KeyBank 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 KeyCorp Annual Report

Focused on

STRENGTH,

Positioned for the Future.

Table of contents

-

Page 1

Focused on STRENGTH, Positioned for the Future. 2008 KeyCorp Annual Report -

Page 2

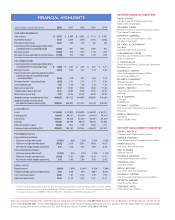

...) Cash dividends paid 1.00 Book value at year end 14.97 Tangible book value at year end 12.41 Market price at year end 8.52 Weighted average common shares (000) 450,039 Weighted average common shares and potential common shares (000) 450,039 AT DECEMBER 31, Loans Earning assets Total assets Deposits... -

Page 3

... 8 Relationship Strategy Strengthens Key Community Banking Loans and Deposits Increase from Maine to Alaska 12 Key at a Glance A Snapshot of Key's Business Units and Geographic Reach 15 Financial Review Management's Discussion & Analysis of Financial Condition & Results of Operations People... -

Page 4

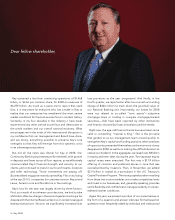

...all the news was dismal for Key in 2008. Our Community Banking businesses performed well, with growth in deposits and loans across all four regions, as we effectively communicated Key's ï¬nancial strength and security to our clients, and continued to invest in our branch teams, locations and teller... -

Page 5

...and essential points about our company and business strategy: • KeyCorp is well-equipped to withstand the economic downturn. As mentioned earlier, we achieved a net increase in deposits for the year. Deposits grew across our operating regions, reï¬,ecting depositor conï¬dence and trust in Key. On... -

Page 6

... affect Key? This past year, our losses primarily related to ï¬nancing homebuilders, as opposed to making mortgage loans to individuals or investing in complex mortgage securities. Over a year ago, we recognized that the economic impact of falling housing prices and a freezing of the credit markets... -

Page 7

...Key for tough times in four critical areas: We've raised capital so that we can operate from a solid position of strength; increased loan loss reserves to deal with a continuing slowdown in the credit markets; reduced our dividend payout to further conserve capital; and taken steps to closely manage... -

Page 8

...- INVESTMENTS IN THE COMMUNITY BANK Key's results in Community Banking businesses were a positive element of 2008 performance. How did the branch network achieve its results in such a tough market? Two things worked in our favor. First, our relationship strategy is well under way and our district... -

Page 9

... in New York State working out? That acquisition doubled Key's branch network in attractive communities outside New York City. I visited ofï¬ces in the Hudson Valley District last year and I watched with no small measure of pride how hard our team worked to fully integrate our processes and culture... -

Page 10

...own. Key's 14-state community banking operations, which now feature nearly 1,000 branches from Maine to Alaska, achieved solid results across its diverse network. Average loans and leases grew by 7 percent for the year, or $1.8 billion, while deposits increased 8 percent, or $3.6 billion. Net income... -

Page 11

... closely with teams in Key National Banking to provide commercial clients with a range of corporate banking services such as cash management, risk management, capital markets access and lease ï¬nancing. All the while, Key has deepened its community commitment. In Portland, for instance, KeyBank... -

Page 12

... exterior of the new Freedom Tower at Ground Zero in New York City. Above: (left to right) KeyBank District President Brian Rice, KeyBank Commercial Banking Relationship Manager John Wyatt and Benson Vice President and Chief Financial Ofï¬cer Peter Potwin meet at the company's facility in Portland... -

Page 13

... real relationships and showing that they value our community and the businesses here. KeyBank has been a wonderful addition to the Keizer community." On the way back from Keizer, Rice swings by Biztown, a model Main Street built inside a renovated warehouse. Biztown teaches real-life business... -

Page 14

....0 COMMUNITY BANKING OFFICES BY REGION y Northwest y Rocky Mountain y Great Lakes y Northeast Loan and deposit ï¬gures are average balances, in billions, for the year ended December 31, 2008. KEYCORP HONORS V Ranked 11th on the BusinessWeek/J. D. Power & Associates top 25 U.S. "Customer Service... -

