Hitachi 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Hitachi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We viewed fiscal 2009 as a year for the Hitachi

Group to make a fresh start. True to this positioning,

we pushed through business structure reforms in the

automotive systems, consumer and other busi-

nesses, and cut fixed expenses and procurement

costs. We also conducted public tender offers for five

publicly listed companies—Hitachi Information

Systems, Ltd., Hitachi Software Engineering Co.,

Ltd., Hitachi Systems & Services, Ltd., Hitachi Plant

Technologies, Ltd., and Hitachi Maxell, Ltd.—turning

them into wholly owned subsidiaries of Hitachi. The

aim of these moves was to strengthen our Social

Innovation Business. Moreover, we raised funds by

issuing new shares and convertible bonds with the

aims of strengthening our financial position and

providing funds for capital expenditures and strategic

investments to develop the Social Innovation Busi-

ness globally.

Fiscal 2009 saw the economic environment

improve as a whole from the second half of the

year. China, in particular, achieved a high rate of

economic growth, due in part to effective govern-

ment measures. Other Asian economies also expe-

rienced modest recoveries due mainly to exports to

China and government economic stimulus mea-

sures. The U.S. and European economies were

supported by massive quantitative easing and

government spending programs, enabling them to

see a moderate recovery in the latter half of 2009 as

well. Rebounding exports to emerging nations

aided this recovery.

Under these conditions, Hitachi posted consoli-

dated revenues in fiscal 2009 of ¥8,968.5 billion,

down 10% year over year. However, operating

income rose 59%, to ¥202.1 billion, a large

improvement resulting from fixed cost cutting and

the benefits of business structure reforms. On the

other hand, in income taxes, we incurred a one-off

charge of ¥67.0 billion, mainly due to the writing off

of deferred tax assets associated with making five

publicly listed companies wholly owned subsidiar-

ies. Due to this and other factors, we posted a net

loss attributable to Hitachi, Ltd. of ¥106.9 billion.

In terms of our financial position, total Hitachi,

Ltd. stockholders’ equity at March 31, 2010 was

¥1,284.6 billion due to the public offering to raise

capital. Total Hitachi, Ltd. stockholders’ equity ratio

improved 3.2 points from March 31, 2009 to 14.4%.

The debt-to-equity ratio (interest-bearing debt/

(noncontrolling interests + total Hitachi, Ltd. stock-

holders’ equity)) improved by 0.25 points from

March 31, 2009 to 1.04 at March 31, 2010. We

decided to suspend cash dividends applicable to

fiscal 2009 in light of our business performance.

As we said earlier, we viewed fiscal 2009 as a

year for making a fresh start. We feel that we made

strong progress implementing strategies that focus

more on the Social Innovation Business. Regret-

tably, however, our performance was not what

shareholders expected. We will therefore do our

utmost to improve our operating results in fiscal

2010 and thereafter.

Fiscal 2009 Results

Fiscal 2012 Mid-term Management Plan

Recently, we announced a new mid-term manage-

ment plan for the period through to fiscal 2012 as a

blueprint for moving from “defense” to “offense”

from fiscal 2010. Under this new plan, we will exe-

cute three management strategies aimed at achiev-

ing “Growth Driven by Social Innovation Business”

and a “Solid Financial Base.” First of all, our priority

is to leverage Hitachi’s strengths to promote a

global growth strategy. In order to give impetus to

this growth strategy, our second main initiative calls

on us to focus business resources on the Social

Innovation Business. Over the next 3 years, we plan

to allocate ¥1.6 trillion of the ¥2.6 trillion budgeted

to the Social Innovation Business. This includes

capital expenditures, strategic investments and

R&D expenses. The third initiative is to strengthen

the business structure to stabilize profitability. Here

we will cut costs, entrench our in-house company

system and take other steps.

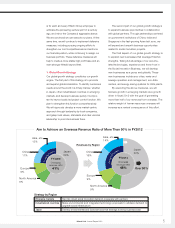

In terms of management targets for fiscal 2012,

we are targeting revenues of ¥10,500 billion, an

operating income ratio of over 5%, net income

3

Hitachi, Ltd. Annual Report 2010