Kimberly-Clark 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Kimberly-Clark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The dividend and market price data included in Item 8, Note 22 to the Consolidated Financial Statements

are incorporated in this Item 5 by reference.

Quarterly dividends have been paid continually since 1935. Dividends have been paid on or about the

second business day of January, April, July and October. The dividend reinvestment service of Computershare

Investor Services is available to our stockholders of record. This service makes it possible for our stockholders of

record to have their dividends automatically reinvested in common stock and to make additional cash

investments.

Kimberly-Clark common stock is listed on the New York Stock Exchange. The ticker symbol is KMB.

As of February 11, 2011, we had 27,955 holders of record of our common stock.

For information relating to securities authorized for issuance under equity compensation plans, see Part III,

Item 12 of this Form 10-K.

We repurchase shares of Kimberly-Clark common stock from time to time pursuant to publicly announced

share repurchase programs. During 2010, we purchased $800 million of our common stock. All our share

repurchases were made through a broker in the open market.

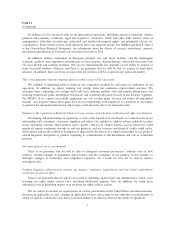

The following table contains information for shares repurchased during the fourth quarter of 2010. None of

the shares in this table was repurchased directly from any of our officers or directors.

Period (2010)

Total Number

of Shares

Purchased(1)

Average

Price Paid

Per Share

Total Number of

Shares Purchased

as Part of

Publicly

Announced Plans

or Programs

Maximum

Number of

Shares That

May Yet Be

Purchased

Under the

Plans or

Programs

October 1 to 31 ................................ 492,000 $65.54 29,724,411 20,275,589

November 1 to 30 .............................. 520,000 62.08 30,244,411 19,755,589

December 1 to 31 .............................. 567,000 62.50 30,811,411 19,188,589

Total .................................... 1,579,000

(1) All share repurchases between October 1, 2010 and December 31, 2010 were made pursuant to a share repurchase program authorized by

the Corporation’s Board of Directors on July 23, 2007, which allows for the repurchase 50 million shares in an amount not to exceed

$5.0 billion. In January 2011, the Board of Directors authorized an additional share repurchase program which provides for purchases up

to 50 million shares, in an amount not to exceed $5.0 billion.

During October, November and December 2010, we withheld for taxes the following shares from current or

former employees with respect to our stock-based compensation plans.

Month Shares Amount

October .................................................................. 20,565 $1,302,587

November ................................................................ 18,573 1,154,583

December ................................................................ ——

13