Freeport-McMoRan 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EXPANDING RESOURCES

2012 ANNUAL REPORT

Table of contents

-

Page 1

EXPANDING RESOURCES 2012 ANNUAL REPORT -

Page 2

... copper and gold deposits; signiï¬cant mining operations in the Americas, including the large-scale Morenci minerals district in North America and the Cerro Verde and El Abra operations in South America; and the Tenke Fungurume minerals district in the Democratic Republic of Congo. Additional... -

Page 3

... for our shareholders, employees and local communities around the world. 18 Pending Oil and Gas Acquisitions TABLE OF CONTENTS 2 Major Mine Operations 3 Letter to Our Shareholders 7 Operational Overview 16 Reserves and Mineralized Material 17 Sustainable Development 20 Board of Directors and... -

Page 4

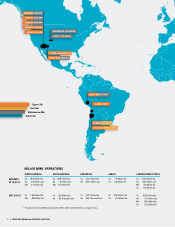

... ARIZONA SIERRITA, ARIZONA BAGDAD, ARIZONA SAFFORD, ARIZONA MIAMI, ARIZONA HENDERSON, COLORADO CLIMAX, COLORADO TYRONE, NEW MEXICO CHINO, NEW MEXICO CERRO VERDE, PERU Copper (Cu) Gold (Au) Molybdenum (Mo) Cobalt (Co) EL ABRA, CHILE CANDELARIA, CHILE OJOS DEL SALADO, CHILE MAJOR MINE OPERATIONS... -

Page 5

LETTER TO OUR SHAREHOLDERS GRASBERG, INDONESIA TENKE FUNGURUME, DEMOCRATIC REPUBLIC OF CONGO TO OUR SHAREHOLDERS We are pleased to present this year's annual report, "Expanding Resources," which highlights our established, long-lived global mining resource position, our growing production and cash... -

Page 6

ESTIMATED INCREMENTAL COPPER FROM EXPANSION PROJECTS IN PROGRESS (in millions) approximately 975 million lbs 225 lbs Morenci 600 lbs 150 lbs Tenke Fungurume* Cerro Verde * Completed in First-Quarter 2013. 4 -

Page 7

...achieved our budgeted cost and schedule for the expansion of our Tenke Fungurume operation in Africa and have begun construction for the expansion of our Morenci mine in Arizona. We received important permits for our world-scale expansion of the Cerro Verde mine in Peru and commenced construction in... -

Page 8

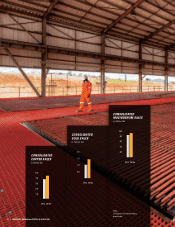

CONSOLIDATED MOLYBDENUM SALES in million lbs 100 CONSOLIDATED GOLD SALES in million ozs 80 60 40 2.0 20 CONSOLIDATED COPPER SALES in billion lbs 1.5 2012 2013e 1.0 5.0 4.0 3.0 2.0 1.0 0.5 2012 2013e 2012 2013e Note: Throughout this annual report, e=estimate. 6 -

Page 9

... COPPER RESERVE BREAKDOWN pound. Lower copper sales volumes in 2012 primarily reï¬,ected lower ore grades in Indonesia and South America, partly offset by increased production in North America and Africa. 7% Africa FCX's consolidated gold sales for 2012 totaled 1.0 million ounces at an average... -

Page 10

...America, FCX currently operates seven copper mines - Morenci, Bagdad, Sierrita, Safford and Miami in Arizona, Tyrone and Chino in New Mexico, and NORTH AMERICA COPPER SALES in billion lbs two molybdenum mines - Henderson and Climax in Colorado. Certain of FCX's North America copper mines (Sierrita... -

Page 11

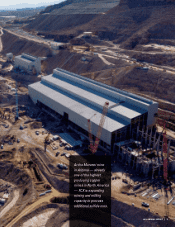

At the Morenci mine in Arizona - already one of the highest producing copper mines in North America - FCX is expanding mining and milling capacity to process additional sulï¬de ores. 9 -

Page 12

... in South America - Cerro Verde in Peru, and El Abra, Candelaria and Ojos del Salado in Chile. In addition to copper, the Cerro Verde mine also produces molybdenum concentrates, and the Candelaria and Ojos del Salado mines produce gold and silver. FCX is engaged in a large-scale expansion project at... -

Page 13

A large-scale expansion under way at FCX's Cerro Verde mine in Peru will triple production at the concentrator facilities. 11 -

