Freeport-McMoRan 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

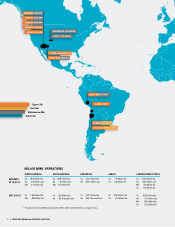

NORTH AMERICA

FCX leads the North America metals industry in the production

of copper and molybdenum. In North America, FCX currently

operates seven copper mines — Morenci, Bagdad, Sierrita, Safford

and Miami in Arizona, Tyrone and Chino in New Mexico, and

two molybdenum mines — Henderson and Climax in Colorado.

Certain of FCX’s North America copper mines (Sierrita, Bagdad,

Morenci and Chino) also produce molybdenum concentrates.

FCX has completed projects to increase production at the North

America copper mines, including restarting certain mining and

milling operations and increasing mining rates at Morenci and

Chino. Ramp up activities at Chino are continuing, with annual

production of approximately 250 million pounds of copper targeted

in 2014. FCX is also engaged in a project to advance mining and

milling capacity at Morenci, which targets incremental annual

production of approximately 225 million pounds of copper in 2014.

In May 2012, the Climax molybdenum mine began commercial

operations. FCX intends to operate the Climax and Henderson

molybdenum mines in a flexible manner to meet market requirements.

North America’s consolidated copper sales totaled 1.35 billion pounds

at an average realized price of $3.64 per pound in 2012, compared to

1.25 billion pounds at an average realized price of $3.99 per pound in

2011. Consolidated molybdenum sales totaled 83 million pounds in

2012, compared to 79 million pounds in 2011. FCX expects 2013 copper

sales from North America to increase to approximately 1.45 billion

pounds (primarily reflecting higher production at Morenci and Chino)

and molybdenum sales to increase to approximately 90 million pounds

(primarily reflecting increased production from Climax).

0.75

1.50

1.25

1.00

0.50

0.25

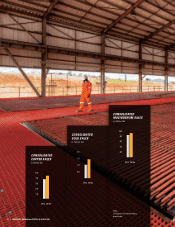

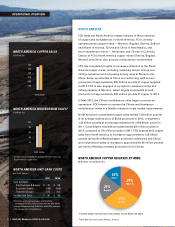

NORTH AMERICA COPPER SALES

in billion lbs

NORTH AMERICA MOLYBDENUM SALES*

in billion lbs

100

60

80

40

20

* Include sales of molybdenum produced at FCX’s North and

South America copper mines.

2012 2013e*

Cash Unit Costs

Site Production & Delivery $ 1.91 $ 1.98

By-product Credits (0.36) (0.26)

Treatment Charges 0.12 0.10

Unit Net Cash Costs $ 1.67 $ 1.82

NORTH AMERICA UNIT CASH COSTS

per lb of copper

NORTH AMERICA COPPER RESERVES BY MINE

38.8 billion consolidated lbs

34%

Morenci

31%

Sierrita

21%

Bagdad

14%

Other *

* Includes copper reserves from Chino, Safford, Tyrone, Miami and Cobre.

OPERATIONAL OVERVIEW

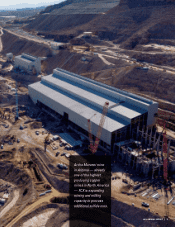

Photo: New mill construction, Morenci, Arizona

2012

2012

2013e

2013e

* Estimates assume an average price of $11/lb for

molybdenum for 2013. Unit net cash costs for 2013 would

change by approximately $0.04/lb for each $2/lb change in

the average price of molybdenum.

8