General Dynamics 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 General Dynamics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

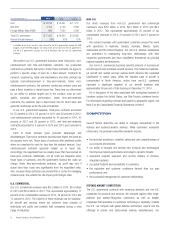

Year Ended December 31 2014 2013 2012

DoD $ 14,516 $ 15,441 $ 17,217

Non-DoD 2,750 2,790 2,382

Foreign Military Sales (FMS)* 689 1,032 1,206

Total U.S. government $ 17,955 $ 19,263 $ 20,805

Percent of total revenues 58% 62% 67%

* In addition to our direct non-U.S. sales, we sell to non-U.S. governments through the FMS

program. Under the FMS program, we contract with and are paid by the U.S. government,

and the U.S. government assumes the risk of collection from the non-U.S. government

customer.

We perform our U.S. government business under fixed-price, cost-

reimbursement and time-and-materials contracts. Our production

contracts are primarily fixed-price. Under these contracts, we agree to

perform a specific scope of work for a fixed amount. Contracts for

research, engineering, repair and maintenance and other services are

typically cost-reimbursement or time-and-materials. Under cost-

reimbursement contracts, the customer reimburses contract costs and

pays a fixed, incentive or award-based fee. These fees are determined

by our ability to achieve targets set in the contract, such as cost,

quality, schedule and performance. Under time-and-materials

contracts, the customer pays a fixed hourly rate for direct labor and

generally reimburses us for the cost of materials.

In our U.S. government business, fixed-price contracts accounted

for 53 percent in 2014, 54 percent in 2013 and 56 percent in 2012;

cost-reimbursement contracts accounted for 43 percent in 2014, 42

percent in 2013 and 39 percent in 2012; and time-and-materials

contracts accounted for 4 percent in 2014 and 2013 and 5 percent in

2012.

Each of these contract types presents advantages and

disadvantages. Fixed-price contracts typically have higher fee levels as

we assume more risk. These types of contracts offer additional profits

when we complete the work for less than the contract amount. Cost-

reimbursement contracts generally subject us to lower risk.

Accordingly, the negotiated fees are usually lower than fees earned on

fixed-price contracts. Additionally, not all costs are allowable under

these types of contracts, and the government reviews the costs we

charge. Under time-and-materials contracts, our profit may vary if

actual labor-hour costs vary significantly from the negotiated rates.

Also, because these contracts can provide little or no fee for managing

material costs, the content mix can impact profit margin rates.

U.S. COMMERCIAL

Our U.S. commercial revenues were $5.3 billion in 2014, $5.4 billion

in 2013 and $3.8 billion in 2012. This represented approximately 17

percent of our consolidated revenues in 2014, 18 percent in 2013 and

12 percent in 2012. The majority of these revenues are for business-

jet aircraft and services where our customer base consists of

individuals and public and privately held companies across a wide

range of industries.

NON-U.S.

Our direct revenues from non-U.S. government and commercial

customers were $7.6 billion in 2014, $6.3 billion in 2013 and $6.4

billion in 2012. This represented approximately 25 percent of our

consolidated revenues in 2014, 20 percent in 2013 and 21 percent in

2012.

We conduct business with government customers around the world

with operations in Australia, Canada, Germany, Mexico, Spain,

Switzerland and the United Kingdom. Our non-U.S. defense subsidiaries

are committed to maintaining long-term relationships with their

respective governments and have established themselves as principal

regional suppliers and employers.

Our non-U.S. commercial business consists primarily of business-jet

aircraft exports and worldwide aircraft services. The market for business-

jet aircraft and related services outside North America has expanded

significantly in recent years. While the installed base of aircraft is

concentrated in North America, orders from non-U.S. customers

represent a significant segment of our aircraft business with

approximately 60 percent of total backlog on December 31, 2014.

For a discussion of the risks associated with conducting business in

locations outside the United States, see Risk Factors contained herein.

For information regarding revenues and assets by geographic region, see

Note Q to the Consolidated Financial Statements in Item 8.

COMPETITION

Several factors determine our ability to compete successfully in the

defense and business-aviation markets. While customers’ evaluation

criteria vary, the principal competitive elements include:

•the technical excellence, reliability, safety and cost competitiveness of

our products and services;

•our ability to innovate and develop new products and technologies

that improve mission performance and adapt to dynamic threats;

•successful program execution and on-time delivery of complex,

integrated systems;

•our global footprint and accessibility to customers;

•the reputation and customer confidence derived from our past

performance; and

•the successful management of customer relationships.

DEFENSE MARKET COMPETITION

The U.S. government contracts with numerous domestic and non-U.S.

companies for products and services. We compete against other large-

platform and system-integration contractors as well as smaller

companies that specialize in a particular technology or capability. Outside

the U.S., we compete with global defense contractors’ exports and the

offerings of private and state-owned defense manufacturers. Our

8 General Dynamics Annual Report 2014