Kimberly-Clark 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Kimberly-Clark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

(Continued)

Commentary:

2010 versus 2009

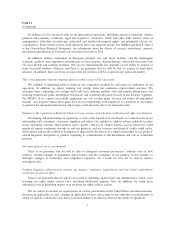

Percent Change in Net Sales Versus Prior Year

Total

Change

Changes Due To

Volume

Net

Price Currency

Mix/

Other

Consolidated ............................................. 3.3 1 1 — 1

Personal Care ............................................. 3.6 3 — — 1

Consumer Tissue .......................................... 1.4 (2) 2 — 1

K-C Professional & Other ................................... 3.4 1 2 — —

Health Care .............................................. 6.5 7 (2) 1 —

• Personal care net sales in North America increased about 4 percent due to an increase in sales volumes

and net selling prices of 3 percent and 1 percent, respectively. The sales volume increases resulted from

higher sales of feminine care and adult incontinence products, including benefits from innovation in the

U by Kotex, Poise and Depend brands and higher sales of training pants and baby wipes, partially offset

by lower sales of Huggies diapers.

In Europe, personal care net sales decreased about 2 percent due to unfavorable currency effects of

2 percent and a decrease in net selling prices of 1 percent, partially offset by increases in sales volumes

of 1 percent.

In K-C’s International operations in Asia, Latin America, the Middle East, Eastern Europe and Africa

(“K-C International”), net sales increased about 6 percent driven by a 5 percent increase in sales

volumes and a 1 percent favorable currency effect. The growth in sales volumes was broad-based, with

particular strength in Asia and Latin America, excluding Venezuela.

• Consumer tissue net sales in North America decreased 1 percent as an increase in net selling prices of

2 percent and improvements in product mix of 1 percent were more than offset by a sales volume

decline of 4 percent. Sales volumes were down low single-digits in bath tissue and double-digits in

paper towels, primarily as a result of continued consumer trade-down to lower-priced product offerings.

In Europe, consumer tissue net sales decreased 2 percent due to unfavorable currency effects of

2 percent and a decrease in sales volumes of 2 percent, partially offset by an increase in net selling

prices of 2 percent.

In K-C International, consumer tissue net sales increased about 8 percent due to an increase in net

selling prices of 4 percent, favorable currency effects of 2 percent and improvements in product mix of

1 percent. Increases in net selling prices were broad-based, with particular strength in Latin America and

Russia.

• K-C Professional’s net sales in North America increased 3 percent due to higher net selling prices of

about 2 percent and favorable currency effects of 1 percent. Volume comparisons benefited from the

Jackson Products, Inc. (“Jackson”) acquisition in 2009 and growth in the wiper and safety categories,

while washroom product volumes declined in a continued challenging economic environment. In

Europe, sales of K-C Professional products decreased 1 percent, as an increase in sales volumes of

3 percent was more than offset by unfavorable currency effects of 3 percent and lower net selling prices

of 1 percent.

• The increased sales volumes for health care products were primarily due to a 9 percent benefit from the

acquisition of I-Flow Corporation (“I-Flow”) in late November 2009, as well as volume increases in

17