Health Net 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Health Net annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foundation Health Systems, Inc.

21650 Oxnard Street, Woodland Hills, California 91367

Foundation Health Systems, Inc.

1999 Annual R eport

Table of contents

-

Page 1

Foundation Health Systems, Inc. 1999 An n u al R epo r t Foundation Health Systems, Inc. 21650 O xnard Street, Woodland H ills, C alifornia 91367 -

Page 2

-

Page 3

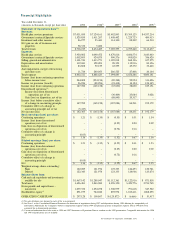

Financial Highlights Year ended December 31, (Amounts in thousands, except per share data) Statement of Operations Data (2) : Revenues 1999 1998(3) 1997(3) 1996(3) 1995(3) Health plan services premiums Government contracts/ Specialty services Investment and other income Net gain on sale of ... -

Page 4

... to management, integrate a new management team, improve core health plan operations and, overall, tighten our focus. While 1999 saw us achieve many important goals, we now are devoting significant energies to building a sustainable future that is based on the consumer and continued sound financial... -

Page 5

...r ano the r tro ubling sympto m, Health Net members c an c all HealthLine, a servic e available 24/ 7 to pro vide parents with medic al info rmatio n and assistanc e fro m a medic al pro fe ssio nal. Reg ular c hec kups and immunizatio ns are extremely impo rtant fo r ne wbo rns and infants. To keep... -

Page 6

... program of non-core operations in 1999. During the year, we completed nine transactions and several real estate dispositions, meeting our goal. We sold health plans or health plan assets in seven states including Colorado, Louisiana, New Mexico, O klahoma,Texas, Utah and Washington. In each case... -

Page 7

... of the two hospitals the company owned in Los Angeles, and its Preferred Health Network, Inc. and Foundation Health Preferred Administrator subsidiaries.The company also sold several real estate assets, primarily medical offices and clinics in Northern California. This ambitious divestiture program... -

Page 8

...in health care costs, ensuring that the doctors, hospitals and other health care providers who work with us are fairly compensated for their services. While both commercial and Medicare enrollment declined, enrollment in Medicaid plans, called Medi-Cal in California, rose by 13.9 percent. Health Net... -

Page 9

...of the state's largest medical groups. Health Net's leadership role helped pave the way for a solution that benefits physicians and our members.With this behind us, we see a relatively stable environment for 2000, thanks, in part, to rate increases that reflect the underlying health care cost trends... -

Page 10

...pricing.We believe that 2000 will show renewed enrollment growth. PHS continues to enjoy success in its joint venture with The Guardian Life Insurance Company for the small group market. In other market segments, PHS' broad provider network continues to attract new customers. The new management team... -

Page 11

... provider network, the revenue base of its commercial business and Medicare.While 1999 was a difficult year, a new management team, led by Bruce Young, instituted substantial price increases, yielding a 17 percent average increase to account for rapidly rising health care costs. In addition, the new... -

Page 12

... year and added one million new members for the early part of 2000.The primary growth engine for MHN is Employee Assistance Programs (EAPs). Among the many Fortune 500 companies that are MHN clients, such programs have gained increasing popularity as they move beyond mental health care to encompass... -

Page 13

... continued to achieve excellent results in managing pharmacy costs for our health plans and government contracts business. While we sold certain "back office" operations, we retained our role in managing the preferred lists of medications offered to our members.We believe this service is fundamental... -

Page 14

... receive higher quality health care - it will only increase costs. We believe, however, that the bills passed in California and signed into law by Governor Davis last fall represent a step in the right direction in the debate over patients' rights. A new law allows health plan members to sue their... -

Page 15

-

Page 16

... additional state regulations which may restrict the declaration of dividends by HMO s, insurance companies and licensed managed health care plans.The payment of any dividend is at the discretion of the Company's Board of Directors and depends upon the Company's earnings, financial position, capital... -

Page 17

...: Arizona (Arizona and Utah), California (encompassing only the State of California), Central (Colorado, Florida, Idaho, Louisiana, New Mexico, O klahoma, O regon,Texas and Washington) and Northeast (Connecticut, New Jersey, New York, O hio, Pennsylvania and West Virginia). During 1999, the Company... -

Page 18

... Health Health Health plan plan plan plan premiums medical care ratio premiums per member per month services per member per month Government Contracts/Specialty Services Segment: Government contracts and specialty services revenues Government contracts and specialty services expense medical care... -

Page 19

... due to continued growth in the Company's managed behavioral health network. The overall medical care ratio ("MCR ") (medical costs as a percentage of the sum of Health Plan Services and Government Contracts/ Specialty Services revenues) for the year ended December 31, 1999 was 81.22% as compared to... -

