Henry Schein 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Henry Schein annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

y any measure, 2008 was a challenging year for corporations

around the world, particularly those operating in the United

States. Henry Schein was not immune to these challenges,

although our Company fared better than most. Healthcare is

historically more resistant to macroeconomic challenges.

Henry Schein is strategically and geographically diversified,

operationally efficient and customer focused, making us more

resilient to these turbulent times. Our financial results for 2008

clearly illustrate this fact.

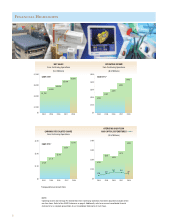

2008 Financial Results

Our 2008 record net sales of $6.4 billion represent an increase

of 8.3% compared with 2007. This increase includes 7.5%

local currency growth (1.3% internally generated and 6.2% from

acquisitions) and 0.8% related to foreign currency exchange.

Excluding sales of certain lower-margin pharmaceutical products

that we discontinued selling in 2008, internal net sales growth

in local currencies was 3.6%.

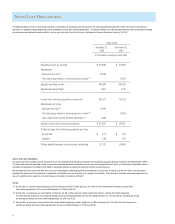

Our income from continuing operations for 2008 was

$251.0 million, or $2.75 per diluted share. Excluding certain

one-time charges1, income from continuing operations for 2008

was $270.0 million, or $2.96 per diluted share, reflecting growth

of 14.4% and 14.3%, respectively, compared with 2007.

Our operating margin excluding certain one-time charges for

2008 was 6.9%, an increase of 35 basis points, which is in line

with our stated Company goal for annual operating margin

expansion. We also generated record operating cash flow of

$384.6 million for the year.

Growth during 2008 continued to be enhanced by strategic

acquisitions, which included:

• Minerva Dental, a full-service dental distributor in the

U.K., which strengthens our presence in the U.K. dental

equipment market;

• Noviko, the leading distributor of animal health supplies

in the Czech Republic, the addition of which we believe

makes Henry Schein the largest Pan-European animal

health distributor;

• DNA Anthos Impianti, which adds national equipment sales

and service capabilities to Henry Schein’s offering in Italy;

• Medka, a full-service provider of medical consumables,

equipment and technical services in Germany, which

complements our current German operations;

• ABC Group of Companies, a Hong Kong-based dental

equipment and merchandise distributor that extends our

presence in the growing Chinese dental market;

• Sirona Ibérica, a distribution subsidiary of Sirona Dental

Systems, which enhances our offering of capital equipment

and technology-driven products in Spain; and

• Ortho Organizers, a California-based orthodontics

manufacturer and distributor.

4

T

O

O

UR

S

TOCKHOLDERS

“Healthcare is

historically

more resistant to

macroeconomic

challenges.”

B

1

Third quarter 2008 charge related to the Lehman Brothers

bankruptcy ($0.03 per diluted share after tax) and fourth quarter

2008 restructuring costs ($0.18 per diluted share after tax).