Kimberly-Clark 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Kimberly-Clark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The strength of our financial position continued to serve

us well.

We were encouraged that cash provided by operations rose about 4 percent

to $2.5 billion. Our cash flow allowed us to repurchase $625 million worth

of our shares during the year and to provide a top-tier dividend payout and

a strong yield. In fact, the 3.4 percent increase we have announced for 2009

marks the 37th consecutive year Kimberly-Clark has raised its dividend.

The health of our cash flow and balance sheet gave us ready access to

credit, and demand for our commercial paper remained steady, even amid

the financial market turbulence in the fourth quarter.

Cash flow funded our buy-out of the remaining interest from our minority

partner in the Andean region in early 2009 and also will be used to fulfill

our commitment to improve funding levels of our pension plans in 2009.

The road ahead

As we enter a new year, our success will require a shift in priorities. The effects

of the global economic weakness we experienced in 2008 will likely persist

throughout 2009. Consequently, we will be solidly focused on managing and

generating cash flow, and on margin improvement.

Meanwhile, we remain committed to doing the right things for the long-term

health of our business. Despite volatility in markets around the world, our

financial position remains solid. I’m confident we will emerge from this

challenging period strengthened—and in a position to generate growth for

the benefit of our shareholders.

For 137 years, Kimberly-Clark and its brands have been a vital part of

healthy, active lives the world over. We intend to remain “simply essential”

to consumers for many years to come.

Thomas J. Falk

Chairman and Chief Executive Officer

February 27, 2009

7

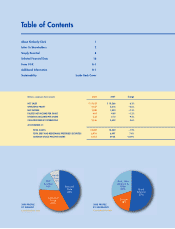

STRONG VOLUME GROWTH

IN BRICIT* COUNTRIES

2004 2005 2006 2007 2008

180

160

140

120

100

D&E Overall

BRICIT

2004 Volume Indexed to100.

*Brazil, Russia, India, China,

Indonesia, Turkey