Page 15

... relationship managers and specialists advise midsize businesses across the branch network. They offer a broad range of services, including commercial lending, cash management, equipment leasing, investment and employee beneï¬t programs, succession planning, capital markets, derivatives and foreign... -

Page 16

... a leader invested in the communities we serve. Moody's Investors Service "A1" rated* Standard & Poor's To our clients, old and new, thank you for your business. We stand strong, ready to serve you. Deposits now FDIC-insured1 up to $250,000. "A" rated* Fitch Ratings "A+" rated* Top Bank [ key... -

Page 17

... of business Forward-looking statements Long-term goals Corporate strategy Economic overview Critical accounting policies and estimates Highlights of Key's 2008 Performance Financial performance Strategic developments Line of Business Results Community Banking summary of operations National Banking... -

Page 18

...Line of Business Results"), which begins on page 88. In addition to the customary banking services of accepting deposits and making loans, KeyCorp's bank and trust company subsidiaries offer personal and corporate trust services, personal ï¬nancial services, access to mutual funds, cash management... -

Page 19

...business, ï¬nancial condition, results of operations, access to credit and the trading price of Key's common shares could all suffer a material decline. • The terms of the Capital Purchase Program ("CPP"), pursuant to which KeyCorp issued securities to the United States Department of the Treasury... -

Page 20

...primarily within the states where we have branches) that serve individuals, small businesses and middle market companies. In addition, we focus nationwide on businesses such as commercial real estate activities, investment management and equipment leasing. Management believes Key possesses resources... -

Page 21

... the regions in which its two major business groups, Community Banking and National Banking, operate. Key's Community Banking group serves consumers and small to mid-sized businesses by offering a variety of deposit, investment, lending and wealth management products and services. These products and... -

Page 22

... 100.0% $15,835 100.0% $9,846 100.0% Represents core deposit, commercial loan and home equity loan products centrally managed outside of the four Community Banking regions. Figure 18 on page 42 shows the diversity of Key's commercial real estate lending business based on industry type and location... -

Page 23

..., 2008. Derivatives and related hedging activities. Key uses interest rate swaps and caps to hedge interest rate risk for asset and liability management purposes. These derivative instruments modify the repricing characteristics of speciï¬ed on-balance sheet assets and liabilities. Key's accounting... -

Page 24

... unit. Key's reporting units for purposes of this testing are its major business segments, Community Banking and National Banking. Fair values of reporting units are estimated using discounted cash ï¬,ow models derived from internal earnings forecasts. The primary assumptions management uses include... -

Page 25

... it applied Key's critical accounting policies or developed related assumptions and estimates. HIGHLIGHTS OF KEY'S 2008 PERFORMANCE Financial performance For 2008, Key recorded a loss from continuing operations of $1.468 billion, or $3.36 per common share. This compares to income from continuing... -

Page 26

... businesses, consistent with the corporate strategy of focusing capital and resources on Key's best relationship customers. Key is in the process of exiting retail and ï¬,oor-plan lending for marine and recreational vehicle products, will limit new education loans to those backed by government... -

Page 27

... sale or trading Severance and other exit costs Net (losses) gains from principal investing U.S. taxes on accumulated earnings of Canadian leasing operation McDonald Investments branch network Gains related to MasterCard Incorporated shares Gain from settlement of automobile residual value insurance... -

Page 28

... book value at year end Market price at year end Dividend payout ratio Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) AT DECEMBER 31, Loans Earning assets Total assets Deposits Long-term debt Common shareholders' equity... -

Page 29

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES Figure 5 presents certain 2008 earnings data and performance ratios, excluding (credits) charges related to the leveraged lease tax litigation and goodwill impairment charges summarized below ... -

Page 30

... testing. During the third quarter of 2008, Key recorded an after-tax charge of $4 million, or $.01 per common share, as a result of goodwill impairment related to management's decision to limit new education loans to those backed by government guarantee. cease offering Payroll Online services... -

Page 31

...OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 6. MAJOR BUSINESS GROUPS - TAXABLE-EQUIVALENT REVENUE AND (LOSS) INCOME FROM CONTINUING OPERATIONS Year ended December 31, dollars in millions REVENUE FROM CONTINUING OPERATIONS (TE) Community Banking(a) National Banking... -

