Hasbro 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition, Hasbro leases certain facilities which, as a result of restructurings, are no longer in use.

Future costs relating to such facilities were accrued as a component of the original restructuring charge and

are not included in minimum rental amounts above.

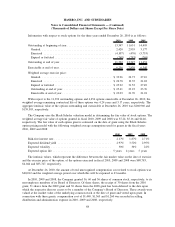

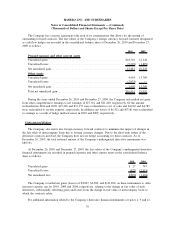

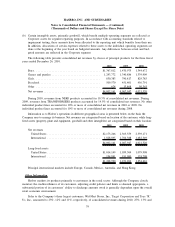

(16) Derivative Financial Instruments

Hasbro uses foreign currency forward contracts to mitigate the impact of currency rate fluctuations on

firmly committed and projected future foreign currency transactions. These over-the-counter contracts, which

hedge future currency requirements related to purchases of inventory and other cross-border transactions not

denominated in the functional currency of the business unit, are primarily denominated in United States and

Hong Kong dollars, Euros and British pound sterling and are entered into with a number of counterparties, all

of which are major financial institutions. The Company believes that a default by a single counterparty would

not have a material adverse effect on the financial condition of the Company. Hasbro does not enter into

derivative financial instruments for speculative purposes.

The Company also has warrants to purchase common stock that qualify as derivatives. For additional

information related to these warrants see note 12. In addition, the Company is also party to several interest

rate swap agreements to adjust the amount of long-term debt subject to fixed interest rates. For additional

information related to these interest rate swaps see note 9.

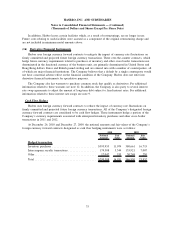

Cash Flow Hedges

Hasbro uses foreign currency forward contracts to reduce the impact of currency rate fluctuations on

firmly committed and projected future foreign currency transactions. All of the Company’s designated foreign

currency forward contracts are considered to be cash flow hedges. These instruments hedge a portion of the

Company’s currency requirements associated with anticipated inventory purchases and other cross-border

transactions in 2011 and 2012.

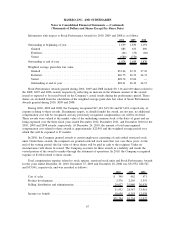

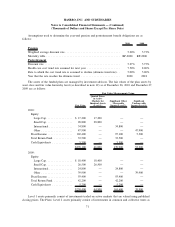

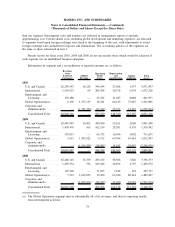

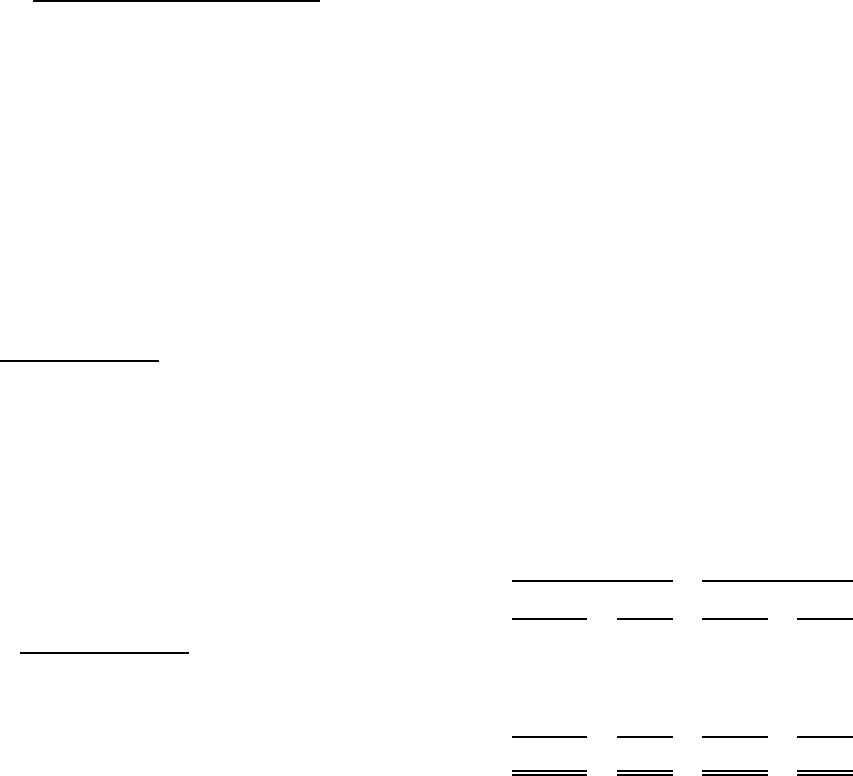

At December 26, 2010 and December 27, 2009, the notional amounts and fair values of the Company’s

foreign currency forward contracts designated as cash flow hedging instruments were as follows:

Notional

Amount

Fair

Value

Notional

Amount

Fair

Value

2010 2009

Hedged transaction

Inventory purchases ............................ $593,953 11,074 380,661 16,715

Intercompany royalty transactions .................. 179,308 5,344 135,921 7,007

Other ....................................... 17,047 533 30,268 230

Total ....................................... $790,308 16,951 546,850 23,952

75

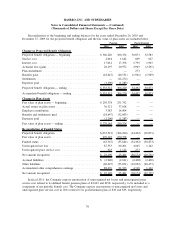

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)