Page 14

Already one of the largest underground mining complexes in the world, expansion projects in progress in the Grasberg minerals district include development of large-scale, highgrade underground ore bodies. 12 -

Page 15

..., FCX mines one of the world's largest deposits of both copper and gold located at the Grasberg minerals district in Papua, Indonesia. INDONESIA COPPER SALES in billion lbs FCX has several projects in progress in the Grasberg minerals district related to the development of large-scale, high-grade... -

Page 16

OPERATIONAL OVERVIEW AFRICA FCX operates the Tenke Fungurume copper and cobalt mining concessions in the Katanga province of the Democratic Republic of Congo. At the end of 2012, FCX had substantially completed an expansion of the project to optimize the current plant and increase capacity. The ... -

Page 17

The expansion project at the Tenke Fungurume minerals district is essentially complete, resulting in an increase of 150 million pounds of copper production per year. 15 -

Page 18

...20 per pound. FCX continues to aggressively pursue opportunities to convert this mineralized material into reserves, future production and cash ï¬,ows. VALUE CREATION FOCUS Production Growth Cash Flows/ Returns Mineral Resources 16 Reserve Additions Investment in Attractive Development Projects -

Page 19

... of living on a global scale. To supply critical metals to current and future generations, FCX relies on its 2012 COMMUNITY INVESTMENT $173 million stated business objectives, principles, and policies, and strives to continuously improve its sustainable development programs. To accomplish this... -

Page 20

PENDING OIL AND GAS ACQUISITIONS HIGH QUALITY U.S. OIL AND GAS PORTFOLIO MADDEN CALIFORNIA HAYNESVILLE GULF OF MEXICO SHELF DEEPWATER GULF OF MEXICO EAGLE FORD Natural Gas Oil 18 Photo: Drilling rig in the Gulf of Mexico -

Page 21

... and large onshore resources in the Haynesville natural gas 23% 8% Africa trend in Louisiana. MMR is an industry leader in the emerging shallow water ultra-deep gas trend with sizeable potential, located offshore in the shallow waters of the Gulf of Mexico and onshore in South Louisiana. The MMR... -

Page 22

... (1) Retired Chairman and Chief Executive Ofï¬cer, KPMG LLP Dustan E. McCoy (4) Chairman and Chief Executive Ofï¬cer Brunswick Corporation B. M. Rankin, Jr. (4) Vice Chairman of the Board Freeport-McMoRan Copper & Gold Inc. Private Investor Stephen H. Siegele (1, 4) Private Investor DIRECTOR... -

Page 23

FINANCIAL AND OPERATING INFORMATION EXPANDING RESOURCES TABLE OF CONTENTS 22 Selected Financial and Operating Data 25 Management's Discussion and Analysis 65 Management's Report on Internal Control Over Financial Reporting 66 Report of Independent Registered Public Accounting Firm 67 Report of ... -

Page 24

...agreement costs at Candelaria in 2012 and $116 million ($50 million to net income attributable to common stockholders or $0.05 per share) primarily associated with bonuses for new labor agreements and other employee costs at PT Freeport Indonesia, Cerro Verde and El Abra in 2011. c. Includes charges... -

Page 25

... Gold (thousands of recoverable ounces) Production Sales, excluding purchases Average realized price per ounce Molybdenum (millions of recoverable pounds) Production Sales, excluding purchases Average realized price per pound NORTH AMERICA COPPER MINES Operating Data, Net of Joint Venture Interest... -

Page 26

... 31, 2012 2011 2010 2009 2008 INDONESIA MINING Operating Data, Net of Joint Venture Interest Copper (recoverable) Production (millions of pounds) Production (thousands of metric tons) Sales (millions of pounds) Sales (thousands of metric tons) Average realized price per pound Gold (thousands... -

Page 27

... and molybdenum mining companies in terms of reserves and production. Our portfolio of assets includes the Grasberg minerals district in Indonesia, signiï¬cant mining operations in North and South America, and the Tenke Fungurume (Tenke) minerals district in the Democratic Republic of Congo (DRC... -

Page 28

... of molybdenum produced at our North and South America copper mines. Projected copper sales for 2013 are expected to be higher than 2012 sales primarily reï¬,ecting access to higher grade ore in Indonesia and South America and higher production in North America and Africa. Projected 2013 gold sales... -

