Kenwood 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Kenwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management

Policy

Principal Management Policy

From reconstruction to rebirth

During the fiscal year ended March 2003, Kenwood did its utmost

to implement restructuring across the company, aiming to eliminate

the negative net worth that was booked in the previous fiscal year.

In June 2002, the entire executive management team was replaced

by a newly created management board. On July 11, 2002, the

new management team launched the Kenwood Revitalization

Action Plan (announced on the same day).

Kenwood Revitalization Action Plan and its results

The Kenwood Revitalization Action Plan calls for eliminating the

negative net worth, which stood at 17 billion yen on a consolidated

basis by the end of fiscal 2003, through the three reforms

described below.

Afterward, financial institutions and investors helped the

Company increase its capital by some 27 billion yen, which allowed

us to eliminate the negative net worth as of December 27, 2002.

The Kenwood Revitalization Action Plan also generated more

positive effects than expected.

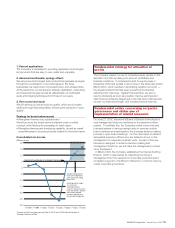

1. Reform of business structure: phasing out of unprofitable

operations

• The Home Electronics Business effectively turned a profit in the

latter half of the fiscal year, excluding restructuring costs, through

a change in product strategies, reduction of marketing territories,

concentration of manufacturing bases and cutback in personnel.

• The Company completed to terminate production and sales of

PDC terminals in November 2002, by drastically scaling down

operations of manufacturing base Kenwood Yamagata

Corporation as scheduled.

Through these moves, the Company established a management

framework that centers on the three core businesses: car

electronics, home electronics and wireless radio.

2. Overhaul of cost structure: reduction in consolidated fixed

costs and production costs

• In its sweeping overhaul of its production structure, the Company

has completed divestment of production plants in Mexico and

Huizhou (China), closure of a factory in Hungary as well as scaling

down of its operations at plants in Yamagata (Japan), France and

Singapore, as part of the Kenwood Revitalization Action Plan.

These moves, combined with further personnel cuts at a Malaysian

plant, enabled to further reduce production and fixed costs.

• In an effort to drastically overhaul the sales structure, the

Company succeeded in reducing selling, general and

administrative expenses at home by 30%, by consolidating sales

offices, cutting staff and introducing a sales agent system.

Outside Japan, it integrated sales firms in the Americas into a

single corporation, while setting up regional supervisory offices in

Europe and Asia.

• Meanwhile, Kenwood itself began to cut employees' salaries by

15% in October, while reducing outsourcing fees paid to

domestic affiliates. It consolidated its 19 Japanese affiliates (as of

the end of March 2002) into 12.

Through these efforts, the Kenwood Group reduced 3,965 workers

(45% of the total 8,820 at the end of March 2002), considerably

more than the 3,000 target of the Kenwood Revitalization Action

Plan. Consequently, it reduced consolidated fixed costs by 11.7

billion yen, approximately 10% more than the plan's goal.

3. Management reforms: enhancement of management

framework and transparency

• The Company has revamped its management framework after

the general shareholders' meeting in June 2002, through

adoption of the executive officer system, streamlining of the

corporate organization, a drastic rejuvenation of the management

teams at affiliated firms in Japan and overseas, as well as a full-

scale introduction of a framework for consolidation.

Reform of financial structure: elimination of negative net

worth by capital increase

Our rebuilding measures are steadily progressing, which was

favorably accepted by all concerned. Consequently, we could

boost capital by some 2 billion yen at the end of October 2002

through a third-party allocation of new shares. After an

extraordinary shareholders meeting on December 10, 2002, The

Asahi Bank, Ltd. (present Resona Holdings, Inc.) undertook on

December 27, 2002 a debt-for-equity swap amounting to 25 billion

yen through an issuance of preferred stock. Owing to these capital

increase measures, the Company could eliminate its negative net

worth (both on a consolidated and non-consolidated basis) — our

largest pending matter — by the end of 2002. As a result, we

resolved the most important issue in the reform of our financial

structure. The Company will repay its credits on an appropriate

schedule, aiming to achieve a zero net-debt level in the medium-

range term.

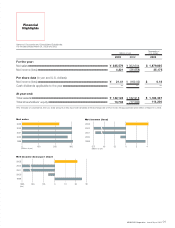

Fiscal year ended March 2003: net balance shows first profit

in four years while marking a "V-shaped" recovery —

Consolidated net income hits record high

In the fiscal year ended March 2003, the Company proceeded with

various reconstruction measures at a faster pace than originally

scheduled, and posted a sharp rise in operating and ordinary

income from the previous fiscal year, and further progressed its

structural reform. This strong performance offset the adverse

factors causing corporate earnings to deteriorate, including a

weakened stock market, deflation taking root, the Iraq war, and the

04 KENWOOD Corporation Annual Report 2003