Page 32

... loan losses Noninterest expense Income before income taxes (TE) Allocated income taxes and TE adjustments Net income Percent of consolidated income from continuing operations AVERAGE BALANCES Loans and leases Total assets Deposits Assets under management at period end (a) Change 2008 vs 2007 2008... -

Page 33

... in the fair values of certain real estate-related investments held by the Private Equity unit within the Real Estate Capital and Corporate Banking Services line of business. These reductions were offset in part by increases in foreign exchange income and investment banking income. The decline in... -

Page 34

... pursue opportunities to improve Key's business mix and credit risk proï¬le, and to emphasize relationship businesses. During the third quarter of 2008, management decided to exit retail and ï¬,oor-plan lending for marine and recreational vehicle products, and to limit new education loans to those... -

Page 35

... agreement with Federal National Mortgage Association" on page 114. In June 2008, Key transferred $384 million of commercial real estate loans ($719 million, net of $335 million in net charge-offs) from the held-to-maturity loan portfolio to held-for-sale status as part of a process undertaken to... -

Page 36

... Banking Total consumer loans Total loans Loans held for sale Securities available for sale(a),(e) Held-to-maturity securities(a) Trading account assets Short-term investments Other investments(e) Total earning assets Allowance for loan losses Accrued income and other assets Total assets LIABILITIES... -

Page 37

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES 2005 Average Balance Interest Yield/ Rate Average Balance 2004 Interest Yield/ Rate Average Balance 2003 Interest Yield/ Rate Compound Annual Rate of Change (2003-2008) Average Balance ... -

Page 38

... available for sale Held-to-maturity securities Trading account assets Short-term investments Other investments Total interest income (TE) INTEREST EXPENSE NOW and money market deposit accounts Savings deposits Certiï¬cates of deposit ($100,000 or more) Other time deposits Deposits in foreign... -

Page 39

... Year ended December 31, dollars in millions Brokerage commissions and fee income Personal asset management and custody fees Institutional asset management and custody fees Total trust and investment services income 2008 $159 158 221 $538 2007 $125 165 200 $490 2006 $235 156 162 $553 Change 2008 vs... -

Page 40

... & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 13. ASSETS UNDER MANAGEMENT December 31, dollars in millions Assets under management by investment type: Equity Securities lending Fixed income Money market Hedge funds Total Proprietary mutual funds included... -

Page 41

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES of net losses from loan sales and write-downs recorded during the ï¬rst quarter, due primarily to volatility in the ï¬xed income markets and the related housing correction. Approximately $84... -

Page 42

...exempt income from corporate-owned life insurance increased. The effective tax rate also changed from 2007 to 2008 because of changes in the tax circumstances pertaining to certain foreign leasing operations described in Note 17. On an adjusted basis, the effective tax rates for the past three years... -

Page 43

...tax-advantaged assets such as corporate-owned life insurance, earns credits associated with investments in low-income housing projects, and records tax deductions associated with dividends paid to Key's common shares held in the 401(k) savings plan. FINANCIAL CONDITION Loans and loans held for sale... -

Page 44

.... Key's commercial real estate lending business is conducted through two primary sources: a 14-state banking franchise, and Real Estate Capital and Corporate Banking Services, a national line of business that cultivates relationships both within and beyond the branch system. This line of business... -

Page 45

... the transfer of $3.284 billion of education loans from held-for-sale status to the loan portfolio, and sales of commercial real estate loans. At December 31, 2008, Key's loans held for sale included $273 million of commercial mortgage loans. In the absence of quoted market prices, management uses... -

Page 46

... the past several years have improved Key's ability under favorable market conditions to originate and sell new loans, and to securitize and service loans generated by others, especially in the area of commercial real estate. During 2008, Key sold $2.244 billion of commercial real estate loans, $802... -

Page 47

... share) during the ï¬rst quarter of 2007. This net loss was previously recorded in "net unrealized losses on securities available for sale" in the accumulated other comprehensive income component of shareholders' equity. In addition to changing market conditions, the size and composition of Key... -

