Hasbro 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

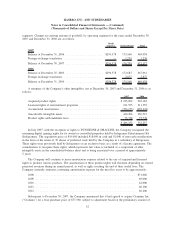

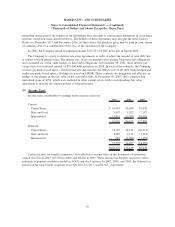

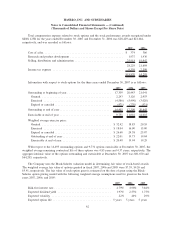

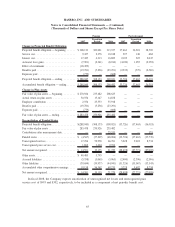

Total compensation expense related to stock options and the stock performance awards recognized under

SFAS 123R for the years ended December 30, 2007 and December 31, 2006 was $28,229 and $21,684,

respectively, and was recorded as follows:

2007 2006

Cost of sales................................................... $ 374 306

Research and product development . ................................. 1,937 1,436

Selling, distribution and administration ............................... 25,918 19,942

28,229 21,684

Income tax expense ............................................. 9,359 7,399

$18,870 14,285

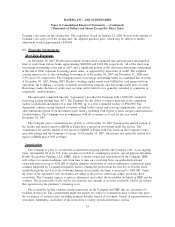

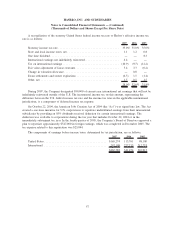

Information with respect to stock options for the three years ended December 30, 2007 is as follows:

2007 2006 2005

Outstanding at beginning of year ............................ 17,309 20,443 21,041

Granted ............................................. 2,243 3,126 2,953

Exercised ........................................... (4,586) (5,490) (3,020)

Expired or canceled .................................... (471) (770) (531)

Outstanding at end of year ................................. 14,495 17,309 20,443

Exercisable at end of year ................................. 9,731 11,016 14,015

Weighted average exercise price:

Granted ............................................. $ 32.42 18.83 20.55

Exercised ........................................... $ 18.04 16.00 15.00

Expired or canceled .................................... $ 26.60 24.38 25.07

Outstanding at end of year ............................... $ 22.01 19.73 19.04

Exercisable at end of year ............................... $ 20.48 19.94 19.29

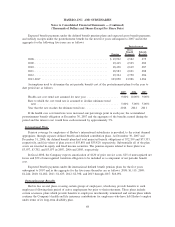

With respect to the 14,495 outstanding options and 9,731 options exercisable at December 30, 2007, the

weighted average remaining contractual life of these options was 4.83 years and 4.37 years, respectively. The

aggregate intrinsic value of the options outstanding and exercisable at December 30, 2007 was $81,670 and

$64,205, respectively.

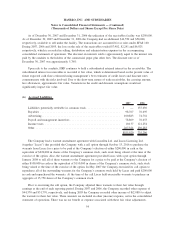

The Company uses the Black-Scholes valuation model in determining fair value of stock-based awards.

The weighted average fair value of options granted in fiscal 2007, 2006 and 2005 were $7.39, $4.26 and

$5.41, respectively. The fair value of each option grant is estimated on the date of grant using the Black-

Scholes option pricing model with the following weighted average assumptions used for grants in the fiscal

years 2007, 2006, and 2005:

2007 2006 2005

Risk-free interest rate .................................... 4.79% 4.98% 3.84%

Expected dividend yield .................................. 1.97% 2.55% 1.75%

Expected volatility ...................................... 22% 24% 29%

Expected option life ..................................... 5years 5 years 5 years

62

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)