KeyBank 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our fellow shareholders:

I am pleased to report that 2012 was a significant year for Key. Our balance

sheet continued to strengthen and grow, credit quality measures improved to

pre-financial crisis levels and we delivered on our strategic and financial goals.

In addition, and perhaps most noteworthy, we accomplished all of this while

navigating through the challenges of a weak economy and a prolonged low

rate environment, as well as ongoing regulatory changes.

Our relationship-based strategy, unique business model and geographic

footprint allow us to make progress despite these headwinds. In 2012, we

continued to leverage and build upon the alignment of our franchise across

business lines, sharpening our targeted focus on specific client segments

and industries while investing to enhance our capabilities. As a result, we

are a stronger, more focused company, building momentum and delivering

sustainable profitability as we pursue our long-term growth strategy.

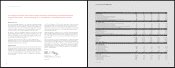

Full-year net income from continuing operations was $827 million, or $.88 per

diluted share, compared with $857 million, or $.92 per diluted share, in 2011.

Our results in 2012 were impacted by a lower level of reserve release as credit

costs normalized, as well as costs related to our strategic acquisitions and

efficiency initiative.

A year of accomplishment

Strong revenue growth. Revenue was up 4% for 2012 compared to the prior year

as loans grew, net interest margin improved and fees increased. In the fourth

quarter, Key grew revenue by 10%, and contrary to industry trends, expanded

net interest margin by 24 basis points from the same period one year ago.

Robust loan growth. Key’s strong loan growth reflects the strength of our

relationship strategy. Peer-leading growth in commercial and industrial (C&I)

loans was once again the primary driver of our overall loan portfolio, as

businesses increasingly turned to Key to meet their borrowing needs.

The C&I portfolio has been a consistent bright spot for Key, growing 21%

last year. Consumer loans also grew in 2012, driven by rising home equity

balances and increased loan and credit card balances from the acquisitions

of our Key-branded credit card portfolio and branches in Buffalo and

Rochester, New York.

Positive fee income results. Fees were another positive story for Key in 2012.

The Corporate Bank had a great year, increasing fees year-over-year by

emphasizing our relationship-based strategy and pursuing targeted clients

and industries with specific capabilities and expertise. Our Commercial Real

Estate Mortgage Banking group had its best year ever due to increasing loan

originations and fee income. It was also a record year for KeyBanc Capital

Markets, with strong fee growth from loan syndications, investment banking

and debt placement.

Strengthened credit quality. Net charge-offs declined by 36% in 2012

compared to the prior year. In the fourth quarter, net charge-offs were

$58 million or .44% of average loans, the best level since third quarter

2007. This is significant as we are now within our targeted range for

net charge-offs, and we will continue to be disciplined in our lending.

letter to shareholders

2012 KeyCorp Annual Review

Left: Beth Mooney, Chairman and Chief Executive Officer, collaborates with Chris Gorman (at left),

President, Corporate Bank, and Bill Koehler, President, Community Bank.

32