Page 29

... countries, the timing of the development of new supplies of copper and production levels of mines and copper smelters. The LME spot copper price closed at $3.72 per pound on February 15, 2013. COPPER, GOLD AND MOLYBDENUM MARKETS World prices for copper, gold and molybdenum can ï¬,uctuate... -

Page 30

... on projected copper sales volumes for 2013, if estimated copper reserves at our mines were 10 percent higher at December 31, 2012, we Mineral Reserves. Recoverable proven and probable reserves are the part of a mineral deposit that can be economically and legally extracted or produced at the time... -

Page 31

... impact to the value of the material removed from the stockpiles at a revised weighted-average cost per pound of recoverable copper. During third-quarter 2012, we completed an assessment of estimated future recovery rates within the current mine plan at our Chino leaching operations resulting in... -

Page 32

...(121) $1,453 $ 1,464 97 19 - (158) $ 1,422 2012 2011 2010 a. Represents accretion of the fair value of environmental obligations assumed in the acquisition of Freeport-McMoRan Corporation (FMC), which were determined on a discounted cash flow basis. b. Reductions primarily reflected adjustments... -

Page 33

... with bonuses for new labor agreements and other employee costs at PT Freeport Indonesia, Cerro Verde and El Abra in 2011. f. We defer recognizing profits on intercompany sales until final sales to third parties occur. Refer to "Operations - Atlantic Copper Smelting & Refining" for a summary of... -

Page 34

... Revenues Consolidated revenues totaled $18.0 billion in 2012, $20.9 billion in 2011 and $19.0 billion in 2010, and included the sale of copper concentrates, copper cathodes, copper rod, gold, molybdenum and other metals by our North and South America copper mines, the sale of copper concentrates... -

Page 35

... lower copper sales volumes in Indonesia and increased mining and input costs in North and South America and Africa. Consolidated site production and delivery costs in 2011 also included $116 million ($0.03 per pound) primarily related to bonuses for new labor agreements and other employee costs... -

Page 36

... location before income taxes and equity in affiliated companies' net earnings. b. In July 2012, Sociedad Minera Cerro Verde S.A.A. (Cerro Verde) signed a new 15-year mining stability agreement with the Peruvian government, which is expected to become effective when the current mining stability... -

Page 37

... 2012). OPERATIONS North America Copper Mines We currently operate seven copper mines in North America - Morenci, Bagdad, Safford, Sierrita and Miami in Arizona, and Tyrone and Chino in New Mexico. All of these mining operations are wholly owned, except for Morenci, an unincorporated joint venture... -

Page 38

... our North America copper mines are expected to approximate 1.45 billion pounds in 2013. Higher projected copper sales volumes in 2013, compared with 2012, primarily reï¬,ect higher production at Morenci and Chino. Refer to "Outlook" for projected molybdenum sales volumes. information differs from... -

Page 39

... South America mines ship a portion of their copper concentrate inventories to Atlantic Copper, an afï¬liated smelter. In addition to copper, the Cerro Verde mine produces molybdenum concentrates, and the Candelaria and Ojos del Salado mines produce gold and silver. El Abra Sulï¬de. During 2011... -

Page 40

... Candelaria and Cerro Verde, partly offset by higher mining rates and ore grades at El Abra. Consolidated copper sales volumes from our South America mines are expected to approximate 1.33 billion pounds in 2012 By-Product Method Co-Product Method By-Product Method 2011 Co-Product Method Revenues... -

Page 41

... million ($0.04 per pound) for bonuses paid at Cerro Verde and El Abra pursuant to new labor agreements. 1,322 1,322 1,335 1,335 Unit net cash costs (net of by-product credits) for our South America mining operations increased to $1.20 per pound of copper in 2011, compared with $1.15 per pound... -

Page 42

...2012). Operating Data. Following is summary operating data for our Indonesia mining operations for the years ended December 31. 2012 2011 2010 Operating Data, Net of Joint Venture Interest Copper (millions of recoverable pounds) 695 Production Sales 716 Average realized price per pound $ 3.58 Gold... -

Page 43

...PT Freeport Indonesia gains access to higher ore grades and achieves the targeted ramp up in production from the DOZ mine. Approximately 33 percent of projected copper sales and 38 percent of projected gold sales from our Indonesia mining operations are currently expected in fourth-quarter 2013. of... -

Page 44

...Africa Mining Africa mining includes TFM's Tenke minerals district. We hold an effective 56 percent interest in the Tenke copper and cobalt mining concessions in the Katanga province of the DRC and are the operator of TFM. As further discussed in Note 14, effective March 26, 2012, the DRC government... -

