Hasbro 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

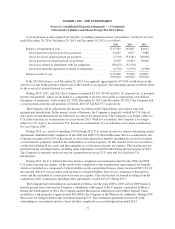

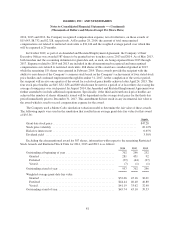

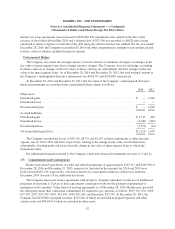

Stock Options

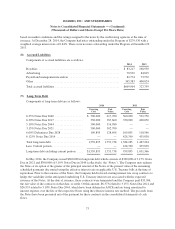

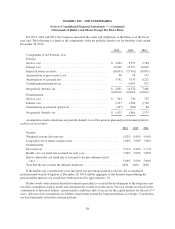

Information with respect to stock options for the three years ended December 28, 2014 is as follows:

2014 2013 2012

Outstanding at beginning of year .............................. 5,543 9,283 11,004

Granted ................................................ 684 776 1,730

Exercised ............................................... (1,951) (4,377) (3,126)

Expired or forfeited ....................................... (90) (139) (325)

Outstanding at end of year .................................... 4,186 5,543 9,283

Exercisable at end of year .................................... 2,374 3,144 6,094

Weighted average exercise price:

Granted ................................................ $52.11 47.21 36.14

Exercised ............................................... $31.07 26.99 21.23

Expired or forfeited ....................................... $39.85 39.59 35.19

Outstanding at end of year .................................. $41.68 36.63 31.25

Exercisable at end of year .................................. $38.90 33.22 27.84

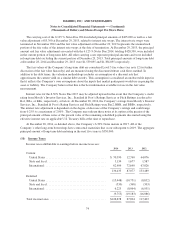

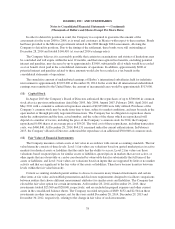

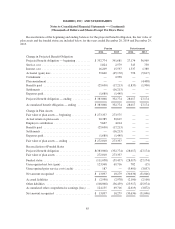

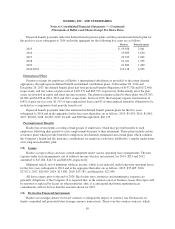

With respect to the 4,186 outstanding options and 2,374 options exercisable at December 28, 2014, the

weighted average remaining contractual life of these options was 3.98 years and 3.17 years, respectively. The

aggregate intrinsic value of the options outstanding and exercisable at December 28, 2014 was $57,627 and

$39,264, respectively. Substantially all unvested outstanding options are expected to vest.

The Company uses the Black-Scholes valuation model in determining the fair value of stock options. The

expected life of the options used in this calculation is the period of time the options are expected to be

outstanding and has been determined based on historical exercise experience. The weighted average fair value of

options granted in fiscal 2014, 2013 and 2012 was $8.40, $6.94 and $6.29, respectively. The fair value of each

option grant is estimated on the date of grant using the Black-Scholes option pricing model with the following

weighted average assumptions used for grants in the fiscal years 2014, 2013 and 2012:

2014 2013 2012

Risk-free interest rate ....................................... 1.42% 0.62% 0.69%

Expected dividend yield ..................................... 3.30% 3.39% 3.99%

Expected volatility ......................................... 26% 26% 31%

Expected option life ........................................ 5years 5 years 5 years

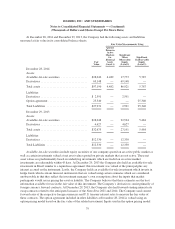

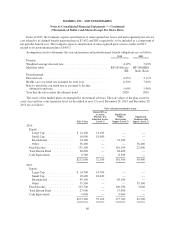

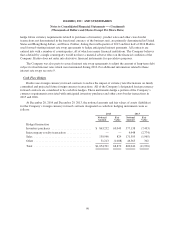

The intrinsic values, which represent the difference between the fair market value on the date of exercise

and the exercise price of the option, of the options exercised in fiscal 2014, 2013 and 2012 were $44,890,

$89,534 and $49,225, respectively.

At December 28, 2014, the amount of total unrecognized compensation cost related to stock options was

$6,599 and the weighted average period over which this will be expensed is 21 months.

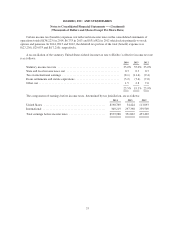

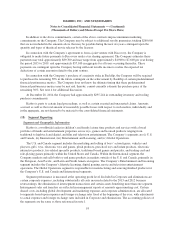

Non-Employee Awards

In 2014, 2013 and 2012, the Company granted 34, 33 and 44 shares of common stock, respectively, to its

non-employee members of its Board of Directors. Of these shares, the receipt of 26 shares from the 2014 grant,

28 shares from the 2013 grant and 33 shares from the 2012 grant has been deferred to the date upon which the

83