HR Block 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual Report

Table of contents

-

Page 1

2012 Annual Report -

Page 2

... Tax Credits â- Employs approximately 90,000 highly trained tax professionals In addition to company-owned and franchise retail tax offices worldwide, and its H&R Block At HomeTM software and online solutions, the company offers affordable financial products and services to support its tax business... -

Page 3

... first. If we stay focused on them and on preparing error-free returns, we'll ultimately increase the number of returns we're a part of. And if we do that, we'll ultimately increase profitability." Henry Bloch Co-Founder Happy Birthday, Henry! 90 years old on July 30, 2012 Anyway Anywhere Anyhow 1 -

Page 4

...heavily in marketing and our free refund anticipation check (RAC) promotion, which helped level the playing field. The free RAC promotion also helped us retain early season clients and led to a 24 percent increase in total Emerald Cards issued, which is part of our long-term strategy. We believe the... -

Page 5

...$100 million of pretax earnings to our bottom line in fiscal 2013. Next, we believe RALs will largely lose their importance in the marketplace next tax season. This should create a more level playing field and give us a competitive advantage, as we believe we have the best RAC offering in the market... -

Page 6

... Tax Market Share* (%) 2011 2012 25.6 24.6 23.9 23.2 24.5 18.6 18.7 16.4 16.7 13.8 13.0 2008 2009 2010 2011 2012 Assisted DIY Total *Calculated as fiscal year returns prepared in U.S. as a percentage of estimated total IRS filings in tax season 2012. 4 H&R Block 2012 Annual Report -

Page 7

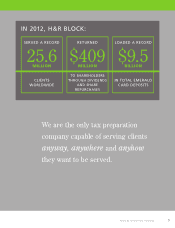

IN 2012, H&R BLOCK: SERVED A RECORD RETURNED LOADED A RECORD 25.6 $409 $9.5 MILLION MILLION BILLION CLIENTS WORLDWIDE TO SHAREHOLDERS THROUGH DIVIDENDS AND SHARE REPURCHASES IN TOTAL EMERALD CARD DEPOSITS We are the only tax preparation company capable of serving clients anyway, anywhere and ... -

Page 8

... General Partner and Investment Manager GFP, L.P. New York, NY William C. Cobb President and Chief Executive Officer H&R Block, Inc. Kansas City, MO Paul J. Brown President, Brands and Commercial Services Hilton Worldwide McLean, VA Marvin R. Ellison Executive Vice President- U.S. Stores The Home... -

Page 9

2012 Form 10-K -

Page 10

(This page intentionally left blank.) -

Page 11

... Block Way, Kansas City, Missouri 64105 (Address of principal executive offices, including zip code) (816) 854-3000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common... -

Page 12

(This page intentionally left blank.) -

Page 13

... III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accountant Fees and Services PART IV... -

Page 14

(This page intentionally left blank.) -

Page 15

...products related to income tax return preparation to the general public primarily in the United States (U.S.), and also in Canada and Australia. This segment also offers financial services including the H&R Block Prepaid Emerald MasterCard® and Emerald Advance lines of credit through H&R Block Bank... -

Page 16

... software, online tax preparation fees, fees from refund anticipation checks (RACs), fees from our H&R Block Prepaid Emerald MasterCard®, and interest and fees from Emerald Advance lines of credit (EAs). HRB Bank also offers traditional banking services including checking and savings accounts... -

Page 17

... management software, calculations, completion of the appropriate tax forms, error checking and electronic filing. Our software products may be purchased online, through third-party retail stores or via direct mail. RACs. RACs are offered to U.S. clients who would like to (1) receive their refund... -

Page 18

...name "H&R Block" are operated by franchisees. Our franchising activities are subject to the rules and regulations of the Federal Trade Commission (FTC), potential enforcement by the CFPB, and various state laws regulating the offer and sale of franchises. The FTC and various state laws require us to... -

Page 19

... Street Reform and Consumer Protection Act (the Dodd-Frank Act) was signed into law on July 21, 2010. This federal statute made extensive changes to the laws regulating federal savings banks, their holding companies and other financial services companies. The Dodd-Frank Act requires various federal... -

