to additional acquisitions within the Photography segment. The

$21 million of goodwill written off in relation to disposals/divestitures dur-

ing 2003 for the Photography segment was attributable to the divesture of

Consumer Imaging Services (CIS) in Germany.

The aggregate amount of goodwill acquired during 2002 of $26 mil-

lion was attributable to acquisitions that are all individually immaterial.

The goodwill written off related to disposals during 2002 of $17 million

was attributable to the disposal of Kodak Global Imaging, Inc. within the

Commercial Imaging segment. The $17 million charge to earnings relating

to the write-off of goodwill is included in the loss from discontinued oper-

ations in the Consolidated Statement of Earnings. See Note 22,

“Discontinued Operations.”

The gross carrying amount and accumulated amortization by major

intangible asset category for 2003 and 2002 were as follows:

As of December 31, 2003

Gross Carrying Accumulated

(in millions) Amount Amortization Net

Technology-based $ 201 $ 76 $ 125

Customer-related 176 17 159

Other 14 4 10

Total $ 391 $ 97 $ 294

As of December 31, 2002

Gross Carrying Accumulated

Amount Amortization Net

Technology-based $ 132 $ 58 $ 74

Customer-related 47 9 38

Other 8 2 6

Total $ 187 $ 69 $ 118