Page 48

...traded in the secondary markets. FIGURE 23. MORTGAGE-BACKED SECURITIES BY ISSUER December 31, in millions Federal Home Loan Mortgage Corporation Federal National Mortgage Association Government National Mortgage Association Total During 2008, net gains from Key's mortgage-backed securities totaled... -

Page 49

... basis using the statutory federal income tax rate of 35%. Excludes $8 million of securities at December 31, 2008, that have no stated yield. Other investments Most of Key's other investments are not traded on a ready market. Management determines the fair value at which these investments should... -

Page 50

... limitations, funds are periodically transferred back to the checking accounts to cover checks presented for payment or withdrawals. As a result of this program, average deposit balances for 2008 include demand deposits of $8.301 billion that are classiï¬ed as money market deposit accounts... -

Page 51

...change in shareholders' equity over the past three years are shown in the Consolidated Statements of Changes in Shareholders' Equity presented on page 75. Common shares outstanding KeyCorp's common shares are traded on the New York Stock Exchange under the symbol KEY. At December 31, 2008: • Book... -

Page 52

...limit new education loans to those backed by government guarantee were made in accordance with this strategy. Capital adequacy Capital adequacy is an important indicator of ï¬nancial stability and performance. Key's ratio of total shareholders' equity to total assets was 10.03% at December 31, 2008... -

Page 53

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES 10.00% for total capital, 6.00% for Tier 1 capital and 5.00% for the leverage ratio. If these provisions applied to bank holding companies, Key would qualify as "well capitalized" at December ... -

Page 54

...an interest-only strip, residual asset, servicing asset or security. Key reports servicing assets in "accrued income and other assets" on the balance sheet. All other retained interests are accounted for as debt securities and classiï¬ed as securities available for sale. By retaining an interest in... -

Page 55

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES by the securitized loans become inadequate to service the obligations of the trusts, the investors in the asset-backed securities would have no further recourse against Key. Additional ... -

Page 56

... not be as high as the return that would have been generated had payments been received over the original term of the loan. Deposits that can be withdrawn on demand also present option risk. RISK MANAGEMENT Overview Like other ï¬nancial services companies, Key engages in business activities with... -

Page 57

...on loans and securities, and loan and deposit growth. Simulation analysis produces only a sophisticated estimate of interest rate exposure based on assumptions and judgments related to balance sheet growth, customer behavior, new products, new business volume, product pricing, the behavior of market... -

Page 58

... days, or three to four times each quarter. Key manages exposure to market risk in accordance with VAR limits for trading activity that have been approved by the Risk Capital Committee. At December 31, 2008, the aggregate one-day trading limit set by the committee was $6.9 million. Key is operating... -

Page 59

... 2008, cash generated from the issuance of common shares and preferred stock, and the net issuance of long-term debt was used to fund the growth in portfolio loans. A portion was also deposited in interestbearing accounts with the Federal Reserve. During 2007, Key used short-term borrowings to pay... -

Page 60

... service its debt; support customary corporate operations and activities (including acquisitions) at a reasonable cost, in a timely manner and without adverse consequences; and pay dividends to shareholders. Management's primary tool for assessing parent company liquidity is the net short-term cash... -

Page 61

... the parent company or KeyBank to effect future offerings of securities that would be marketable to investors at a competitive cost. Current conditions in the capital markets are not normal, and for regional banking institutions such as Key, access to the capital markets for unsecured term debt... -

Page 62

... & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES Credit risk management Credit risk is the risk of loss arising from an obligor's inability or failure to meet contractual payment or performance terms. Like other ï¬nancial service institutions, Key makes loans... -

Page 63

...the Real Estate Capital and Corporate Banking Services line of business. The U.S.B. Holding Co., Inc. acquisition, deterioration in the marine lending portfolio (which experienced a higher level of net charge-offs as repossessions continue to rise) and the March 2008 transfer of education loans from... -

Page 64

...26.6 100.0% dollars in millions Commercial, ï¬nancial and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease ï¬nancing Total commercial loans Real estate - residential mortgage Home equity: Community Banking National Banking Total home equity loans Consumer... -

