ING Direct 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

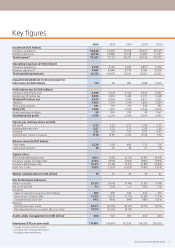

Contribution business lines to 2006 underlying profit before tax*

in percentages

Insurance Europe 23

Insurance Americas 20

Insurance Asia/Pacific 6

Wholesale Banking 25

Retail Banking 19

ING Direct 7

Total 100

* Excludes component ‘Other’ in Banking and Insurance.

Our performance

continued

Financial highlights continued

Embedded value and value of new

business

The embedded value of ING’s life

insurance businesses increased 7.7% to

EUR 29,714 million in 2006. Taking into

account EUR 1,996 million in net dividends

that were paid to ING Group, the year-end

embedded value was EUR 27,718 million.

Embedded value profi t, an important

measure of value creation, decreased

12.1% to EUR 1,981 million as improved

fi nancial performance was more than

offset by lower operational performance

variances and negative assumption

changes. The value of new business

increased slightly with 0.2% to EUR 807

million as it was negatively impacted by

an increase of the discount rate to refl ect

higher interest rates.

The insurance activities in Central and

Rest of Europe and in Asia/Pacifi c both

generated particularly strong growth

in 2006, indicating the strong future

earnings potential of the businesses in

both regions. New sales, measured in

annual premium equivalent, rose 2.9%

to EUR 6,495 million, while the internal

rate of return increased to 13.3% from

13.2% in 2005. The internal rate of

return in developing markets increased to

17.7% up from 17.4% as business units

benefi ted from increased scale. New sales

in developing markets rose 11.7%.

Banking operations

ING’s banking activities continued to

show strong growth in savings and

mortgages, which helped offset the

impact of fl attening yield curves. Operating

expenses were under control, while risk

costs remained very low, although the

fourth quarter of 2006 showed an increase

as releases from old provisions diminish.

Underlying profi t before tax rose 11.4%

to EUR 5,072 million, driven by a 7.3%

increase in income, notably from ING Real

Estate and ING Direct. Interest income rose

2.6% as strong volume growth was largely

offset by the impact of fl attening yield

curves. Loans and advances to customers

increased by EUR 34.7 billion, or 8.6%, to

EUR 437.8 billion, despite the divestments

of Deutsche Hypothekenbank and Degussa

Bank in 2006.

Growth was driven mainly by residential

mortgage lending at ING Direct and the

retail banking activities in the Netherlands.

The total interest margin narrowed to

1.06% from 1.17% in 2005. Commission

income rose 15.5%, driven by higher

management fees, mainly from the

investment management activities at ING

Real Estate, and increased fees from the

securities business, brokerage & advisory

and insurance broking. Investment income

was up 4.1%, while other income rose

26.8%, mainly caused by a strong increase

in net trading income.

Underlying operating expenses were

up 4.9% to EUR 9,032 million, including

EUR 164 million in additional compliance-

related costs in 2006. ING Direct

contributed 2.3%-points to the expense

growth of the bank activities. Although

the underlying addition to the provision

for loan losses increased to EUR 100

million from EUR 69 million in 2005,

risk costs were only three basis points

of average credit-risk-weighted assets,

which is well below the normalised level

of 25-30 basis points.

Asset management

Assets under management increased

9.6% to EUR 600 billion in 2006.

Compared with 2005, growth was

mainly offset by the negative impact

of exchange rates of EUR 31.8 billion,

while developments on stock markets

contributed EUR 33.7 billion to growth.

The net infl ow of EUR 43.8 billion was

mainly realised by Insurance Asia/Pacifi c

(EUR 11.2 billion), ING Real Estate

(EUR 13.5 billion) and Insurance Americas

(EUR 6.8 billion). Growth was achieved

for the greater part in third-party assets,

which increased by 14.7% to EUR 404.5

billion by year-end 2006. Proprietary

assets increased 0.4% to EUR 195.5 billion.

Looking ahead

Our strong profi t growth in 2006

demonstrates the solid earnings capacity

of ING’s well-balanced portfolio of

businesses. While the interest rate

environment in 2006 was challenging,

particularly for our banking business,

we have benefi ted from rallying equity

and real estate markets, a benign credit

environment, a favourable underwriting

cycle in non-life insurance and lower

taxes. Looking forward, risk costs and

non-life claims will trend gradually to more

normalised levels, however we do not

anticipate a signifi cant shift in the market

environment over the coming period.

ING Group Annual Review 2006

10