Kenwood 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Kenwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

02 KENWOOD Corporation Annual Report 2003

To Shareholders

The business climate of Kenwood Corporation

remained harsh due to weakened capital investment

and consumer spending, amid the prolonged sluggish

economy and falling stock prices, as well as the

ongoing deflation in Japan and abroad.

Under these circumstances, the Company booked an

extraordinary loss of 27.9 billion yen in the fiscal year

ended March 2002 due to a valuation loss on

investment securities as well as losses on sales of

investment securities, disposal of inventories and fixed

assets — dormant assets that had no effects on cash

and cash equivalents. As a result, the Company had a

negative net worth of 17 billion yen by the end of March

2002.

Considering the situation extremely grave, the

Company reshuffled the entire executive management

team in June 2002, creating a wholly new management

board. On July 11, 2002, the new management team

announced its Kenwood Revitalization Action Plan that

focuses on a sweeping reform of the Kenwood's

corporate and cost structures. Since then, the

Company has been implementing the plan.

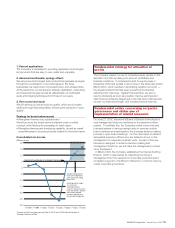

Under the plan, the Company proceeded with

drastic, epochal reorganizations, including: structural

streamlining of the home electronics business, whereby

a stand-alone profitability was secured for this segment;

terminating the cellular phone business operations with

no outlook of fresh demand; liquidating other

unprofitable businesses; shutting down and

consolidating production facilities and sales bases in

Japan and elsewhere; reducing approximately 45% of

its global employee workforce; realigning affiliated firms;

and cutting material as well as other costs.

The Company moved ahead with the measures in the

action plan, completing its downsizing and other

measures by the end of September 2002.

In the course of these voluntary restructuring

activities, The Asahi Bank, Ltd. (present Resona

Holdings, Inc.), which has always been a true believer in

the Company, undertook a debt-for-equity swap

amounting to 25 billion yen in an effort to rebuild the

manufacturing industry. Concurrently, we were able to

receive further support from other banks we do

business with in finalizing special arrangements for a

three-year repayment period.

Also noteworthy was the fact that a third party

allotment totaling some 2 billion yen was provided by

our major shareholder SPARX Asset Management Co.,

Ltd. who has shown continuing interest in Kenwood's

potential, as well as Merrill Lynch Investment Managers

Co., Ltd. With this unprecedented simultaneous debt-

for-equity swap and capital increase by allotting these

new shares, the Company's capital grew by

approximately 27 billion yen.

As a result, the Company could eliminate the negative

net worth by the end of 2002. Taking this opportunity,

we would like to express our deep gratitude to all

concerned.

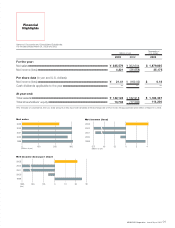

In the fiscal year ended March 2003, overseas sales

of car electronics products were brisk, which, however,

was offset by negative factors, including the sluggish

domestic economy, as well as the effects of phasing

out the personal digital cellular (PDC) terminal business

and the home electronics operations in Asia. As a

result, consolidated net sales dropped 25.5%, year on

year, to 225.6 billion yen from 302.6 billion yen for the

previous fiscal year.

Meanwhile, operating income doubled to top 12.3

billion yen, a sharp rise of 6.2 billion yen from a year

earlier. The favorable performance is attributable to

substantially strong results from the three core

operations, with the car electronics business expanding