Hasbro 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

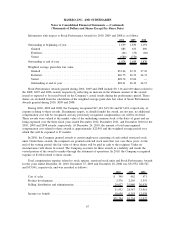

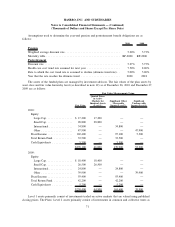

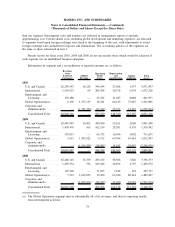

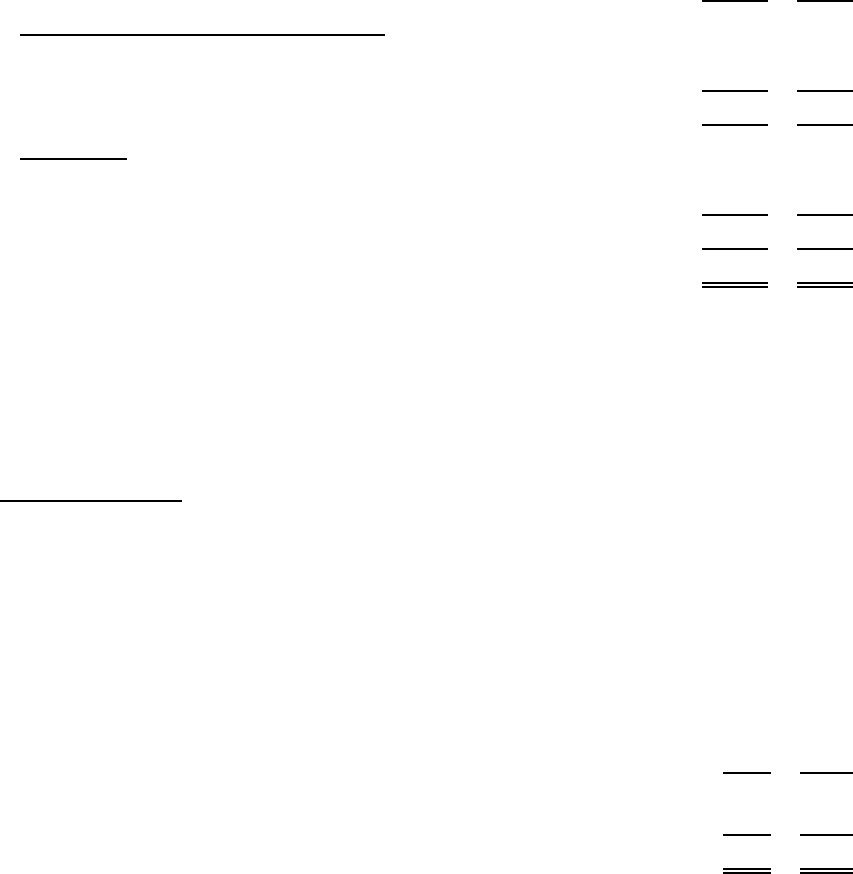

The Company has a master agreement with each of its counterparties that allows for the netting of

outstanding forward contracts. The fair values of the Company’s foreign currency forward contracts designated

as cash flow hedges are recorded in the consolidated balance sheet at December 26, 2010 and December 27,

2009 as follows:

2010 2009

Prepaid expenses and other current assets

Unrealized gains ................................................ $24,710 12,142

Unrealized losses ............................................... (9,229) (1,899)

Net unrealized gain.............................................. 15,481 10,243

Other assets

Unrealized gains ................................................ 4,403 13,709

Unrealized losses ............................................... (2,933) —

Net unrealized gain.............................................. 1,470 13,709

Total net unrealized gain .......................................... $16,951 23,952

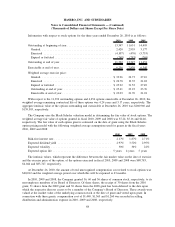

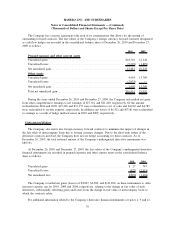

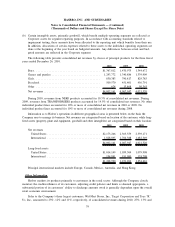

During the years ended December 26, 2010 and December 27, 2009, the Company reclassified net gains

from other comprehensive earnings to net earnings of $17,912 and $21,240, respectively. Of the amount

reclassified in 2010 and 2009, $13,249 and $17,173 were reclassified to cost of sales and $4,663 and $4,785

were reclassified to royalty expense, respectively. In addition, net losses of $(132) and $(718) were reclassified

to earnings as a result of hedge ineffectiveness in 2010 and 2009, respectively.

Undesignated Hedges

The Company also enters into foreign currency forward contracts to minimize the impact of changes in

the fair value of intercompany loans due to foreign currency changes. Due to the short-term nature of the

derivative contracts involved, the Company does not use hedge accounting for these contracts. As of

December 26, 2010, the total notional amount of the Company’s undesignated derivative instruments was

$89,191.

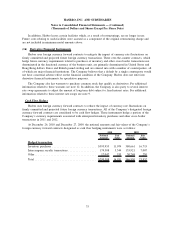

At December 26, 2010 and December 27, 2009, the fair values of the Company’s undesignated derivative

financial instruments are recorded in prepaid expenses and other current assets in the consolidated balance

sheet as follows:

2010 2009

Unrealized gains .................................................. $ 27 747

Unrealized losses ................................................. (827) (2,151)

Net unrealized loss ................................................ $(800) (1,404)

The Company recorded net gains (losses) of $4,827, $6,580, and $(42,382) on these instruments to other

(income) expense, net for 2010, 2009 and 2008, respectively, relating to the change in fair value of such

derivatives, substantially offsetting gains and losses from the change in fair value of intercompany loans to

which the contracts relate.

For additional information related to the Company’s derivative financial instruments see notes 2, 9 and 12.

76

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)