Hamilton Beach 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

HBB continues to monitor both currency effects and

commodity costs closely and intends to adjust product

prices and product placements, as appropriate, if

these costs increase more than anticipated. HBB

expects cash flow before financing activities in 2014

to be substantial but down significantly from 2013’s

very strong results.

Longer-Term Perspective

HBB’s vision is to be the leading designer,

marketer and distributor of small electric household

and commercial appliances sold worldwide under

strong brand names and to achieve profitable growth

from innovative solutions that improve everyday living.

As part of this vision, HBB is focused on delivering

growth above historic rates to reach sales of approxi-

mately $750 million. As the company moves toward

this target sales level, HBB expects to take advantage

of increasing economies of scale to improve return on

sales by focusing on its five key strategic initiatives.

First, HBB is focused on enhancing placements

in the North American consumer business through

consumer-driven innovative products and strong

sales and marketing support. The company’s product

and placement track record is strong due to innovation

processes centered on understanding and meeting

end-user needs and focusing on quality and best-

in-class customer service. In the North American

consumer market, HBB believes it has a stronger and

deeper portfolio of new products than its competitors.

HBB expects its product pipeline in 2014 and beyond

to be at or above 2013 levels, with strong brands and

best-in-class products.

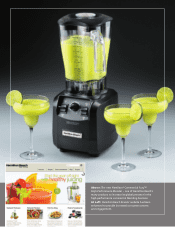

A second area of growth opportunity is through

the enhancement of online sales. In the past few

years, online sales of small kitchen appliances have

grown significantly. During 2013, 15 percent of small

kitchen appliances were purchased online. Retailers

are looking for partners that can provide not only

products, but also the capabilities and support for

promotion, marketing and distribution programs

appropriate for that channel. As consumers’ shopping

habits evolve to rely more on the Internet, HBB is

focused on providing best-in-class retailer support,

increasing engagement with end users, including

maintaining a website that is appropriate for mobile

devices, and enhancing its programs designed to make

HBB the preferred source for small appliances.

Third, the “only-the-best” high-end small kitchen

appliance market segment is a strong growth area

in which HBB has not previously participated. This

segment accounts for approximately 38 percent of

the small kitchen appliance market, and its target

consumer is financially strong. HBB is concentrating its

efforts on participating in the “only-the-best” market

with strong brands and a broad product line. HBB is

planning to enter the “only-the-best” high-end small

kitchen appliance market selectively. The company is

currently working with the Jamba Juice Company to

create a product line focused on blending and juicing.

HBB is also working with other partners to create

additional lines that can be distributed in high-end

specialty stores and on the Internet.

Fourth, HBB is focused on expanding its retail

presence internationally in the emerging growth

markets of Asia and Latin America by increasing

product offerings designed specifically for those

market needs and by expanding distribution channels

and sales and marketing capabilities. HBB’s historical

strength has been in the domestic consumer goods

market, with only 22 percent of total sales occurring

outside the United States in 2013. The company’s

objective is to increase international sales to 35 to 45

percent of total sales by concentrating on key markets.

HBB’s efforts will focus on continuing to expand in

Mexico, Canada, Central America and South America,

as well as entering the emerging markets of China,

India and Brazil. To achieve this growth, the company

is working to understand local consumers’ needs,

increasing resources allocated to these markets and

developing products to meet those needs, especially

in the mid- to high-end segments of these markets.

In addition, HBB expects to work with local partners

in certain targeted countries. HBB began selling

retail product in China in early 2013 and in Brazil

in late 2013. The company expects to increase sales

in these areas in 2014 and enter the Indian market

during mid-2014.

Fifth, while HBB has a solid position in the

Commercial market, it continues to focus on achieving

further penetration of the global Commercial market

through a commitment to an enhanced global product