Johnson and Johnson 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 BUSINESS HIGHLIGHTS 5

With these actions and others, our

MD&D business unit has been able to

sustain the No. 1 or No. 2 leadership

positions in 80 percent of our key

platforms while growing or maintaining

share in the majority of these platforms.

We’ve also made some strategic

portfolio decisions in this business

segment, such as refocusing our

cardiovascular business. In 2011,

we exited the drug-eluting stent

business and shifted investments to

higher-growth, higher-need areas like

electrophysiology. These decisions

will help to fund growth potential in

other promising areas. Decisions to

acquire Synthes, Inc. and strengthen

our leadership position in orthopaedics,

as well as our acquisition of SterilMed,

Inc. for its experience in re-processing

surgical instruments, are examples of

how we are continuously looking across

our business for the best long-term

growth opportunities.

CONSUMER

With $14.9 billion in sales in 2011,

our Consumer business segment is

the sixth largest consumer health care

company in the world. Operational sales

declined just under 1 percent, reflecting

the impact of remediation and supply

issues associated with our U.S. over-the-

counter (OTC) business. The decline was

partially offset by solid growth in certain

franchises including Skin Care and Oral

Care, with strong performances from

NEUTROGENA® and the LISTERINE®

Mouthwash brands.

Our Consumer group continued

expanding into emerging markets

with the acquisition of a line of OTC

cough-and-cold brands in Russia from

J.B. Chemicals & Pharmaceuticals

Limited. We also continued to innovate,

introducing NEUTROGENA® Naturals,

AVEENO® SMART ESSENTIALS™,

NICORETTE® QUICKMIST™ and

LISTERINE® ZERO™.

The recovery and remediation of

the McNeil Consumer Healthcare

business continues. The major

commitments to date under the Consent

Decree with the U.S. Food and Drug

Administration have been achieved, and

several products have already returned

to market. Volume will continue to ramp

up, and products will be reintroduced

throughout 2012.

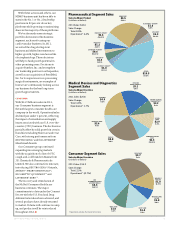

Medical Devices and Diagnostics

Segment Sales

Sales by Major Franchise

(in billions of dollars)

2011 Sales: $25.8

Sales Change

Total: 4.8%

Operational*: 1.7%

Pharmaceutical Segment Sales

Sales by Major Product

(in billions of dollars)

2011 Sales: $24.4

Sales Change

Total: 8.8%

Operational*: 6.2%

Consumer Segment Sales

Sales by Major Franchise

(in billions of dollars)

2011 Sales: $14.9

Sales Change

Total: 2.0%

Operational*: (0.7%)

BABY CARE

$2.4

5.9%

SKIN CARE

$3.7

7.6%

WOUND CARE/

OTHER

$1.0

0.0%

OTC

PHARMACEUTICALS

& NUTRITIONALS

$4.4

(3.2%)

ORAL CARE

$1.6

6.4%

WOMEN’S

HEALTH

$1.8

(2.8%)

* Operational excludes the impact of currency

LEVAQUIN®/FLOXIN®

$0.6

(54.1%)

PREZISTA®

$1.2

41.3%

PROCRIT®/EPREX®

$1.6

(16.1%)

CONCERTA®

$1.3

(3.9%)

ACIPHEX®/PARIET®

$1.0

(3.1%)

RISPERDAL® CONSTA®

$1.6

5.5%

VELCADE®

$1.3

18.0%

OTHER

$10.3

18.2%

REMICADE®

$5.5

19.1%

DEPUY®

$5.8

4.0%

ETHICON

ENDO-SURGERY®

$5.1

6.8%

DIABETES CARE

$2.6

7.4%

ORTHO-CLINICAL

DIAGNOSTICS®

$2.2

5.4%

VISION

CARE

$2.9

8.8%

CARDIOVASCULAR

CARE

$2.3

(10.3%)

ETHICON®

$4.9

8.2%