Page 20

.... At April 30, 2012, HRB Bank had no outstanding advances from the FHLB. Federal Reserve Regulation of SLHCs. Each of our Holding Companies is a savings and loan holding company within the meaning of the HOLA. As such, they are registered as unitary savings and loan holding 6 H&R BLOCK 2012 Form 10K -

Page 21

... like a printed copy of any of these corporate governance documents, please send your request to the Office of the Secretary, H&R Block, Inc., One H&R Block Way, Kansas City, Missouri 64105. Information contained on our website does not constitute any part of this report. H&R BLOCK 2012 Form 10K 7 -

Page 22

...of our direct competitors offer certain free online tax preparation and electronic filing options. In order to compete, we also have free tax service offerings in several categories. We prepared 861,000, 767,000 and 810,000 federal income tax returns in fiscal years 2012, 2011 and 2010, respectively... -

Page 23

... parties may be able to circumvent these security and business measures, and errors in the storage, use or transmission of personal information may result in a breach of client or employee privacy or theft of assets, which may require notification under applicable data privacy regulations. We employ... -

Page 24

...affect our Holding Companies and could alter our strategic plans. The Dodd-Frank Act made extensive changes to the laws regulating banks, holding companies and financial services firms, and requires various federal agencies to adopt a broad range of new implementing rules and regulations and prepare... -

Page 25

...The CFPB has extensive rulemaking and enforcement powers that may impact our business operations. Specifically, the CFPB may examine, and take enforcement actions against, our non-bank subsidiaries that provide consumer financial products and services. New CFPB regulations may require changes to our... -

Page 26

... tax service and product offerings, changes in government regulations or processes that affect how we provide such offerings to our clients, or significant problems with such offerings may harm our revenue, results of operations and reputation. Tax laws and tax forms are subject to change each year... -

Page 27

... the mortgage loan, SCC may be obligated to repurchase the loan or may otherwise indemnify certain parties for losses, referred to as "representation and warranty claims." The statute of limitations for a contractual claim to enforce a representation and warranty obligation is generally six years or... -

Page 28

... insurance companies, have filed or may file lawsuits, or may assert indemnification claims, directly against depositors and loan originators in securitization transactions alleging a variety of claims, including federal and state securities law violations, common law torts and fraud and breach... -

Page 29

... in Thornleigh, New South Wales. Our Australian tax offices are operated under leases throughout Australia. HRB Bank is headquartered and its single branch location is located in our corporate headquarters. We own our corporate headquarters, which is located in Kansas City, Missouri. All current... -

Page 30

... with funding employee income tax withholding obligations arising upon the exercise of stock options or the lapse of restrictions on restricted shares. In June 2008, our Board of Directors approved an authorization to purchase up to $2.0 billion of our common stock through June 2012. In June 2012... -

Page 31

...banking services. We are the only major company offering a full range of software, online and in-office tax preparation solutions to individual tax clients. OVERVIEW A summary of our fiscal year 2012 results is as follows: â...¢ Revenues for the fiscal year were $2.9 billion, down 1.7% from prior year... -

Page 32

... Results of Operations Data Year ended April 30, REVENUES: Tax Services Corporate and eliminations 2012 $ 2,862,378 31,393 $ 2,893,771 INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE TAXES: Tax Services Corporate and eliminations Income taxes Net income from continuing operations Net income (loss... -

Page 33

... Company-owned operations Franchise operations Total retail operations Software Online Free File Alliance Total digital tax solutions Total U.S. operations International operations: Canada (1) Australia Total international operations Tax returns prepared worldwide TAX OFFICES : U.S. offices: Company... -

Page 34

Tax Services - Financial Results Year ended April 30, Tax preparation fees Royalties Fees from refund anticipation checks Fees from Emerald Card Fees from Peace of Mind guarantees Interest income on Emerald Advance Loan participation fees and related revenue Other Total revenues Compensation and ... -

Page 35

... through the free Federal EZ filing we began offering during fiscal year 2011, that increase did not have a significant impact on our revenues. Royalties increased $28.6 million, or 10.4%, primarily due to the conversion of 280 company-owned offices into franchises. Fees earned on RACs increased $94... -

