General Dynamics 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 General Dynamics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Combat Systems group competes with a large number of domestic and

non-U.S. businesses. Our Information Systems and Technology group

competes with many companies, from large defense companies to

small niche competitors with specialized technologies or expertise. Our

Marine Systems group has one primary competitor with which it also

partners on the Virginia-class submarine program. The operating cycle

of many of our major platform programs can result in sustained periods

of program continuity when we perform successfully.

We are involved in teaming and subcontracting relationships with

some of our competitors. Competitions for major defense programs

often require companies to form teams to bring together a spectrum of

capabilities to meet the customer’s requirements. Opportunities

associated with these programs include roles as the program’s

integrator, overseeing and coordinating the efforts of all participants on

a team, or as a provider of a specific component or subsystem.

BUSINESS-JET AIRCRAFT MARKET COMPETITION

The Aerospace group has several competitors for each of its

Gulfstream products. Key competitive factors include aircraft safety,

reliability and performance; comfort and in-flight productivity; service

quality, global footprint and responsiveness; technological and new-

product innovation; and price. We believe that Gulfstream competes

effectively in all of these areas.

The Aerospace group competes worldwide in the business-jet

aircraft services business primarily on the basis of price, quality and

timeliness. In our maintenance, repair and FBO businesses, the group

competes with several other large companies as well as a number of

smaller companies, particularly in the maintenance business. In our

completions business, the group competes with other OEMs, as well as

several third-party providers.

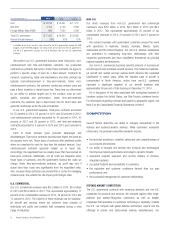

BACKLOG

Our total backlog represents the estimated remaining value of work to be performed under firm contracts and includes funded and unfunded portions.

For additional discussion of backlog, see Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7.

Summary backlog information for each of our business groups follows:

2014 Total

Backlog Not

Expected to Be

Completed in

2015

December 31 2014 2013

Funded Unfunded Total Funded Unfunded Total

Aerospace $ 13,115 $ 117 $ 13,232 $ 13,785 $ 158 $ 13,943 $ 6,931

Combat Systems 19,292 506 19,798 5,451 1,113 6,564 15,060

Information Systems and Technology 7,070 1,539 8,609 7,253 1,267 8,520 2,229

Marine Systems 13,452 17,319 30,771 11,795 5,063 16,858 24,518

Total backlog $ 52,929 $ 19,481 $ 72,410 $ 38,284 $ 7,601 $ 45,885 $ 48,738

RESEARCH AND DEVELOPMENT

To foster innovative product development and evolution, we conduct

sustained R&D activities as part of our normal business operations. In the

commercial sector, most of our Aerospace group’s R&D activities support

Gulfstream’s product enhancement and development programs. In our

U.S. defense businesses, we conduct customer-sponsored R&D activities

under government contracts and company-sponsored R&D. In accordance

with government regulations, we recover a portion of company-sponsored

R&D expenditures through overhead charges to U.S. government

contracts. For more information on our company-sponsored R&D

activities, including our expenditures for the past three years, see Note A

to the Consolidated Financial Statements in Item 8.

INTELLECTUAL PROPERTY

We develop technology, manufacturing processes and systems-

integration practices. In addition to owning a large portfolio of

proprietary intellectual property, we license some intellectual property

rights to and from others. The U.S. government holds licenses to many

of our patents developed in the performance of U.S. government

contracts, and it may use or authorize others to use the inventions

covered by these patents. Although these intellectual property rights

are important to the operation of our business, no existing patent,

license or other intellectual property right is of such importance that its

loss or termination would have a material impact on our business.

General Dynamics Annual Report 2014 9