Hertz 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

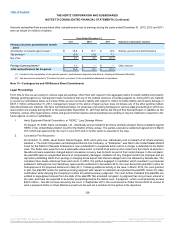

million will be recorded to Additional paid-in capital. The Federal NOLs begin to expire in 2025. State NOLs exclusive of the effects of the

excess tax deductions, have generated a deferred tax asset of $142.2 million. The state NOLs expire over various years beginning in 2014

depending upon particular jurisdiction.

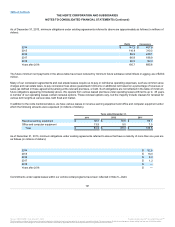

As of December 31, 2013, deferred tax assets of $233.4 million were recorded for foreign NOL carry forwards of $994.2 million. A valuation

allowance of $201.0 million at December 31, 2013 was recorded against these deferred tax assets because those assets relate to jurisdictions

that have historical losses and the likelihood exists that a portion of the NOL carry forwards may not be utilized in the future.

The foreign NOL carry forwards of $994.2 million include $722.5 million which have an indefinite carry forward period and associated

deferred tax assets of $155.4 million. The remaining foreign NOLs of $271.7 million are subject to expiration beginning in 2015 and have

associated deferred tax assets of $78.0 million.

As of December 31, 2013, deferred tax assets for U.S. Foreign Tax Credit carry forwards were $20.8 million which relate to credits generated

as of December 31, 2007. The carry forwards will begin to expire in 2015. A valuation allowance of $13.5 million at December 31, 2013 was

recorded against a portion of the U.S. foreign tax credit deferred tax assets in the likelihood that they may not be utilized in the future. A

deferred tax asset was also recorded for various state tax credit carry forwards of $3.0 million, which will begin to expire in 2027.

In determining the valuation allowance, an assessment of positive and negative evidence was performed regarding realization of the net

deferred tax assets in accordance with ASC 740-10, “Accounting for Income Taxes,” or “ASC 740-10.” This assessment included the

evaluation of scheduled reversals of deferred tax liabilities, the availability of carry forwards and estimates of projected future taxable income.

Based on the assessment, as of December 31, 2013, total valuation allowances of $279.4 million were recorded against deferred tax assets.

Although realization is not assured, we have concluded that it is more likely than not the remaining deferred tax assets of $2,069.2 million

will be realized and as such no valuation allowance has been provided on these assets.

