Johnson and Johnson 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S LETTER 3

global developer and manufacturer of minimally invasive

devices for hemorrhagic and ischemic stroke. In February

2011, Johnson & Johnson completed its tender offer for

Crucell N.V., which develops vaccines against infectious

diseases. In addition to strategic acquisitions, we collaborate

and partner with other companies and academic institutions

pursuing exciting discoveries that we can enhance with our

global development capabilities.

• Growth in Emerging Markets: We continued our

strong progress in emerging markets, with sales growing

14 percent operationally in Brazil, Russia, India and China.

We continue maximizing research and development centers

in these regions to develop medical devices, pharmaceuticals

and consumer products based on insights in local markets.

We have a vast and growing network of medical and surgical

institutes around the world to train and educate the doctors

and nurses who use our products. And with rapid economic

growth in emerging markets, we’re expanding our product

offerings to meet the unique needs of the mass market

comprising billions of people who are now gaining a greater

degree of health care coverage.

The opportunity here may reflect more affordable

products or products focused on diseases that are more

common in emerging markets than in developed markets.

Offerings include market-appropriate sutures, consumer

products, staplers, blood glucose meters, knee replacements

and local or regional pharmaceuticals. The objective is

superior outcomes for patients who may not have had access

to such technologies or products.

• Talented People: As we look toward the future, a top

priority for Johnson & Johnson is continued development of a

leadership team that is well-positioned for sustainable growth.

At the end of 2010, we announced organizational changes

designed to further long-term succession plans and assure that

we have talented and experienced leaders at all levels of the

organization. Joining me as part of an expanded Office of the

Chairman are Alex Gorsky, previously Worldwide Chairman,

Medical Devices & Diagnostics, and Sheri McCoy, previously

Worldwide Chairman, Pharmaceuticals.

Other additions to our senior leadership team are a

direct reflection of the strength, depth and diversity of our

talent pipeline. We are committed to giving our people

opportunities to work across our various business groups

and geographies. And we continue to invest more than ever in

our people. Our objective is simple: to develop employees

with the skills, judgment and integrity to carry on the

Johnson & Johnson legacy.

We have the people, products, pipelines and footprints in

global markets to sustain long-term growth. And with a

continuous focus on addressing unmet needs, we invest in

technologies with the potential to significantly improve

health care.

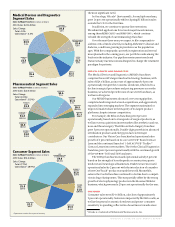

PHARMACEUTICALS

Our Pharmaceuticals segment focuses on meeting important

patient needs. With sales of $22.4 billion, we saw rapid growth

of recently launched products. For the year, the segment

experienced an operational sales decline of 1 percent. Excluding

the impact of generic competition and health care reform,

pharmaceutical sales would have increased by nearly 4 percent

operationally.

We continued to make significant investments to expand

our presence in emerging markets which grew at double-

digit rates, as well as in new therapeutic areas like vaccines

and Alzheimer’s disease. We are the leader in the U.S.

immunology market, with three significant brands. Our

flagship product REMICADE® (infliximab), for the treatment

of a number of immune-mediated inflammatory diseases,

grew 7 percent operationally. Newer products STELARA®

(ustekinumab) and SIMPONI® (golimumab) continued

increasing market share and generated more than a combined

$600 million in sales for the year. REMICADE®, STELARA® and

SIMPONI® contributed to 17 percent operational growth for the

Immunology franchise.

In long-acting antipsychotics, we grew 14 percent

operationally. RISPERDAL® CONSTA® (risperidone) Long-

Acting Injection, an atypical antipsychotic administered

every two weeks for the treatment of schizophrenia or the

maintenance of bipolar 1 disorder, grew 6 percent operationally.

INVEGA® SUSTENNA® (paliperidone palmitate), for the

treatment of schizophrenia, continued to increase U.S. market

share, contributing to our expanding market leadership.

In the HIV area, PREZISTA® (darunavir) and INTELENCE®

(etravirine) grew sales operationally by 46 percent and

41 percent, respectively, achieving together more than $1 billion

in sales for the first time while providing access to markets with

The source of our enduring strength

is a fundamental commitment to

Our Credo

and an operating model that has

served us well for decades.

PEOPLE AND

VALUES

MANAGED FOR

THE LONG TERM

BROADLY BASED IN

HUMAN HEALTH

DECENTRALIZED

APPROACH