Page 65

... mortgage Real estate - construction Commercial lease ï¬nancing Total commercial loans Home equity - Community Banking Home equity - National Banking Marine Education Other Total consumer loans Total net loan charge-offs Net loan charge-offs to average loans from continuing operations (a) 2008... -

Page 66

...net charge-offs) from the loan portfolio to held-for-sale status. See Figure 18 and the accompanying discussion on page 42 for more information related to Key's commercial real estate portfolio. On March 31, 2008, Key transferred $3.284 billion of education loans from loans held for sale to the loan... -

Page 67

...335 million in net charge-offs) from the loan portfolio to held-for-sale status. Primarily investments held by the Private Equity unit within Key's Real Estate Capital and Corporate Banking Services line of business. (c) As shown in Figure 39, the growth in nonperforming assets during 2008 was due... -

Page 68

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 40. EXIT LOAN PORTFOLIO Net Loan Charge-offs from July 1, 2008 to December 31, 2008 $105 -(a) 105 14 119 73 29 41 7 150 $269 Balance on Nonperforming Status at December 31, 2008 $254 88... -

Page 69

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 42. SUMMARY OF CHANGES IN NONPERFORMING LOANS 2008 Quarters in millions BALANCE AT BEGINNING OF PERIOD Loans placed on nonaccrual status Charge-offs Loans sold Payments Transfers to ... -

Page 70

...Cash dividends paid Book value at period end Tangible book value at period end Market price: High Low Close Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) AT PERIOD END Loans Earning assets Total assets Deposits Long-term... -

Page 71

...and lowered the cost of borrowings. Also, net losses attributable to investments made by the Private Equity unit within Key's Real Estate Capital and Corporate Banking Services line of business rose by $9 million, and letter of credit and loan fees decreased by $16 million as a result of weakness in... -

Page 72

... present fairly Key's ï¬nancial position, results of operations and cash ï¬,ows in all material respects. Management is responsible for establishing and maintaining a system of internal control that is designed to protect Key's assets and the integrity of its ï¬nancial reporting. This corporate... -

Page 73

... the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of KeyCorp as of December 31, 2008 and 2007, and the related consolidated statements of income, changes in shareholders' equity, and cash ï¬,ows for each of the three years in the period... -

Page 74

...REGISTERED PUBLIC ACCOUNTING FIRM Shareholders and Board of Directors KeyCorp We have audited the accompanying consolidated balance sheets of KeyCorp and subsidiaries as of December 31, 2008 and 2007, and the related consolidated statements of income, changes in shareholders' equity, and cash ï¬,ows... -

Page 75

... SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, in millions, except share data ASSETS Cash and due from banks Short-term investments Trading account assets Securities available for sale Held-to-maturity securities (fair value: $25 and $28) Other investments Loans, net of unearned income of... -

Page 76

... Year ended December 31, dollars in millions, except per share amounts INTEREST INCOME Loans Loans held for sale Securities available for sale Held-to-maturity securities Trading account assets Short-term investments Other investments Total interest income INTEREST EXPENSE Deposits Federal funds... -

Page 77

... adjustments Net pension and postretirement beneï¬t costs, net of income taxes Total comprehensive income Deferred compensation Cash dividends declared on common shares ($1.835 per share) Common shares reissued for stock options and other employee beneï¬t plans Common shares repurchased BALANCE AT... -

Page 78

... from sales of other real estate owned NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES FINANCING ACTIVITIES Net increase in deposits Net (decrease) increase in short-term borrowings Net proceeds from issuance of long-term debt Payments on long-term debt Purchases of treasury shares Net proceeds... -

Page 79

... on trading account assets are reported in "investment banking and capital markets income" on the income statement. SECURITIES Securities available for sale. These are securities that Key intends to hold for an indefinite period of time but that may be sold in response to changes in interest rates... -

Page 80

...residuals. Relationships with a number of equipment vendors gives the asset management team insight into the life cycle of the leased equipment, pending product upgrades and competing products. In accordance with SFAS No. 13, "Accounting for Leases," residual values are reviewed at least annually to... -

