Harley Davidson 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

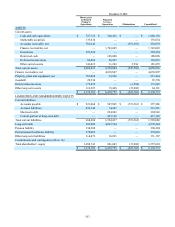

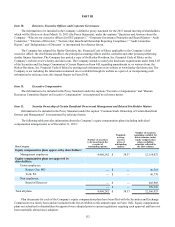

SUPPLEMENTARY DATA

Quarterly financial data (unaudited)

(In millions, except per share data)

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

April 1,

2012 Mar 27,

2011 July 1,

2012 June 26,

2011 Sep 30,

2012 Sep 25,

2011 Dec 31,

2012 Dec 31,

2011

Motorcycles:

Revenue $1,273.4 $1,063.0 $1,569.0 $1,339.7 $1,089.3 $1,232.7 $1,010.9 $1,026.8

Operating income(a) $ 208.1 $ 125.1 $ 309.6 $ 219.8 $ 144.8 $ 180.7 $ 53.1 $ 35.6

Financial Services:

Revenue $ 156.3 $ 161.9 $ 160.6 $ 165.9 $ 161.0 $ 164.6 $ 160.0 $ 157.2

Operating income $ 67.4 $ 67.9 $ 82.0 $ 82.1 $ 72.4 $ 62.0 $ 63.0 $ 56.8

Consolidated:

Income before taxes $ 265.9 $ 182.9 $ 382.1 $ 292.3 $ 207.1 $ 233.9 $ 106.4 $ 83.6

Income from continuing

operations $ 172.0 $ 119.3 $ 247.3 $ 190.6 $ 134.0 $ 183.6 $ 70.6 $ 54.6

Income from discontinued

operations(b) $ — $ — $ — $ — $ — $ — $ — $ 51.0

Net income $ 172.0 $ 119.3 $ 247.3 $ 190.6 $ 134.0 $ 183.6 $ 70.6 $ 105.6

Earnings per common share from

continuing operations:

Basic $ 0.75 $ 0.51 $ 1.08 $ 0.81 $ 0.59 $ 0.79 $ 0.31 $ 0.24

Diluted $ 0.74 $ 0.51 $ 1.07 $ 0.81 $ 0.59 $ 0.78 $ 0.31 $ 0.24

Earnings per common share from

discontinued operations:

Basic $ — $ — $ — $ — $ — $ — $ — $ 0.22

Diluted $ — $ — $ — $ — $ — $ — $ — $ 0.22

Earnings per common share:

Basic $ 0.75 $ 0.51 $ 1.08 $ 0.81 $ 0.59 $ 0.79 $ 0.31 $ 0.46

Diluted $ 0.74 $ 0.51 $ 1.07 $ 0.81 $ 0.59 $ 0.78 $ 0.31 $ 0.46

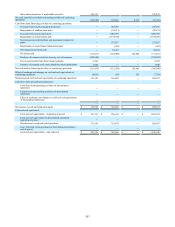

(a) Operating income for the Motorcycles segment includes restructuring expense as discussed in Note 4 for the following periods (in millions):

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

April 1,

2012 Mar 27,

2011 July 1,

2012 June 26,

2011 Sep 30,

2012 Sep 25,

2011 Dec 31,

2012 Dec 31,

2011

Restructuring expense $ 11.5 $ 23.0 $ 6.2 $ 13.6 $ 9.2 $ 12.4 $ 1.6 $ 19.0

(b) Income from discontinued operations for the quarter ended December 31, 2011 includes a $51.0 million income tax benefit as discussed in Note 3.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

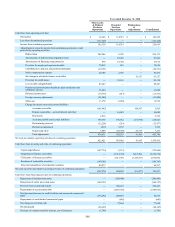

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

In accordance with Rule 13a-15(b) of the Securities Exchange Act of 1934 (the Exchange Act), as of the end of the period

covered by this Annual Report on Form 10-K, the Company’s management evaluated, with the participation of the Company’s

Chairman, President and Chief Executive Officer and the Senior Vice President and Chief Financial Officer, the effectiveness

of the design and operation of the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) under the

Exchange Act). Based upon their evaluation of these disclosure controls and procedures, the Chairman, President and Chief

Executive Officer and the Senior Vice President and Chief Financial Officer have concluded that the disclosure controls and