IBM 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

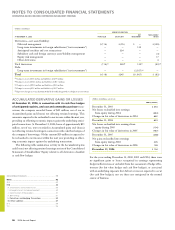

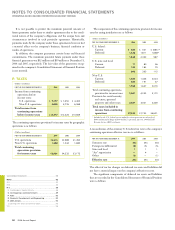

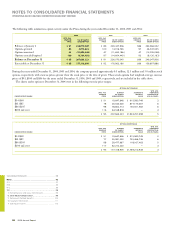

T. RENTAL EXPENSE AND

LEASE COMMITMENTS

Rental expense from continuing operations, including amounts

charged to inventories and fixed assets, and excluding amounts

previously reserved, was $1,263 million in 2006, $1,345 million in

2005 and $1,442 million in 2004. Rental expense in agreements with

rent holidays and scheduled rent increases is recorded on a straight-

line basis over the lease term. Contingent rentals are included in the

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

96 2006 Annual Report

determination of rental expense as accruable. The table below depicts

gross minimum rental commitments from continuing operations

under noncancelable leases, amounts related to vacant space associ-

ated with infrastructure reductions and restructuring actions taken

through 1993, and in 1999, 2002 and 2005 (previously reserved),

sublease income commitments and capital lease commitments. These

amounts reflect activities primarily related to office space, as well as

manufacturing facilities.

(Dollars in millions)

2007 2008 2009 2010 2011 BEYOND 2011

Operating lease commitments:

Gross minimum rental commitments

(including Vacant space below) $, $, $ $ $ $

Vacant space

Sublease income commitments () () () () () ()

Capital lease commitments

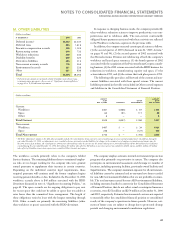

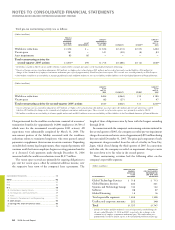

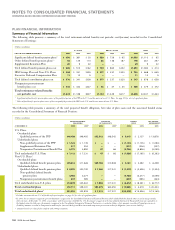

U. STOCK-BASED COMPENSATION

Effective January 1, 2005, the company adopted the fair value rec-

ognition provisions for stock-based awards granted to employees

using the modified retrospective application method provided by

SFAS No. 123(R), “Share-Based Payment,” (SFAS No. 123(R)).

Stock-based compensation cost is measured at grant date, based on

the fair value of the award, and is recognized as expense over the

employee requisite service period. See note A, “Significant Accounting

Policies,” on page 68 for additional information.

The following table represents total stock-based compensation

expense included in the Consolidated Statement of Earnings:

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 2004

Cost $ $ $

Selling, general and

administrative*

Research, development and

engineering

Other (income) and expense** — () —

Pre-tax stock-based

compensation expense , ,

Income tax benefits () () ()

Total stock-based

compensation expense $ $ $,

* Includes $7 million of credits recorded during the year ended December 31, 2005,

as a result of awards forfeited in connection with the company’s second-quarter

2005 workforce resource actions.

** Reflects the one-time effects on stock-based compensation expense as a result of the

divestiture of the Personal Computing business.

Total unrecognized compensation costs related to non-vested awards at

December 31, 2006 and 2005 were $1,238 million and $1,512 million,

respectively, and are expected to be recognized over a weighted-aver-

age period of approximately two years.

There were no significant capitalized stock-based compensation

costs at December 31, 2006, 2005 and 2004.

Consolidated Statements .........................................................

Notes .....................................................................................

A-G .........................................................................................

H-M .........................................................................................

N-S ..........................................................................................

T-X ..........................................................................................

T. Rental Expense and Lease Commitments .......................

U. Stock-Based Compensation ............................................

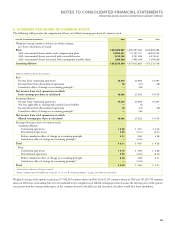

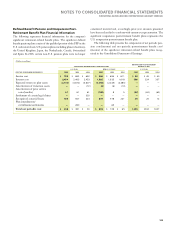

V. Retirement-Related Benefits .........................................

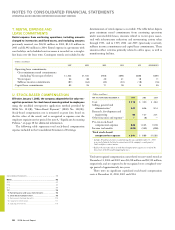

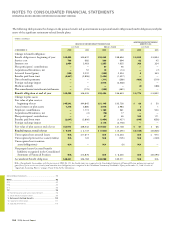

W. Segment Information....................................................

X. Subsequent Events ........................................................

Black

MAC

390 CG10