ING Direct 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

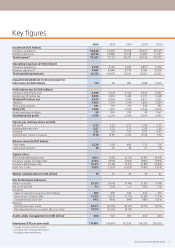

2006 2005 2004 2003(1) 2002(1)

Income (in EUR million)

Insurance operations 59,642 57,403 55,614 53,223 59,729

Banking operations 14,195 13,848 12,678 11,680 11,201

Total income(2) 73,621 71,120 68,171 64,736 70,913

Operating expenses (in EUR million)

Insurance operations 5,275 5,195 4,746 4,897 5,203

Banking operations(3) 9,087 8,844 8,795 8,184 8,298

Total operating expenses 14,362 14,039 13,541 13,081 13,501

Impairments/additions to the provision for

loan losses (in EUR million) 114 99 487 1,288 2,099

Profi t before tax (in EUR million)

Insurance profi t before tax 4,935 3,978 4,322 3,506 4,453

Banking profi t before tax 5,005 4,916 3,418 2,371 1,468

Total profi t before tax 9,940 8,894 7,740 5,877 5,921

Taxation 1,907 1,379 1,709 1,490 1,089

Third-party interests 341 305 276 344 332

Net profi t 7,692 7,210 5,755

4,043

4,500

Divestments/special items -58 976 796 -10 1,067

Underlying net profi t 7,750 6,234 4,959 4,053 3,433

Figures per ordinary share (in EUR)

Net profi t 3.57 3.32 2.71 2.00 2.32

Distributable net profi t 3.57 3.32 2.71 2.00 2.20

Dividend 1.32 1.18 1.07 0.97 0.97

Shareholders’ equity (in parent) 17.78 16.96 12.95 10.08 9.14

Balance sheet (in EUR billion)

Total assets 1,226 1,159 964 779 716

Capital and reserves 38 37 28 21 18

Capital ratios

ING Group debt/equity ratio 9.0% 9.4% 10.2% 14.4% 19.9%

Insurance capital coverage ratio 274% 255% 204% 180% 169%

Insurance debt/equity ratio 14.2% 13.4% 14.3% 19.8% 22.8%

Bank Tier-1 ratio 7.63% 7.32% 6.92% 7.59% 7.31%

Market capitalisation (in EUR billion) 74 65 49 39 32

Key Performance Indicators

Return on equity 23.5% 26.6% 25.4% 21.5% 17.4%

Net profi t growth 7% 25% n.a. -10% -2%

Insurance

Value of new life business (in EUR million) 807 805 632 440 519

Internal rate of return (life) 13.3% 13.2% 12.1% 10.9% 11.5%

Combined ratio (non-life) 91% 95% 94% 98% 102%

Banking

Cost/income ratio (total) 64.0% 63.9% 69.4% 70.1% 74.1%

Risk-adjusted return on capital after tax (total) 19.7% 22.6% 14.5%

Assets under management (in EUR billion) 600 547 492 463 449

Employees (FTEs at year-end) 119,801 116,614 112,195 114,335 116, 20 0

(1) Figures according to Dutch GAAP.

(2) Including inter-company eliminations.

(3) Including other impairments.

Key fi gures

1 ING Group Annual Review 2006