Page 36

... mortgage business. Income Taxes Our effective tax rate for discontinued operations was 50.5% for the fiscal year ended April 30, 2011, compared to 44.0% in the prior year. This increase resulted from the impact of permanent tax items and increased state tax rates. 22 H&R BLOCK 2012 Form 10K -

Page 37

...an increase in representation and warranty claims as a result of volatility in mortgage delinquency rates, housing prices and expected expiration of applicable statutes of limitations and developments in securities litigation and other proceedings to which SCC is not a party. SCC accrues a liability... -

Page 38

... in credit quality may exceed our modeled assumptions. Mortgage loans held for investment include loans originated by our affiliate, SCC, and purchased by HRB Bank. We have greater exposure to loss with respect to this segment of our loan portfolio as a result of 24 H&R BLOCK 2012 Form 10K -

Page 39

... pool, as we are no longer originating or purchasing new mortgage loans, and we believe that factor, over time, will limit variability in our loss estimates. VALUATION OF GOODWILL - The evaluation of goodwill for impairment is a critical accounting estimate due both to the magnitude of our goodwill... -

Page 40

... note 1 to the consolidated financial statements. FINANCIAL CONDITION CAPITAL RESOURCES AND LIQUIDITY - Our sources of capital include cash from operations, cash from customer deposits, issuances of common stock and debt. We use capital primarily to fund working capital, 26 H&R BLOCK 2012 Form 10K -

Page 41

... of sales of tax offices and franchisee draws under our Franchise Equity Lines of Credit (FELCs). CASH FROM FINANCING ACTIVITIES - Changes in cash used in financing activities primarily relate to the following: Short-Term Borrowings. While we use commercial paper borrowings to fund our off-season... -

Page 42

... help meet its capital requirements. Block Financial made capital contributions to HRB Bank of $400.0 million during fiscal year 2012 and $235.0 million during both fiscal year 2011 and fiscal year 2010. Historically, capital contributions by Block Financial have been repaid as dividends or a return... -

Page 43

...30, 2011 Long-term Baa2 BBB BBB (high) Outlook Negative Negative Stable At April 30, 2012, we maintained a CLOC agreement to support commercial paper issuances, general corporate purposes or for working capital needs. This facility provides funding up to $1.7 billion and matures July 31, 2013. This... -

Page 44

... 0.25% 7.38% 2010 Average Balance Interest Average Income/ Yield/ Expense Cost 4.12% 0.09% 35.21% 0.71% 1.77% 0.26% 7.00% Interest-earning assets: Mortgage loans, net Federal funds sold Emerald Advance (1) Available-for-sale investment securities FHLB stock Cash and due from banks $ 448,431 2,315... -

Page 45

... $ 4,514 $ $ (264) (22) (286) Change Change Due to Due to Rate Volume $ (1,211) $ 5,951 16 1 73 (128) (21) (6) (13) 450 Interest income: Loans, net (1) Available-for-sale investment securities Federal funds sold FHLB stock Cash & due from banks $ (69,700) 4,004 (2) (58) (521) $ (66,277) $ (46,549... -

Page 46

... of 5% or greater, for our portfolio of mortgage loans held for investment as of April 30, 2012: (dollars in 000s) Loans Purchased from SCC Florida New York California Wisconsin All others Total $ 23,534 68,680 45,976 1,566 111,667 Loans Purchased from Other Parties $ 56,058 8,530 9,764 34,627 68... -

Page 47

... savings Interest-bearing checking accounts IRAs Certificates of deposit Non-interest-bearing deposits $ 306,053 14,871 334,022 50,647 705,593 320,566 $ 1,026,159 RATIOS - The following table shows certain of HRB Bank's key ratios for fiscal years 2012, 2011 and 2010: Year ended April 30, Return... -

Page 48

... timing of the prepayment, the write-offs of mortgage origination costs may result in lower than anticipated yields. Customer Deposits and FHLB Advances. HRB Bank's liabilities consist primarily of transactional deposit relationships, such as prepaid debit card accounts and checking accounts. Other... -

Page 49

... an extensive program of internal audits and requires the management teams of certain of our individual subsidiaries to certify their respective financial information. Our system of internal control over financial reporting also includes formal policies and procedures, including a Code of Business... -

