Johnson and Johnson 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Analysis of Sales by Business Segments

Consumer Segment

Consumer segment sales in 2013 were $14.7 billion, an increase of 1.7% from 2012, which included 2.8% operational

growth and a negative currency impact of 1.1%. U.S. Consumer segment sales were $5.2 billion, an increase of 2.3%.

International sales were $9.5 billion, an increase of 1.4%, which included 3.1% operational growth and a negative

currency impact of 1.7%.

Major Consumer Franchise Sales:*

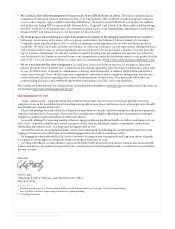

% Change

(Dollars in Millions) 2013 2012 2011 ’13 vs. ’12 ’12 vs. ’11

OTC $4,028 3,766 3,740 7.0% 0.7

Skin Care 3,704 3,618 3,715 2.4 (2.6)

Baby Care 2,295 2,254 2,340 1.8 (3.7)

Oral Care 1,622 1,624 1,624 (0.1) 0.0

Women’s Health 1,568 1,625 1,792 (3.5) (9.3)

Wound Care/Other 1,480 1,560 1,672 (5.1) (6.7)

Total Consumer Sales $14,697 14,447 14,883 1.7% (2.9)

* Prior year amounts have been reclassified to conform to current year presentation. Nutritionals, previously included in OTC, is included

in Wound Care/Other.

The Over-the-Counter (OTC) franchise achieved sales of $4.0 billion, an increase of 7.0% from 2012. Strong U.S. sales

growth of 19.7% was driven by analgesics and upper respiratory products, primarily due to continued progress in

returning a reliable supply of products to the marketplace.

McNEIL-PPC, Inc. continues to operate under a consent decree, signed in 2011 with the U.S. Food and Drug

Administration (FDA), which governs certain McNeil Consumer Healthcare manufacturing operations. McNeil continues to

operate the manufacturing facilities in Las Piedras, Puerto Rico and Lancaster, Pennsylvania and has made significant

progress; having met the remediation commitments at those facilities. The Company also successfully reintroduced many

products previously made in Fort Washington, Pennsylvania, from other sites. Plants operating under the consent decree

will continue to produce a simplified portfolio focused on key brands. The Fort Washington manufacturing site is not in

operation at this time and the Company recently made the decision to make further investments in that facility prior to

certification.

The Skin Care franchise achieved sales of $3.7 billion, an increase of 2.4% as compared to the prior year, primarily due to

strong results from the NEUTROGENA®, AVEENO®and Dabao product lines. The Baby Care franchise sales grew to

$2.3 billion, an increase of 1.8% from 2012. Growth was primarily due to sales of haircare and baby cleansers outside the

U.S. and newly acquired products from the acquisition of Shanghai Elsker Mother & Baby Co., Ltd. The Oral Care

franchise sales were flat as compared to the prior year. Increased sales of LISTERINE®outside the U.S. were partially

offset by the impact of the divestiture of the manual toothbrush product line in the U.S. The Women’s Health franchise

sales were $1.6 billion, a decrease of 3.5% primarily due to the divestiture of women’s sanitary protection products in the

U.S., Canada and Caribbean. The Wound Care/Other franchise sales were $1.5 billion in 2013, a decrease of 5.1% from

2012 due to competitive pressures and the impact of divestitures.

Consumer segment sales in 2012 were $14.4 billion, a decrease of 2.9% from 2011, which included 0.5% operational

growth offset by a negative currency impact of 3.4%. U.S. Consumer segment sales were $5.0 billion, a decrease of

2.0%. International sales were $9.4 billion, a decrease of 3.4%, which included 1.9% operational growth offset by a

negative currency impact of 5.3%.

4•Johnson & Johnson 2013 Annual Report