Page 20

... March 31, 1999, the Company recorded pretax charges for restructuring and other charges of $21.1 million which included $18.5 million for severance and benefit costs related to executives and employees at the Colorado regional processing center and at the Northwest health plans, and $2.6 million... -

Page 21

...1998, FPA Medical Management, Inc. ("FPA") filed for bankruptcy protection under Chapter 11 of the Federal Bankruptcy Code. FPA, through its affiliated medical groups, provided services to approximately 190,000 of the Company's affiliated members in Arizona and California and also leased health care... -

Page 22

...22.1 million for certain health plans whose health care costs exceed contractual premium revenues and additional claims reserves and other costs totaling $9.4 million.These costs were recorded in the fourth quarter of 1998. Management assesses the profitability of contracts when operating results or... -

Page 23

... maintain effective control over health care costs while providing members with quality care. Factors such as health care reform, integration of acquired companies, increased cost of individual services, regulatory changes, utilization, new technologies, hospital costs, major epidemics and numerous... -

Page 24

..., which cautionary statements are contained in the Company's Annual R eport on Form 10-K for the year ended December 31, 1999. Liquidity and Capital Resources Certain of the Company's subsidiaries must comply with minimum capital and surplus requirements under applicable state laws and regulations... -

Page 25

..., these notes are no longer outstanding. O n December 31, 1999, the Company sold the capital stock of Q ualMed Washington Health Plan, Inc., the Company's HMO subsidiary in the state of Washington ("Q M-Washington"), to American Family Care ("AFC"). Upon completion of the transaction, AFC assumed... -

Page 26

... to changes in credit spreads. Credit spread risk arises from the potential that changes in an issuer's credit rating or credit perception may affect the value of financial instruments. The Company has several bond portfolios to fund reserves.The Company attempts to manage the interest rate risks... -

Page 27

...of the Company's Internal Audit Department, thereby providing full and free access to the Committee. Earl B. Fowler, Chairman Audit Committee February 29, 2000 Report of Independent Auditors To the Board of Directors and Stockholders of Foundation Health Systems, Inc. Woodland Hills, California We... -

Page 28

...n Health Systems, Inc. December 31, (Amounts in thousands) Assets 1999 1998 Current Assets: Cash and cash equivalents Investments - available for sale Premium receivables, net of allowance for doubtful accounts (1999 - $21,937; 1998 - $28,522) Amounts receivable under government contracts Deferred... -

Page 29

Consolidated Statements of Operations Fo undatio n Health Systems, Inc. Year ended December 31, (Amounts in thousands, except per share data) Revenues 1999 1998 1997 Health plan services premiums Government contracts/ Specialty services Investment and other income Net gain on sale of businesses ... -

Page 30

... Net income Change in unrealized depreciation on investments, net Total comprehensive income Exercise of stock options including related tax benefit Conversion of Class B to Class A Employee stock purchase plan Balance at December 31, 1999 See accompanying notes to consolidated financial statements... -

Page 31

... Net income Change in unrealized depreciation on investments, net Total comprehensive income Exercise of stock options including related tax benefit Conversion of Class B to Class A Employee stock purchase plan Balance at December 31, 1999 See accompanying notes to consolidated financial statements... -

Page 32

...: Proceeds from exercise of stock options and employee stock purchases Proceeds from issuance of notes payable and other financing arrangements R epayment of debt and other noncurrent liabilities Stock repurchase Net cash provided by (used in) financing activities Net increase in cash and cash... -

Page 33

Consolidated Statements of Cash Flows Fo undatio n Health Systems, Inc. (continued) Year ended December 31, (Amounts in thousands) Supplemental Cash Flows Disclosure: 1999 1998 1997 Interest paid Income taxes paid (refunded) Supplemental Schedule of Non-Cash Investing and Financing Activities: $... -

Page 34

...:Arizona (Arizona and Utah), California (encompassing only the State of California), Central (Colorado, Florida, Idaho, Louisiana, New Mexico, Oklahoma, Oregon,Texas and Washington) and Northeast (Connecticut, New Jersey, New York, Ohio, Pennsylvania and West Virginia). During 1999, the Company... -

Page 35

... financial statements and notes have been reclassified to conform to the 1999 presentation. Revenue Recognition Health plan services premium revenues include HMO and PPO premiums from employer groups and individuals and from Medicare recipients who have purchased supplemental benefit coverage... -

Page 36

... value of employer group contracts, provider networks, non-compete agreements and debt issuance costs. Goodwill and other intangible assets are amortized using the straight-line method over the estimated lives of the related assets listed below. In accordance with Accounting Principles Board ("APB... -

Page 37

... with generally accepted accounting principles ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues... -