Page 50

... - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated June 26, 2012 expressed an unqualified opinion on the Company's internal control over financial reporting. Kansas City, Missouri June 26, 2012 36 H&R BLOCK 2012 Form 10K -

Page 51

... Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended April 30, 2012 of the Company and our report dated June 26, 2012 expressed an unqualified opinion on those financial statements. Kansas City, Missouri June 26, 2012 H&R BLOCK 2012 Form... -

Page 52

... OF INCOME AND COMPREHENSIVE INCOME Year ended April 30, REVENUES: Service revenues Product and other revenues Interest income 2012 $2,434,307 359,664 99,800 2,893,771 OPERATING EXPENSES: Cost of revenues: Compensation and benefits Occupancy and equipment Provision for bad debt and loan losses... -

Page 53

... LIABILITIES: Customer banking deposits Accounts payable, accrued expenses and other current liabilities Accrued salaries, wages and payroll taxes Accrued income taxes Current portion of long-term debt Federal Home Loan Bank borrowings Liabilities of discontinued operations, held for sale Total... -

Page 54

... at beginning of the year Cash and cash equivalents at end of the year SUPPLEMENTARY CASH FLOW DATA: Income taxes paid, net of refunds received Interest paid on borrowings Interest paid on deposits Transfers of foreclosed loans to other assets Accrued purchase of common stock 2012 $ 265,932 103,576... -

Page 55

...common shares Cash dividends declared Cash dividends paid - $0.60 per share Balances at April 30, 2010 Net income Unrealized translation gain Change in net unrealized gain (loss) on available-for-sale securities Stock-based compensation Shares issued for: Option.... H&R BLOCK 2012 Form 10K 41 -

Page 56

... offer: assisted tax return preparation; H&R Block At Homeâ„¢ digital services and products, and certain retail banking services. We also provide tax preparation services in Canada and Australia. PRINCIPLES OF CONSOLIDATION - The consolidated financial statements include the accounts of the Company... -

Page 57

..., we revoke the franchisee's franchise rights, write off the remaining balance of the loan and assume control of the office. Tax client receivables related to RALs. All tax client receivables related to RALs outstanding at April 30, 2012 were originated prior to fiscal year 2011 and are past due. We... -

Page 58

... where applicable. We update our estimates of expected cash flows periodically and recognize changes in calculated effective yields as appropriate. Held-to-Maturity. Our investment in the stock of the Federal Home Loan Bank (FHLB) is carried at cost, as it is a restricted security, which is required... -

Page 59

... assets using the straight-line method. COMMERCIAL PAPER - During fiscal year 2012, we issued commercial paper to finance temporary liquidity needs and various financial activities. There was no commercial paper outstanding at April 30, 2012 or 2011. MORTGAGE LOAN REPRESENTATION AND WARRANTY CLAIMS... -

Page 60

... Service revenues consist primarily of fees for preparation and filing of tax returns, both in offices and through our online programs and fees associated with our Peace of Mind (POM) guarantee program and interchange income associated with our H&R Block Prepaid Emerald MasterCard® program. Service... -

Page 61

...as incurred. Total advertising costs of continuing operations for fiscal years 2012, 2011 and 2010 totaled $278.8 million, $243.3 million and $235.9 million, respectively. GAINS ON SALES OF TAX OFFICES - We periodically sell company-owned tax offices to franchisees. We offer loans to our franchisees... -

Page 62

...price method. In addition, this guidance significantly expands required disclosures related to a vendor's new multiple-deliverable revenue arrangements. We adopted this guidance as of May 1, 2011 and it did not have a material effect on our consolidated financial statements. 48 H&R BLOCK 2012 Form... -

Page 63

... of stock for fiscal years 2012, 2011 and 2010, respectively, as the effect would be antidilutive. NOTE 3: RECEIVABLES Short-term receivables consist of the following: (in 000s) As of April 30, Loans to franchisees Receivables for tax preparation and related fees Emerald Advance lines of credit... -

Page 64

...) Emerald Advance Lines of Credit Credit Quality Indicator - Year of origination: 2012 2011 2010 2009 and prior Revolving loans $ 8,948 6,940 3,601 5,150 12,085 Tax Client Receivables - RALs $ - - - 5,272 - $ 36,724 $ 5,272 As of April 30, 2012, $31.4 million of EAs were on non-accrual status... -

