Johnson and Johnson 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JOHNSON & JOHNSON 2010 ANNUAL REPORT4

the most significant need.

In Oncology, Velcade* (bortezomib), for multiple myeloma,

grew 16 percent operationally while eclipsing $1 billion in sales

outside the U.S. for the first time.

In addition, we continue to pursue line extensions.

We submitted applications for several major line extensions,

among them REMICADE® and SIMPONI®, which continue

to build the strength of our Immunology franchise.

Over the next three years, we expect to file compounds to

address critical medical needs, including Alzheimer’s disease and

diabetes, conditions growing in prevalence as the population

ages. With five compounds currently in registration and several

more planned in the coming years, our portfolio ranks among the

leaders in the industry. Our pipeline meets unmet needs and

features many true innovations designed to change the treatment

paradigm for patients.

MEDICAL DEVICES AND DIAGNOSTICS

The Medical Devices and Diagnostics (MD&D) franchises

comprise the world’s largest medical technology business, with

sales of $24.6 billion, an increase of approximately 3 percent

operationally. Despite the economic slowdown, which led to a

decline in surgical procedures and pricing pressures across the

business, we achieved growth in six of our seven franchises, as

well as in all regions.

Our MD&D businesses advanced a very strong pipeline,

completed and integrated several acquisitions, and aggressively

expanded into emerging markets. The segment maintained or

improved market share in the majority of its largest product

platforms, despite intense competition.

For example, the Ethicon franchise grew 8 percent

operationally, based on its strong suite of surgical products, as

well as recent acquisitions in new markets like aesthetics and ear,

nose and throat surgery. The Ethicon Endo-Surgery franchise

grew 5 percent operationally. Double-digit growth in its advanced

sterilization products and energy products were major

contributors. Our Vision Care franchise had operational sales

growth of 4 percent based on its core ACUVUE® Brand Contact

Lens and the continued launch of 1-DAY ACUVUE® TruEye™

Contact Lenses into new markets. The Ortho Clinical Diagnostics

franchise grew 4 percent operationally with the continued growth

of the VITROS® 3600 and 5600 analyzers.

The DePuy franchise increased operational sales by 3 percent

based on the strength of its orthopaedic reconstruction, sports

medicine and neurological businesses. Diabetes Care increased

operational sales by 2 percent with the introduction of a number

of new OneTouch® products around the world. Meanwhile,

sales in the Cordis franchise continued to decline due to competi-

tion in drug-eluting stents. This was partially offset by the strong

growth of electrophysiology products in the Biosense Webster

business, which grew nearly 20 percent operationally for the year.

CONSUMER

Consumer sales were $14.6 billion, a decline of approximately

9 percent operationally. Sales were impacted by McNeil recalls, as

well as the general economic slowdown and greater consumer

sensitivity to spending, reflected in a broad move towards store

* Velcade is a trademark of Millennium Pharmaceuticals, Inc.

* Operational excludes the impact of currency

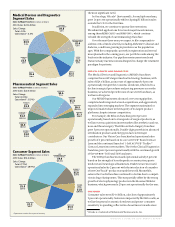

Medical Devices and Diagnostics

Segment Sales

Sales by Major Franchise (in billions of dollars)

2010 Sales: $24.6 billion

Sales Change

Total: 4.4%

Operational*: 3.4%

MD&D

DEPUY®

$5.6

4.0%

ETHICON

ENDO-SURGERY®

$4.8

5.9%

DIABETES

CARE

$2.5

1.2%

ORTHO-CLINICAL

DIAGNOSTICS®

$2.0

4.6%

VISION

CARE

$2.7

6.9%

CORDIS®

$2.5

(4.7%)

ETHICON®

$4.5

9.2%

Pharm

Pharmaceutical Segment Sales

Sales by Major Product (in billions of dollars)

2010 Sales: $22.4 billion

Sales Change

Total: (0.6%)

Operational*: (1.0%)

LEVAQUIN®/

FLOXIN®

$1.4

(12.5%)

PROCRIT®/

EPREX®

$1.9

(13.9%)

OTHER

$9.1

6.6%

CONCERTA®

$1.3

(0.5%)

REMICADE®

$4.6

7.1%

RISPERDAL®

CONSTA®

$1.5

5.3%

TOPAMAX®

$0.5

(53.3%)

VELCADE®

$1.1

15.8%

ACIPHEX®/

PARIET®

$1.0

(8.2%)

Consumer Segment Sales

Sales by Major Franchise (in billions of dollars)

2010 Sales: $14.6 billion

Sales Change

Total: (7.7%)

Operational*: (8.9%)

BABY CARE

$2.2

4.4% SKIN CARE

$3.5

(0.4%)

WOUND

CARE/

OTHER

$1.0

(10.4%)

OTC

PHARMACEUTICALS

& NUTRITIONALS

$4.6

(19.2%)

ORAL CARE

$1.5

(2.7%)

Consumer

WOMEN’S

HEALTH

$1.8

(2.7%)