Isuzu 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Isuzu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

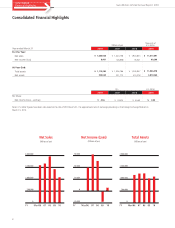

4

• With replacement demand spurred by

emissions regulations having come

full circle in FY2007, domestic truck

demand has been falling as the

economic slowdown exacerbates the

already difficult business environment

for customers.

0

75

150

225

300

07

33

08

33

09

31

10

25

11

(forecast)

41

232

201

165

155

190

FY

Light Duty Trucks

(payload/1.4–5.5 ton 48.9%

Medium&Heavy Duty bus

(minimum 24 seats) 85.5%

1-ton Pickup Trucks 67.6%

Light Duty Trucks 68.7%

Light Duty Buses 21.6%

Domestic CV

FY

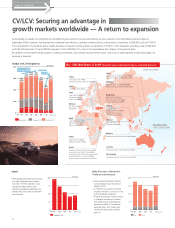

Global CV/LCV Shipments

Overseas CV Overseas LCV

Domestic CV

Isuzu steadily increased unit shipments by strengthening its business structure and opening up new markets. Since the global recession began in

September 2008, however, slowing demand combined with efforts to optimize inventory led to a sharp drop in shipments to 428,000 units for FY2010.

The normalization of shipments and a market recovery is forecast to bring a return to expansion in FY2011, with shipments reaching a total of 582,000

units (45,000 domestic CV and 208,000 overseas CV and 329,000 LCV), close to the level before the collapse of Lehman Brothers.

By carefully monitoring the retail situation, inventory conditions, and products during the economic crisis, Isuzu is well prepared to take advantage of a

recovery in demand.

Asia:

Recovery of demand in

Thailand and Indonesia

CV LCV

• Asian markets have been showing

signs of recovery since the second

half of FY2010.

• In Thailand, Isuzu plans to increase

shipments of both CV and LCV in line

with the economic recovery.

• Since restructuring its business entity

in Indonesia (increasing its stake in

May 2008), Isuzu has leveraged its

expertise in selling CV to promote

expanded sales, and is looking to

increase market share as demand

picks up.

Japan

Vietnum

Thailand

Light Duty Trucks

(payload/2-ton) 43.9%

Australia

Commercial Vehicles GVM 4 ton & over 30.4%

Papua New Guinea

Commercial Vehicles 37.9%

No. 1 Market Share in 2009 (Based on sales registrations figures compiled by Isuzu)

1-ton Pickup Trucks 19.0%

Commercial Vehicles GVW 5-16 ton 33.6%

Strengthening overseas

business structure

Opening up new markets Global recession

Inventory

optimization

Cyprus

1-ton Pickup Trucks 45.5%

Egypt

Turkey Light Duty Trucks (payload/2-3 ton)

39.9%

Medium Duty Trucks (payload/4 ton) 37.7%

Japan

Light Duty Trucks 65.2%

Heavy Duty Trucks (C&E) 40.1%

Heavy Duty Bus Chassis 46.8%

Hong Kong

1-ton Pickup Trucks 49.7%

Commercial Vehicles

GVM 7-10 ton 60.5%

Israel

Bus (40 seats and

over) 51.5%

Morocco

Kenya

Medium Duty Trucks GVM 10-14 ton 62.8%

Heavy Duty Trucks GVM 15-19 ton 49.6%

Heavy Duty Trucks GVM 20 ton and over 37.1%

Medium Duty Buses (21-40 seats) 48.6%

Heavy Duty Buses (minimum 40 seats) 49.7%

Gabon

Light Duty Trucks 40.6%

Medium Duty Trucks 78.8%

Malaysia

Commercial Vehicles GVM 5 ton and over 30.8%

New Zealand

Commercial Vehicles GVM 3.5 ton & over 21.9%

Light Duty Trucks GVM >3-6 ton 56.8%

Medium Duty Trucks GVM>6-18 ton 57.9%

Philippines

Source: Isuzu Motors

(K-units) (K-units)

0

200

400

600

800

90 99

148

372

96

170

377

73

203

364

54

194

259

127

259

42

151

302

543

(453)

543

(453)

619

(520)

643

(547)

640

(567)

554

(500)

554

(500)

428

(386)

582

(537)

582

(537)

45

208

329

11

(forecast)

05 06 07 08 09 10

0

25

50

75

100

96

73

07 08 09

55

10

42

11

(forecast)

45

FY

CV/LCV: Securing an advantage in

growth markets worldwide — A return to expansion

Isuzu at a Glance