Page 81

...days past due. Key's charge-off policy for consumer loans is similar, but takes effect when the payments are 120 days past due. Home equity and residential mortgage loans generally are charged down to the fair value of the underlying collateral when payment is 180 days past due. Management estimates... -

Page 82

... income and other assets" on the balance sheet. Key services primarily mortgage and education loans. Servicing assets at December 31, 2008, include $242 million related to commercial mortgage loan servicing and $23 million related to education loan servicing. Servicing assets are evaluated quarterly... -

Page 83

... systems applications that support corporate and administrative operations. Software development costs, such as those related to program coding, testing, configuration and installation, are capitalized and included in "accrued income and other assets" on the balance sheet. The resulting asset... -

Page 84

...'s valuation occurs quarterly. Assets and liabilities are considered to be fair valued on a nonrecurring basis if the fair value measurement of the instrument does not necessarily result in a change in the amount recorded on the balance sheet. GUARANTEES Key's accounting policies related to certain... -

Page 85

...presented on the income statement as a cumulative effect of a change in accounting principle. Key's cumulative after-tax adjustment increased first quarter 2006 earnings by $5 million, or $.01 per diluted common share. Second, prior to the adoption of SFAS No. 123R, total compensation cost for stock... -

Page 86

... held-to-maturity. This Staff Position is effective for reporting periods ending after December 15, 2008 (December 31, 2008, for Key) and shall be applied prospectively. The adoption of this accounting guidance did not have a material effect on Key's financial condition or results of operations. 84 -

Page 87

...effect on Key's financial condition or results of operations. Accounting for transfers of financial assets and repurchase financing transactions. In February 2008, the FASB issued Staff Position No. FAS 140-3, "Accounting for Transfers of Financial Assets and Repurchase Financing Transactions." This... -

Page 88

... SHARE Key's basic and diluted earnings per common share are calculated as follows: Year ended December 31, dollars in millions, except per share amounts EARNINGS (Loss) income from continuing operations before cumulative effect of accounting change Loss from discontinued operations, net of taxes... -

Page 89

... institutional businesses, including Institutional Equities and Equity Research, Debt Capital Markets and Investment Banking. In addition, KeyBank continues to operate the Wealth Management, Trust and Private Banking businesses. On April 16, 2007, Key changed the name of the registered broker-dealer... -

Page 90

... deposit, investment and credit products, and business advisory services. Regional Banking also offers financial, estate and retirement planning, and asset management services to assist high-net-worth clients with their banking, trust, portfolio management, insurance, charitable giving and related... -

Page 91

...commercial lending, treasury management, investment banking, derivatives, foreign exchange, equity and debt underwriting and trading, and syndicated finance products and services to large corporations and middle-market companies. Through its Victory Capital Management unit, Institutional and Capital... -

Page 92

... (NATIONAL BANKING LINES OF BUSINESS) Real Estate Capital and Corporate Banking Services 2008 $ 574 662 310 $ 2007 691 322 381 $ 2006 792 27 331 Year ended December 31, dollars in millions Total revenue (TE) Provision for loan losses Noninterest expense (Loss) income from continuing operations Net... -

Page 93

... KeyBank in the form of cash. At December 31, 2008, KeyCorp held $4.756 billion in short-term investments, the funds from which can be used to pay dividends, service debt and finance corporate operations. Federal law also restricts loans and advances from bank subsidiaries to their parent companies... -

Page 94

... relates to fixed-rate collateralized mortgage obligations, which Key invests in as part of an overall asset/liability management strategy. Since these instruments have fixed interest rates, their fair value is sensitive to movements in market interest rates. During 2008, interest rates generally... -

Page 95

... mortgage Real estate - construction Commercial lease financing Real estate - residential mortgage Home equity Education Automobile Total loans held for sale (a) 2008 $ 102 273 164 7 77 - 401(a) 3 $1,027 $ 2007 250 1,219 35 1 47 1 3,176 7 Changes in the liability for credit losses on lending... -

Page 96

... sold, but still serviced by Key. Related delinquencies and net credit losses are also presented. December 31, Loan Principal in millions Education loans managed Less: Loans securitized Loans held for sale or securitization(a) Loans held in portfolio (a) Loans Past Due 60 Days or More 2008 $249 163... -

