KeyBank 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

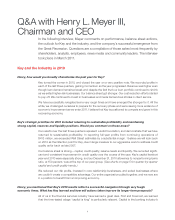

fortification against trouble. Obviously, under dire economic circumstances, measures of capital

adequacy had to be recalibrated. Key has significantly strengthened its capital levels over the last

two years, ranks in the upper tier of our peer group, and enters the nation’s recovery phase in a

favorable position.

Second, we learned a lot about risk management. Key is exiting noncore and riskier loan portfolios,

which produced revenues but proved to be much riskier than we want to tolerate. For example, we

have reduced commitments in our commercial real estate portfolio from approximately $23 billion at

year-end 2007 to $11 billion at December 31, 2010. We have also implemented a company-wide risk

awareness and training program that reaches each and every employee. We have defined our risk

tolerance levels, actively monitor a wider variety of activities, and have broadened our definition of

actively managed risk categories to include areas such as operational risk, market and reputation risk.

Key has also taken significant steps to improve liquidity and funding. Would you discuss those?

We have accomplished a significant change in the way we fund our lending activities. The crisis period

for the industry revealed a need to reduce our reliance on outside, wholesale funding sources that

can be more volatile and expensive. We now fund our portfolios primarily by gathering relationship

deposits. Diversifying our client base and adding new retail clients is contributing to that effort.

At year-end 2010, our loan-to-deposit ratio was 90 percent, reduced from approximately 120 percent

at year-end 2008. A level under 100 percent means that all of Key’s loans are being funded by Key’s

deposits. Obviously, that’s a very significant shift, and the benefit to the company is reduced funding

costs and greater liquidity to fund additional loans.

You said that Key has continued to invest in our businesses. How so?

While we worked to address recession-induced problems,

we kept our eye on the future, too. We continued to invest

in our businesses and sharpen our client service. Over

the last two years, we have opened 77 new branches.

Approximately 250 branches have been renovated since

beginning our remodeling program. We have invested in

online and mobile technology for our clients. We provided

extensive additional training for our people and added

expertise in specialty areas in both our Community Banking

and Corporate Banking organizations. Key has received a

series of top rankings in various customer service categories that began with being the only bank

among BusinessWeek magazine’s “Customer Service Champs” in 2009.

We believe that no other regional bank has a relationship-focused Community Bank coupled with the

capabilities and industry expertise found in our Corporate Bank. The breadth of Key’s products and

expertise is a competitive advantage. Aligning our business groups and executing, day in and day out,

is the goal.

CEO-elect Beth Mooney has organized all of Key’s businesses under these two groups, naming two

veteran Key leaders, Bill Koehler and Chris Gorman, to lead them. Bill and Chris have championed this

approach within their respective businesses. Bankers from across our organizations now participate

in joint calls and relationship reviews, working together to develop prospects and expand relationships.

More than 300,000 new checking accounts opened in 2010.