Freeport-McMoRan 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

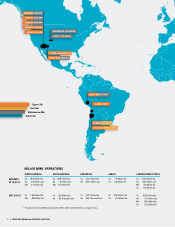

SOUTH AMERICA

FCX operates four copper mines in South America — Cerro Verde in

Peru, and El Abra, Candelaria and Ojos del Salado in Chile. In addition to

copper, the Cerro Verde mine also produces molybdenum concentrates,

and the Candelaria and Ojos del Salado mines produce gold and silver.

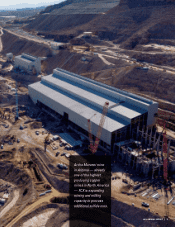

FCX is engaged in a large-scale expansion project at Cerro Verde

that would expand the concentrator facilities from the current rate of

120,000 metric tons of ore per day to 360,000 metric tons of ore per

day and provide incremental annual production of approximately

600 million pounds of copper and 15 million pounds of molybdenum

beginning in 2016. FCX commenced construction on this project in the

first quarter of 2013.

FCX is also engaged in pre-feasibility studies for a potential large-scale

milling operation at El Abra to process additional sulfide material and

to achieve higher recoveries.

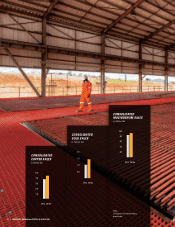

South America’s consolidated copper sales totaled 1.25 billion pounds

at an average realized price of $3.58 per pound in 2012, compared to

1.32 billion pounds at an average realized price of $3.77 per pound in

2011. Lower copper sales volumes in 2012 primarily reflected lower

ore grades at Candelaria and Cerro Verde, partly offset by higher

mining rates and ore grades at El Abra. FCX expects 2013 sales from

South America to increase to approximately 1.33 billion pounds

of copper, primarily reflecting higher-grade ore at Candelaria.

0.75

1.50

1.25

1.00

0.50

0.25

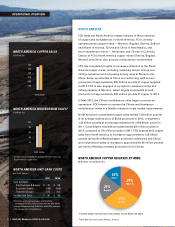

SOUTH AMERICA COPPER SALES

in billion lbs

2012 2013e*

Cash Unit Costs

Site Production & Delivery $ 1.60 $ 1.65

By-product Credits (0.26) (0.32)

Treatment Charges 0.16 0.17

Unit Net Cash Costs $ 1.50 $ 1.50

SOUTH AMERICA UNIT CASH COSTS

per lb of copper

SOUTH AMERICA COPPER RESERVES BY MINE

38.8 billion consolidated lbs

78%

Cerro Verde

11%

Candelaria

and Ojos

del Salado

11%

El Abra

OPERATIONAL OVERVIEW

Photo: Concentrating complex, Cerro Verde, Peru

2012 2013e

* Estimates assume average prices of $1,700/oz for

gold and $11/lb for molybdenum for 2013.

10