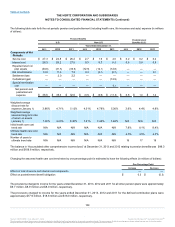

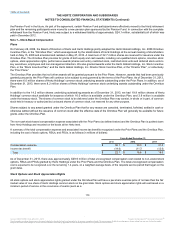

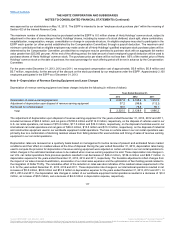

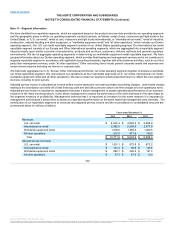

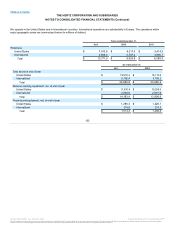

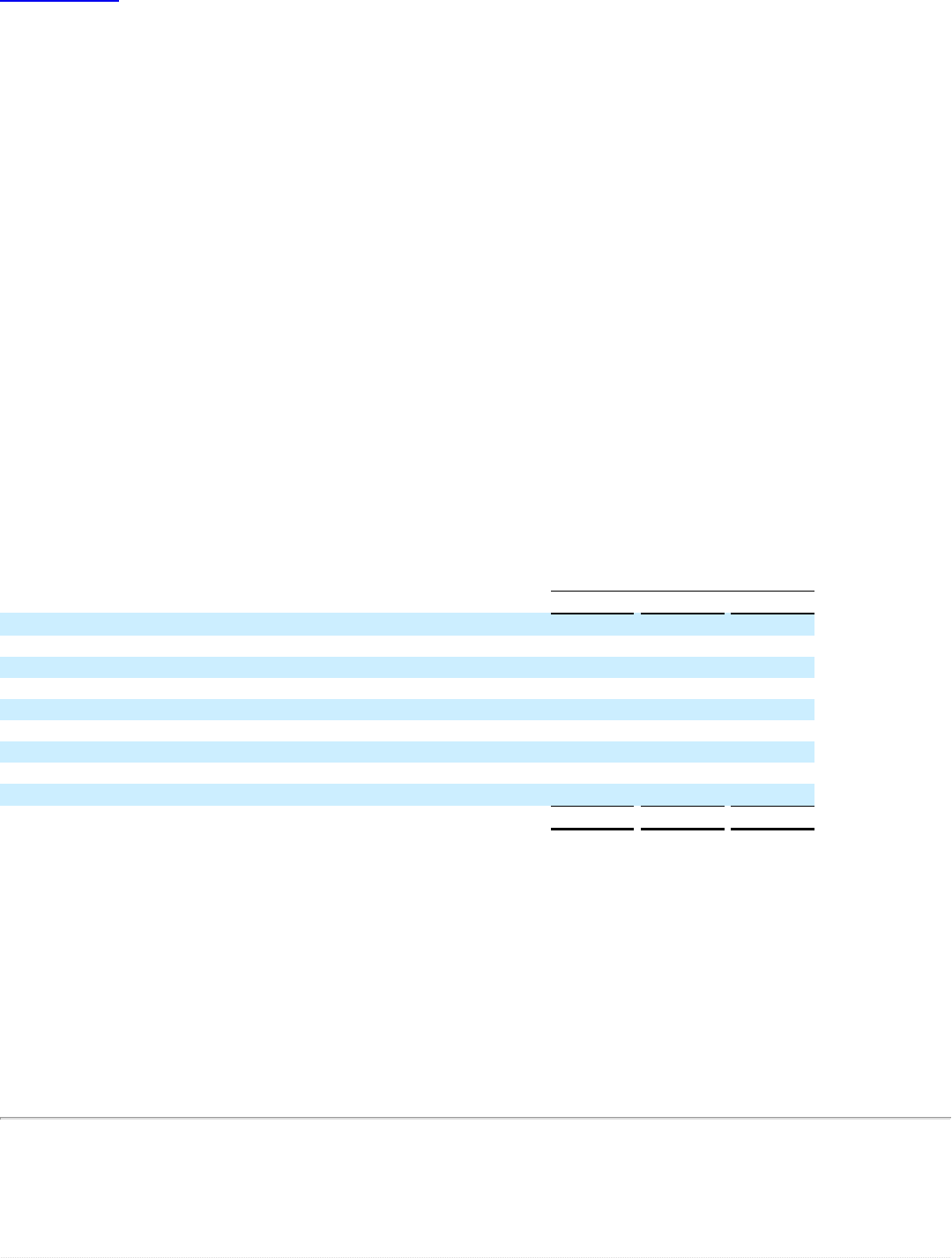

The significant items in the reconciliation of the statutory and effective income tax rates consisted of the following:

Statutory Federal Tax Rate

35.0 %

35.0 %

35.0 %

Foreign tax differential

(2.4)

(3.2)

(3.5)

State and local income taxes, net of federal income tax benefit

4.5

2.9

4.0

Change in state statutory rates, net of federal income tax benefit

(0.1)

(1.0)

0.6

Federal and foreign permanent differences

4.9

2.3

0.5

Withholding taxes

1.7

1.7

2.1

Uncertain tax positions

(0.5)

(0.6)

(0.9)

Change in valuation allowance

5.1

8.0

0.6

All other items, net

(1.5)

—

0.2

Effective Tax Rate

46.7 %

45.1 %

38.6 %

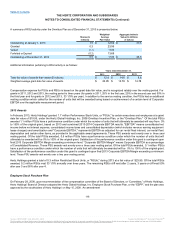

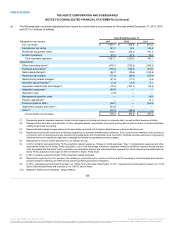

The effective tax rate for the year ended December 31, 2013 was 46.7% as compared to 45.1% in the year ended December 31, 2012. The

provision for taxes on income increased $122.8 million, primarily due to higher income before income taxes, changes in geographic

earnings mix, increased state and local tax expense, increase in deductible interest limitations in various countries and other permanent

differences; offset by a decrease in valuation allowance relating to losses in certain non-U.S. jurisdictions for which tax benefits are not

realized. See Note 9 to the Notes to our consolidated financial statements included in this Annual Report under the caption "Item 8

—Financial Statements and Supplementary Data."

As of December 31, 2013, our foreign subsidiaries have $475.0 million of undistributed earnings which could be subject to taxation if

repatriated. Deferred tax liabilities have not been recorded for such earnings because it is management’s current intention to permanently

reinvest such undistributed earnings offshore. Due to the uncertainty caused by the

119

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.