Page 65

... for loan at origination; (3) occupancy status of property at origination; (4) geography; and (5) credit score and loan to value at origination. We specifically evaluate each loan and assign an internal risk rating of high, medium or low to each loan. The risk rating is based upon multiple loan... -

Page 66

... 58% of our mortgage loan portfolio consists of loans to borrowers located in the states of Florida, California, New York and Wisconsin. Detail of the aging of the mortgage loans in our portfolio as of April 30, 2012 is as follows: (in 000s) Less than 60 Days Past Due Purchased from SCC All other... -

Page 67

...$ $ 5,454 445 5,899 8,548 Interest income on impaired loans recognized on a cash basis on non-accrual status: Purchased from SCC All other $ $ 5,265 417 5,682 $ $ 5,567 744 6,311 $ 7,452 As of April 30, 2012 and 2011, accrued interest receivable on mortgage loans held for investment totaled... -

Page 68

... AVAILABLE-FOR-SALE - The amortized cost and fair value of securities classified as AFS held at April 30, 2012 and 2011 are summarized below: (in 000s) As of April 30, Amortized Cost Short-term: Municipal bonds Long-term: Mortgage-backed securities Municipal bonds $ 1,008 2012 Gross Unrealized... -

Page 69

...underperforming company-owned offices. As a result, we recorded an impairment of goodwill, in the amount of $7.4 million. There is no remaining goodwill related to our ExpressTax brand. We recorded a $22.7 million impairment in our RedGear reporting unit in fiscal year 2011. H&R BLOCK 2012 Form 10K... -

Page 70

...,678 $ - 6,119 $ 8,488 Interest Expense $ 2,168 107 94 - 94 Short-term: Money-market deposits Savings deposits Checking deposits: Interest-bearing Non-interest-bearing $ 177,976 11,401 4,336 276,321 280,657 IRAs and other time deposits: Due in one year IRAs 29,510 328,005 357,515 $ 827,549 Long... -

Page 71

...,527 We maintain a committed line of credit (CLOC) agreement to support commercial paper issuances, general corporate purposes or for working capital needs. This facility provides funding up to $1.7 billion and matures July 31, 2013. This facility bears interest at an annual rate of LIBOR plus 1.30... -

Page 72

... information for similar securities. The fair values provided by third-party pricing service are reviewed and validated by management of HRB Bank. There were no transfers of AFS securities between hierarchy levels during the fiscal years ended April 30, 2012 and 2011. 58 H&R BLOCK 2012 Form 10K -

Page 73

... mortgage loans held for investment is generally based on the net present value of discounted cash flows for TDR loans or the appraised value of the underlying collateral for all other loans. Impaired and TDR loans are required to be remeasured at least annually, based on HRB Bank's Loan Policy... -

Page 74

...market and savings accounts was equal to the amount payable on demand (Level 1). The fair value of IRAs and other time deposits is estimated by discounting the future cash flows using the rates currently offered by HRB Bank for products with similar remaining maturities (Level 3). â...¢ Long-term debt... -

Page 75

...service period of the awards, are expensed over the shorter of the two periods. Options are generally granted at a price equal to the fair market value of our common stock on the grant date. All types of awards granted under the 2003 Plan have a contractual term of ten years. H&R BLOCK 2012 Form 10K... -

Page 76

... at the time of settlement. Our 2000 Employee Stock Purchase Plan (ESPP) provides employees the option to purchase shares of our common stock through payroll deductions. The purchase price of the stock is 90% of the lower of either the fair market value of our common stock on the first trading day... -

Page 77

... Weighted-average fair value ESPP options: Expected volatility Expected term Dividend yield Risk-free interest rate Weighted-average fair value (1) 2012 31.75% - 32.34% 5 years 3.43% - 4.80% 0.79% - 1.95% $ 3.31 2011 28.98% - 30.20% 5 years 4.18% - 5.17% 1.26% - 1.92% $ 2.25 2010 27.11% - 27.27... -