Page 38

... million. In addition, the Company also completed the sale of its HMO operations in Utah,Washington, New Mexico, Louisiana,Texas and Oklahoma, as well as the sale of its two hospitals, a bill review subsidiary, a third-party administrator subsidiary and a PPO network subsidiary. For these businesses... -

Page 39

... fair value (see Note 15). Advantage Health remains a party to long-term provider agreements with the seller. PACC - O n O ctober 22, 1997, the Company completed the acquisitions of PACC HMO and PACC Health Plans (collectively, "PACC"), which are managed health care companies based near Portland... -

Page 40

... 1999, the contractual maturities of the Company's available-for-sale investments were as follows (in thousands): Cost Estimated Fair Value... 50,842 $456,603 Land Construction in progress Buildings and improvements Furniture, equipment and software Less accumulated depreciation $ 20,645 18,930 111... -

Page 41

... the Company's Board of Directors. Under the 1989, 1990, 1991, 1992, 1993, 1997 and 1998 employee stock option plans and the non-employee director stock option plans, the Company grants options at prices at or above the fair market value of the stock on the date of grant.The options carry a maximum... -

Page 42

... compensation cost has been recognized for its stock option or employee stock purchase plans. Had compensation cost for the Company's plans been determined based on the fair value at the grant dates of options and employee purchase rights consistent with the method of SFAS No. 123, the Company's net... -

Page 43

... of Incorporation, all of such shares of Class B Common Stock automatically converted into shares of Class A Common Stock in the hands of such third parties. Shareholder Rights Plan O n May 20, 1996, the Board of Directors of the Company declared a dividend distribution of one right (a "R ight... -

Page 44

... benefit health care plans that provide postretirement medical benefits to directors, key executives, employees and dependents who meet certain eligibility requirements. Under these plans, the Company pays a percentage of the costs of medical, dental and vision benefits during retirement.The plans... -

Page 45

... and amounts recognized in the Company's financial statements (amounts in thousands): Pension Benefits 1999 1998 O ther Benefits 1999 1998 Change in benefit obligation: Benefit obligation, beginning of year Service cost Interest cost Plan amendments Benefits paid Actuarial loss (gain) Projected... -

Page 46

... participants.The account for the FHC plan anticipates future cost-sharing changes to the plan consistent with the Company's expressed intent to increase retiree contributions at the same rates as the Company's premium increases.The Health Net plan is noncontributory for employees retired prior to... -

Page 47

... Requirements All of the Company's health plans as well as its insurance subsidiaries are required to periodically file financial statements with regulatory agencies in accordance with statutory accounting and reporting practices. Under the California Knox-Keene Health Care Service Plan Act of 1975... -

Page 48

...November 1999, a complaint was filed seeking certification of a nationwide class action and alleging that cost containment measures used by FHS-affiliated health maintenance organizations, preferred provider organizations and point-of-service health plans violate provisions of the federal R acketeer... -

Page 49

...also a member of the Company's Board of Directors until April 1, 1997. Medical costs paid to the hospital totaled $67.1 million in 1997. Such contracted hospital is also an employer group of the Company from which the Company receives premium revenues at standard rates. A director of the Company was... -

Page 50

...$18.5 million for severance and benefit costs related to executives and operations employees at the Colorado regional processing center and operations employees at the Northwest health plans.The operations functions include premium accounting, claims, medical management, customer service, sales and... -

Page 51

... adjustments, equitable adjustments relating to government contracts, payment disputes with contracted provider groups and premium deficiency reserves and were primarily included in health care costs within the consolidated statement of operations.The Company also recorded in the fourth quarter... -

Page 52

... amounts credited to participants' accounts in connection with the termination of future benefits under the FHC deferred compensation plan (see Note 9).These benefit plan actions were effected pursuant to the change of control of FHC in connection with the FHS Combination. PROVIDER N ET W ORK COST... -

Page 53

..., fixtures, equipment and software development projects were determined by management to have no continuing value to the Company, due to the Company abandoning plans for the development of this location and its systems and programs as a centralized operations center. Accordingly, in the fourth... -

Page 54

... provides a comprehensive range of health care services through HMO and PPO networks.The Government Contracts/ Specialty Services segment administers large, multi-year managed care government contracts and also offers behavioral, dental, vision, and pharmaceutical products and services. The Company... -

Page 55

...to conform to the fourth quarter of 1999 presentation: March 31 1999: June 30 September 30 December 31 Total revenues Income from continuing operations before income taxes Income before cumulative effect of a change in accounting principle, net of tax Net income Basic and diluted earnings per share... -

Page 56

...2000, at the Hilton Woodland Hills & Towers, 6360 Canoga Avenue,Woodland Hills, California 91367, and via the Internet at www.vcall.com. Investor Contact Financial Consultant Board Committees: 1 2 3 Audit Committee Committee on Directors Compensation and Stock O ption Committee 4 Finance Committee...