Home Shopping Network 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 Home Shopping Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

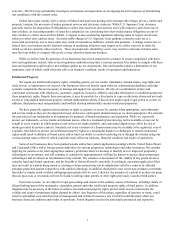

During the quarter ended December 31, 2013, we repurchased approximately 0.2 million shares at an average price of

$51.99 per share. Below is a summary of our common stock repurchases during the fourth quarter of 2013, as well as the

number of shares still available for purchase as of December 31, 2013:

Period

Number of

Shares Purchased

Average Price

Paid Per Share

Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

Maximum Number

of Shares that May

Yet Be Purchased

under the Plans or

Programs

October 1, 2013 - October 31, 2013 . . . . . . . . . . . . . . . . . 168,313 $ 51.96 168,313 1,032,446

November 1, 2013 - November 30, 2013 . . . . . . . . . . . . . 21,500 $ 52.29 21,500 1,010,946

December 1, 2013 - December 31, 2013 . . . . . . . . . . . . . — $ — — 1,010,946

189,813 189,813

Performance Graph

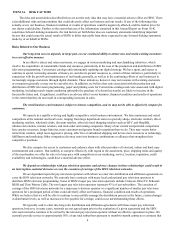

The graph depicted below compares the five-year performance of our common stock with the cumulative total return on

the S&P 500 Retailing Index and the Russell 2000 Index from December 31, 2008 through December 31, 2013.

*Assumes $100 invested on 12/31/08, including reinvestment of dividends.

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013

HSN, Inc. . . . . . . . . . . . . . . . . . . . . . . 100.00 277.72 421.60 500.51 770.13 883.59

S&P 500 Retailing Index . . . . . . . . . . 100.00 154.37 197.92 211.12 270.86 397.30

Russell 2000 Index . . . . . . . . . . . . . . . 100.00 127.17 161.32 154.59 179.86 249.69

$600

$700

$800

$900

$1,000

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among HSN, Inc., the S&P 500 retailing Index, and the Russell 2000 Index

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

12/08 12/09 12/10 12/11 12/12 12/13

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among HSN, Inc., the S&P 500 retailing Index, and the Russell 2000 Index

HSN, Inc. S&P 500 Retailing Index Russell 2000