Page 78

... volatility using historical volatility for H&R Block, Inc. and selected comparable companies. The dividend yield is calculated based on the current dividend and the market price of our common stock on the grant date. The risk-free interest rate is based on the U.S. Treasury zero-coupon yield... -

Page 79

... in fiscal years 2011 and 2010, respectively. The effective tax rate for discontinued operations was 48.4%, 50.5% and 44.0% for fiscal years 2012, 2011 and 2010, respectively. As of April 30, 2012 and 2011, we have deferred tax assets related to capital loss carry-forwards totaling $85.8 million... -

Page 80

..., respectively. We file a consolidated federal income tax return in the U.S. and file tax returns in various state and foreign jurisdictions. The U.S. federal consolidated tax returns for the calendar years 1999 through 2010 are currently under examination by the Internal Revenue Service (IRS), with... -

Page 81

... components of interest income and expense of our continuing operations. (in 000s) Year ended April 30, Interest income: Mortgage loans, net Emerald Advance lines of credit Investment securities Other 2012 $ 20,322 59,660 4,463 15,355 $ 99,800 $ 2011 24,693 94,300 1,609 13,058 $ 2010 31,877 77... -

Page 82

... We offer guarantees under our POM program to tax clients whereby we will assume the cost of additional tax assessments, up to a cumulative per client limit of $5,500, attributable to tax return preparation error for which we are responsible. We defer all revenues and direct costs associated with... -

Page 83

... purchase or disposition of businesses; (2) penalties and interest assessed by federal and state taxing authorities in connection with tax returns prepared for clients; (3) indemnification of our directors and officers; and (4) third-party claims relating to various arrangements in the normal course... -

Page 84

... and warranty claims which may be due to increasing mortgage delinquency rates, declining housing prices, expected expiration of applicable statutes of limitations and developments in securities litigation and other proceedings to which SCC is not a party, among other factors. All claims asserted... -

Page 85

...how opposing parties and their counsel will themselves view the relevant evidence and applicable law. In addition to litigation matters, we are also subject to other claims and regulatory investigations arising out of our business activities, including as described below. H&R BLOCK 2012 Form 10K 71 -

Page 86

... financial position, results of operations and cash flows. On December 9, 2009, a putative class action lawsuit was filed in the United States District Court for the Central District of California against SCC and H&R Block, Inc. styled Jeanne Drake, et al. v. Option One 72 H&R BLOCK 2012 Form 10K -

Page 87

..., results of operations and cash flows. On October 15, 2010, the Federal Home Loan Bank of Chicago filed a lawsuit in the Circuit Court of Cook County, Illinois (Case No. 10CH45033) styled Federal Home Loan Bank of Chicago v. Bank of America Funding Corporation, et al. against multiple defendants... -

Page 88

...compensated for certain training courses occurring on or after April 15, 2007). Two classes were also certified under state laws in California and New York (consisting of tax professionals who worked in company-owned offices in those states). The plaintiffs in the wage and hour class action lawsuits... -

Page 89

... of operations and cash flows. COMPLIANCE FEE LITIGATION - On April 16, 2012 and April 19, 2012, putative class action lawsuits were filed against us in Missouri state and federal courts, respectively, concerning a compliance fee charged to retail tax clients beginning in the 2011 tax season. These... -

Page 90

... are parties to a class action filed on July 11, 2006 and styled Do Right's Plant Growers, et al. v. RSM EquiCo, Inc., et al. (the "RSM Parties"), Case No. 06 CC00137, in the California Superior Court, Orange County. The complaint contains allegations relating to business valuation services provided... -

Page 91

... 30, Revenues Pretax income (loss) from operations: RSM and related businesses Mortgage Income taxes (benefit) Net income (loss) from operations Pretax loss on sales of businesses Income tax benefit Net loss on sales of businesses Net income (loss) from discontinued operations $ $ $ 2012 417,168... -

Page 92

... fees earned for tax preparation services performed at company-owned retail tax offices, royalties from franchise retail tax offices, sales of tax preparation software, online tax preparation fees, fees from refund anticipation checks (RACs), fees from activities related to H&R Block Prepaid Emerald... -