Page 97

... to earn asset management fees. The funds' assets primarily are investments in LIHTC operating partnerships, which totaled $227 million at December 31, 2008. These investments are recorded in "accrued income and other assets" on the balance sheet and serve as collateral for the funds' limited... -

Page 98

... the Community Banking line of business, Key has made investments directly in LIHTC operating partnerships formed by third parties. As a limited partner in these operating partnerships, Key is allocated tax credits and deductions associated with the underlying properties. Management has determined... -

Page 99

...investments held by the Private Equity unit within Key's Real Estate Capital and Corporate Banking Services line of business. 10. GOODWILL AND OTHER INTANGIBLE ASSETS Key's total intangible asset amortization expense was $31 million for 2008, $23 million for 2007 and $21 million for 2006. Estimated... -

Page 100

... of goodwill resulting from annual impairment testing Impairment of goodwill related to cessation of private education lending program Adjustment to Austin Capital Management goodwill Acquisition of Tuition Management Systems goodwill BALANCE AT DECEMBER 31, 2008 Community Banking $565 - - $565... -

Page 101

... continuing operations. Key has several programs through KeyCorp and KeyBank that support short-term financing needs. In addition, certain KeyCorp subsidiaries maintain credit facilities with third parties, which provide alternative sources of funding in light of current market conditions. KeyCorp... -

Page 102

...debt consists primarily of nonrecourse debt collateralized by leased equipment under operating, direct financing and sales-type leases. Long-term advances from the Federal Home Loan Bank had weighted-average interest rates of 5.18% at December 31, 2008, and 5.40% at December 31, 2007. These advances... -

Page 103

... that allows bank holding companies to continue to treat capital securities as Tier 1 capital, but imposed stricter quantitative limits that take effect April 1, 2009. Management believes the new rule will not have any material effect on Key's financial condition. Capital Securities, Net of Discount... -

Page 104

... most recent notification that would cause KeyBank's capital classification to change. Bank holding companies are not assigned to any of the five capital categories applicable to insured depository institutions. However, if those categories applied to bank holding companies, management believes Key... -

Page 105

... fair market value of Key's common shares on the grant date. Management determines the fair value of options granted using the Black-Scholes option-pricing model. This model was originally developed to determine the fair value of exchange-traded equity options, which (unlike employee stock options... -

Page 106

... option life Future dividend yield Historical share price volatility Weighted-average risk-free interest rate 2008 5.9 years 5.80% .284 3.6% 2007 7.0 years 4.04% .231 4.9% 2006 6.0 years 3.79% .199 5.0% Key's annual stock option grant to executives and certain other employees generally occurs... -

Page 107

... grant date. The change did not have a material effect on Key's financial condition or results of operations. Unlike time-lapsed and performance-based restricted stock, performance shares payable in stock and those payable in cash for over 100% of targeted performance do not pay dividends during the... -

Page 108

... of this accounting change, Key recorded an after-tax charge of $7 million to the retained earnings component of shareholders' equity in the fourth quarter of 2008. The components of net pension cost and the amount recognized in other comprehensive income for all funded and unfunded plans are as... -

Page 109

...Expected return on plan assets The (shortage) excess of the fair value of plan assets (under) over the projected benefit obligation. At December 31, 2008, Key's primary qualified cash balance pension plan was sufficiently funded under the requirements of the Employee Retirement Income Security Act... -

Page 110

... of an annual reassessment of current and expected future capital market returns, management deemed a rate of 8.25% to be more appropriate in estimating 2009 pension cost. This change will increase 2009 net pension cost by approximately $4 million. The investment objectives of the pension funds are... -

Page 111

... employees receiving benefits under Key's Long-Term Disability Plan will no longer be eligible for health care and life insurance benefits. Management estimates the expected returns on plan assets for VEBA trusts much the same way it estimates returns on Key's pension funds. The primary investment... -

Page 112

..., on the balance sheet, are as follows: December 31, in millions Provision for loan losses Other Total deferred tax assets Leasing income reported using the operating method for tax purposes Net unrealized securities gains Other Total deferred tax liabilities Net deferred tax liabilities 2008 $ 782... -

