JetBlue Airlines 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2013Annual Report 11

PART I

ITEM 1Business

Financial Health

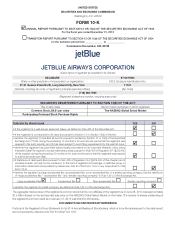

We strive to maintain financial strength and a cost structure that enables

us to grow profitably and sustainably. In the first years of our history, we

relied upon financing activities to fund much of our growth. Starting in

2007, as our airline matured, growth has largely been funded through

internally generated cash from operations. Since 2009, while we have

invested over $2.7 billion in capital assets, we have also generated nearly

$3.1billion in cash from operations resulting in over $300 million in free

cash flow. Our improving financial results have resulted in better credit

ratings, which have in-turn resulted in more attractive financing terms when

we do not purchase assets for cash. Since 2009, we have also reduced

our total debt balance by $570 million.

* 2012 includes $200M unscheduled aircraft pre-delivery deposits, in exchange for favorable pricing terms.

** We have adjusted debt and capitalization for the significant financing obligations of our aircraft operating leases,

which aren’t reflected on our balance sheets. In making these adjustments, we used a multiple of 7 times the

applicable annual aircraft rent expenses as this is the multiple which is routinely used within the airline community

to represent the financing component of aircraft operating lease obligations.

*** See non-GAAP reconciliation of Free Cash Flow in Item 7, Management's Discussion and Analysis of

Financial Condition and Results of Operations, Liquidity and Capital Resources.

CASH FROM

OPERATIONS

TOTAL CAPITAL

EXPENDITURES

POSITIVE FREE

CASH FLOW ***

NEGATIVE FREE

CASH FLOW ***

DEBT TO CAPITALIZATION

RATIO

2009 2010 2011 2012* 2013

In Millions ($)

Debt to Cap Ratio **

$700

$200

80%

60%

40%

LiveTV

LiveTV, LLC is a wholly-owned subsidiary of JetBlue, provides in-flight

entertainment, voice communication and data connectivity services and

solutions for commercial and general aviation aircraft. LiveTV’s largest

customer for its core products and services is JetBlue with a further six

agreements with other domestic and international commercial airlines. It

also has general aviation customers to which it supplies voice and data

communication services. LiveTV continues to pursue additional customers

and related product enhancements. JetBlue, ViaSat Inc. and LiveTV have

worked together to develop and support in-flight broadband connectivity

for JetBlue which is being marketed as Fly-Fi

™

. LiveTV is also working with

ViaSat Inc. to support in-flight connectivity for other airlines in the near future.

LiveTV’s major competitors in the in-flight entertainment systems market

include Rockwell Collins, Thales Avionics and Panasonic Avionics; however,

only Panasonic is currently providing in-seat live television. In the voice

and data communication services market, LiveTV’s primary competitors

are GoGo, Row 44 and Panasonic.