Page 93

...2010, respectively. Information concerning the Company's operations by reportable segment is as follows: (in 000s) Year ended April 30, REVENUES : Tax Services Corporate and eliminations 2012 $2,862,378 31,393 $2,893,771 2011 $2,912,361 32,619 $2,944,980 2010 $2,975,252 39,583 $3,014,835 INCOME... -

Page 94

...Because most of our clients file their tax returns during the period from January through April of each year, substantially all of our revenues from income tax return preparation and related services and products are earned during this period. As a result, we generally operate at a loss through the... -

Page 95

...ended April 30, 2011 Total revenues Cost of revenues Selling, general and administrative Total expenses Operating income (loss) Other income, net Income (loss) from continuing operations before taxes (benefit) Income taxes (benefit) Net income (loss) from continuing operations Net income (loss) from... -

Page 96

... April 30, 2012 Cash & cash equivalents Cash & cash equivalents - restricted Receivables, net Mortgage loans held for investment, net Intangible assets and goodwill, net Investments in subsidiaries Other assets Total assets Customer deposits Long-term debt Other liabilities Net intercompany advances... -

Page 97

... Proceeds from commercial paper Repayments of other borrowings Customer banking deposits, net Dividends paid Repurchase of common stock Proceeds from stock options Net intercompany advances Other, net Net cash provided by (used in) financing activities Effects of exchange rates on cash Net increase... -

Page 98

... Proceeds from commercial paper Repayments of other borrowings Customer banking deposits, net Dividends paid Repurchase of common stock Proceeds from stock options Net intercompany advances Other, net Net cash provided by (used in) financing activities Effects of exchange rates on cash Net increase... -

Page 99

... paper Proceeds from commercial paper Repayments of other borrowings Proceeds from other borrowings Customer banking deposits, net Dividends paid Repurchase of common stock Proceeds from stock options Net intercompany advances Other, net Net cash provided by (used in) financing activities Effects... -

Page 100

... covered by this Annual Report on Form 10-K. (b) MANAGEMENT'S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING - Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company, as such term is defined in Exchange Act Rules 13a-15... -

Page 101

...this Form 10-K and in our definitive proxy statement filed pursuant to Regulation 14A not later than 120 days after April 30, 2012, in the sections entitled "Equity Compensation Plans" and "Information Regarding Security Holders," and is incorporated herein by reference. H&R BLOCK 2012 Form 10K 87 -

Page 102

... April 30, 2012, in the sections entitled "Employment Agreements, Change-of-Control and Other Arrangements," "Review of Related Person Transactions," and "Corporate Governance," and is incorporated herein by reference. ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES The information called for by... -

Page 103

... its behalf by the undersigned, thereunto duly authorized. H&R BLOCK, INC. William C. Cobb President and Chief Executive Officer June 26, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant... -

Page 104

...18, 2000, among H&R Block, Inc., Block Financial Corporation, Bankers Trust Company and the Bank of New York, filed as Exhibit 4(a) to the Company's current report on Form 8-K filed April 17, 2000, file number 1-6089, is incorporated herein by reference. Officer's Certificate, dated October 26, 2004... -

Page 105

...by reference. The H&R Block Executive Performance Plan, as amended July 27, 2010, filed as Exhibit 10.6 to the Company's annual report on Form 10-K for the fiscal year ended April 30, 2011, file number 1-6089, is incorporated herein by reference. The H&R Block, Inc. 2000 Employee Stock Purchase Plan... -

Page 106

.... ** Credit and Guarantee Agreement dated as of March 4, 2010, among Block Financial LLC, H&R Block, Inc., each lender from time to time party thereto, and Bank of America, N.A., filed as Exhibit 10.36 to the Company's annual report on Form 10-K for the fiscal year ended April 30, 2010, file number... -

Page 107

(This page intentionally left blank.) -

Page 108

(This page intentionally left blank.) -

Page 109

... of our 2012 Form 10-K as filed with the Securities and Exchange Commission. Requests should be directed by telephone to Investor Relations, 1.800.869.9220, option 6, or by mail to One H&R Block Way, Kansas City, Missouri 64105. For more information about H&R Block, visit our Web site at www.hrblock... -

Page 110

H&R BLOCK, INC. One H&R Block Way Kansas City, MO 64105 816.854.3000 www.hrblock.com