Page 113

... tax rate State income tax, net of federal tax benefit Amortization of nondeductible intangibles Tax-exempt interest income Corporate-owned life insurance income Tax credits Reduced tax rate on lease income Reduction of deferred tax asset Increase in tax reserves Other Total income tax expense 2008... -

Page 114

... Change in the Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction." Management's assessments of Key's tax position on the LILO/SILO transactions resulted in a change to the amount of unrecognized tax benefits during the first, second and fourth quarters of 2008... -

Page 115

... Home equity Commercial real estate and construction Total loan commitments When-issued and to be announced securities commitments Commercial letters of credit Principal investing commitments Liabilities of certain limited partnerships and other commitments Total loan and other commitments 2008... -

Page 116

... mortgage loan. Return guarantee agreement with LIHTC investors. KAHC, a subsidiary of KeyBank, offered limited partnership interests to qualified investors. Partnerships formed by KAHC invested in low-income residential rental properties that qualify for federal low income housing tax credits... -

Page 117

... derivatives and equity derivatives. Generally, these instruments help Key manage exposure to market risk, mitigate the credit risk inherent in the loan portfolio, and meet client financing and hedging needs. Market risk represents the possibility that economic value or net interest income will be... -

Page 118

... with clients. ASSET AND LIABILITY MANAGEMENT Fair value hedging strategies. Key uses interest rate swap contracts to modify its exposure to interest rate risk. For example, Key uses contracts known as "receive fixed/pay variable" swaps to convert specific fixedrate deposits and long-term debt... -

Page 119

... Key also uses "pay fixed/receive variable" interest rate swaps to manage the interest rate risk associated with anticipated sales or securitizations of certain commercial real estate loans. These swaps protect against a possible short-term decline in the value of the loans that could result... -

Page 120

... of quoted market prices, management determines the fair value of Key's assets and liabilities using valuation models or third-party pricing services. Both of these approaches rely on market-based parameters when available, such as interest rate yield curves, option volatilities and credit spreads... -

Page 121

...Valuations of private equity and mezzanine investments, held primarily within Key's Real Estate Capital and Corporate Banking Services line of business, are based primarily on management's judgment because of the lack of readily determinable fair values, inherent illiquidity and the long-term nature... -

Page 122

... RECURRING BASIS Short-term investments Trading account assets Securities available for sale Other investments Derivative assets Accrued income and other assets Total assets on a recurring basis at fair value LIABILITIES MEASURED ON A RECURRING BASIS Federal funds purchased and securities sold under... -

Page 123

...fourth quarter of 2008, Key transferred $285 million of commercial loans from held for sale to the loan portfolio at their current fair value. Other real estate owned and other repossessed properties are valued based on appraisals and third-party price opinions, less estimated selling costs. Assets... -

Page 124

... Cash and short-term investments(a) Trading account assets(b) Securities available for sale(b) Held-to-maturity securities(c) Other investments(d) Loans, net of allowance(e) Loans held for sale(e) Servicing assets(f) Derivative assets(g) LIABILITIES Deposits with no stated maturity(a) Time deposits... -

Page 125

...-term debt with subsidiary trusts Interest on other borrowed funds Personnel and other expense Income before income tax benefit and equity in net (loss) income less dividends from subsidiaries Income tax benefit Cumulative effect of accounting change, net of taxes (see Note 1) Equity in net (loss... -

Page 126

... of common shares Tax benefits (under) over recognized compensation cost for stock-based awards Cash dividends paid NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES NET INCREASE (DECREASE) IN CASH AND DUE FROM BANKS CASH AND DUE FROM BANKS AT BEGINNING OF YEAR CASH AND DUE FROM BANKS AT END... -

Page 127

... access to useful information and shareholder services, including live webcasts of management's quarterly earnings discussions. ONLINE www.key.com/IR BY TELEPHONE Corporate Headquarters (216) 689-6300 Investor Relations (216) 689-4221 Media Relations (216) 828-7416 Financial Reports Request Line... -

Page 128

® Form# 77-7700KC