Health Net 1999 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1999 Health Net annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

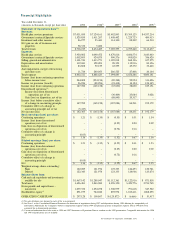

the year. Financial analysts look at days claims

payable, a measure of the relationship between

reserves and health care costs incurred. Here too,

FHS had a banner 1999, with days claims payable

rising 21 percent to 58 days, compared with 48

days at the end of 1998.

One item that epitomizes our financial turn-

around is the relationship between stockholders’

equity and goodwill. At the end of 1998, goodwill

and other intangibles exceeded stockholders’

equity by more than $230 million. At the end

of 1999, the gap had narrowed to less than $20

million and we anticipate the lines will cross this

year. As equity exceeds goodwill we know the

quality of our balance sheet and the assets of

this company are improving and, we believe,

stockholder value is enhanced.

Selling, General and Administrative (SG&A)

expenses fell by nearly 8 percent in 1999 to

$1,301,743,000, or 16.0 percent of Health Plan

and Government Contracts/ Specialty Services

revenues including the costs of depreciation.

The comparable SG&A percentage in 1998

was 17.5 percent.

Divestiture Program

In last year’s Annual R eport, we pledged to

complete our divestiture program of non-core

operations in 1999. During the year, we

completed nine transactions and several real

estate dispositions, meeting our goal.

We sold health plans or health plan assets in

seven states including Colorado, Louisiana, New

Mexico, Oklahoma,Texas, Utah and Washington.

In each case, these plans did not possess the size

or market scope to compete effectively.

We believe the new owners possess adequate

market strength, which will better serve our

former members.

In addition, in 1999 we sold other non-core

operations. Advance Paradigm, a leading pharmacy

benefit management company, purchased certain

4 FOUNDATION HEALTH SYSTEMS, INC.

One item that epitomizes our financial turnaround is

the relationship between stockholders’ equity and goodwill.