HR Block 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS

See discussion below and in Item 8, note 22 to the consolidated financial statements.

DESCRIPTION OF BUSINESS

TAX SERVICES

GENERAL – Our Tax Services segment is primarily engaged in providing tax return preparation and related

services and products in the U.S. and its territories, Canada, and Australia. Major revenue sources include fees

earned for tax preparation and related services performed at company-owned retail tax offices, royalties from

franchisees, sales of tax preparation software, online tax preparation fees, fees from refund anticipation checks

(RACs), fees from our H&R Block Prepaid Emerald MasterCard

®

, and interest and fees from Emerald Advance

lines of credit (EAs). HRB Bank also offers traditional banking services including checking and savings

accounts, individual retirement accounts and certificates of deposit.

Assisted income tax return preparation and related services are provided by tax professionals via a system of

retail offices operated directly by us or by franchisees.

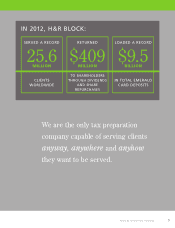

TAX RETURNS PREPARED – We, together with our franchisees, prepared 25.6 million tax returns worldwide

during fiscal year 2012, compared to 24.5 million in 2011 and 23.2 million in 2010. We prepared 22.3 million tax

returns in the U.S. during fiscal year 2012, up from 21.4 million in 2011 and 20.1 million in 2010. Our U.S. tax

returns prepared during the 2012 tax season, including those prepared by our franchisees and those prepared

and filed at no charge, constituted approximately 16% of an Internal Revenue Service (IRS) estimate of total

individual income tax returns filed during the fiscal year 2012 tax season. See Item 7 for further discussion of

changes in the number of tax returns prepared.

FRANCHISES – We offer franchises as a way to expand our presence in certain markets. Our franchise

arrangements provide us with certain rights designed to protect our brand. Most of our franchisees receive the

right to use our software, access to product offerings and expertise, signs, specialized forms, advertising and

initial training and supervisory services. Our franchisees pay us a percentage, typically approximately 30%, of

gross tax return preparation and related service revenues as a franchise royalty in the U.S.

During fiscal years 2012, 2011 and 2010 we sold certain offices to existing franchisees for sales proceeds

totaling $17.3 million, $65.6 million and $65.7 million, respectively. The net gain on these transactions totaled

$16.6 million, $45.1 million and $49.1 million in fiscal years 2012, 2011 and 2010, respectively. The extent to

which we choose to sell company-owned offices depends upon our analysis regarding the optimal mix of offices

for our network, including geographic location, as well as our ability to identify qualified franchisees.

From time to time, we have also acquired the assets of existing franchisees and other tax return preparation

businesses, and may continue to do so if future conditions warrant and satisfactory terms can be negotiated.

OFFICES – In fiscal year 2012 we operated in 10,992 offices across the U.S., which is slightly less than the

prior year. A summary of our company-owned and franchise offices is included in Item 7, under “Tax Services –

Operating Statistics.” We sold 83, 280 and 267 company-owned offices to franchisees in fiscal years 2012, 2011

and 2010, respectively. Offices in shared locations at April 30, 2012 consist primarily of offices in Sears and

Wal-Mart stores. Offices in shared locations at April 30, 2011 and 2010 consist primarily of offices in Sears

stores. The Sears license agreement expires in July 2012, while the Wal-Mart agreement expires in May 2013.

SERVICE AND PRODUCT OFFERINGS – In addition to our retail offices, we offer a number of digital tax

preparation alternatives. By offering professional and do-it-yourself tax preparation options through multiple

channels, we seek to serve our clients in the manner they choose to be served. We also offer clients a number of

options for receiving their income tax refund, including a check directly from the IRS, an electronic deposit

directly to their bank account, a prepaid debit card or a RAC offered through HRB Bank.

Online Tax Preparation. We offer a comprehensive range of online tax services, from tax advice to complete

professional and do-it-yourself tax return preparation and electronic filing, through our website at

www.hrblock.com. The services available at this website allow clients to prepare their federal and state income

tax returns using the H&R Block At Home™ Online Tax Program, access tax tips, advice and tax-related news,

and use calculators for tax planning.

We participate in the Free File Alliance (FFA). This alliance was created by the tax return preparation

industry and the IRS, and allows qualified filers with adjusted gross incomes of less than $57,000 to prepare and

file their federal return online at no charge. We believe this program provides a valuable public service and

increases our visibility with new clients, while also providing an opportunity to offer our state return

preparation and other services to these clients.

2

H&R BLOCK 2012 Form 10K