Page 45

...being incorporated in future plans to evaluate opportunities for expansion. Future expansions are subject to a number of factors, including economic and market conditions and the business and investment climate in the DRC. Consolidated sales volumes from our Africa mining operations are expected to... -

Page 46

... chemical-grade molybdenum concentrates, which are typically further processed into value-added molybdenum chemical products. The Molybdenum operations also include a sales company that purchases and sells molybdenum from our primary molybdenum mines and from our North and South America copper mines... -

Page 47

... production from the Climax molybdenum mine that began commercial operations in May 2012. For the year 2013, we expect molybdenum sales volumes to approximate 90 million pounds, of which approximately 40 million pounds represent production from our North and South America copper mines. Henderson... -

Page 48

... acquisition of PXP. No amounts are currently available to us under the new revolving credit facility. Refer to Note 20 for further discussion. CAPITAL RESOURCES AND LIQUIDITY Our operating cash ï¬,ows vary with prices realized from copper, gold and molybdenum sales, our sales volumes, production... -

Page 49

... PT Freeport Indonesia as a result of lower production in 2012. Lower noncontrolling interest payments in 2011, compared with 2010, primarily reï¬,ected lower dividends to the noncontrolling interest holders of Cerro Verde related to capital retained for the expansion project. Investing Activities... -

Page 50

... totaling $107 million that relate to unrecognized tax benefits where the timing of settlement is not determinable; Atlantic Copper's obligations for retired employees totaling $38 million (refer to Note 10); and PT Freeport Indonesia's reclamation and closure cash fund obligation totaling $17... -

Page 51

... rod, gold, molybdenum and other metals by our North and South America mines, the sale of copper concentrates (which also contain signiï¬cant quantities of gold and silver) by our Indonesia mining operations, the sale of copper cathodes and cobalt hydroxide by our Africa mining operations, the sale... -

Page 52

... costs to revenues from the copper, gold, molybdenum and other metals we produce, (iv) it is the method used to compare mining operations in certain industry publications and (v) it is the method used by our management and the Board to monitor operations. In the co-product method presentation below... -

Page 53

... primarily for pricing on prior period open sales Eliminations and other North America copper mines South America mining Indonesia mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements... -

Page 54

... primarily for pricing on prior period open sales Eliminations and other North America copper mines South America mining Indonesia mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements... -

Page 55

... primarily for pricing on prior period open sales Eliminations and other North America copper mines South America mining Indonesia mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements... -

Page 56

... for pricing on prior period open sales Eliminations and other South America mining North America copper mines Indonesia mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements $ 4,817... -

Page 57

... includes sales of Cerro Verde production to our molybdenum sales company of 10 million pounds ($13.78 per pound average realized price), which reflects molybdenum produced at market-based pricing. b. Includes $50 million for bonuses paid at Cerro Verde and El Abra pursuant to new labor agreements... -

Page 58

... for pricing on prior period open sales Eliminations and other South America mining North America copper mines Indonesia mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements $ 5,210... -

Page 59

... open sales PT Smelting intercompany loss Indonesia mining North America copper mines South America mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements a. Includes silver sales of... -

Page 60

... open sales PT Smelting intercompany profit Indonesia mining North America copper mines South America mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements a. Includes silver sales of... -

Page 61

... open sales PT Smelting intercompany loss Indonesia mining North America copper mines South America mining Africa mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported in FCX's consolidated financial statements a. Includes silver sales of... -

Page 62

...Royalty on metals Net noncash and other costs Revenue adjustments, primarily for pricing on prior period open sales Africa mining North America copper mines South America mining Indonesia mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported... -

Page 63

...Royalty on metals Net noncash and other costs Revenue adjustments, primarily for pricing on prior period open sales Africa mining North America copper mines South America mining Indonesia mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported... -

Page 64

...Royalty on metals Net noncash and other costs Revenue adjustments, primarily for pricing on prior period open sales Africa mining North America copper mines South America mining Indonesia mining Molybdenum Rod & Refining Atlantic Copper Smelting & Refining Corporate, other & eliminations As reported... -

Page 65

... Reported Production and Delivery Depreciation, Depletion and Amortization Revenues Year Ended December 31, 2012 Totals presented above Treatment charges and other Net noncash and other costs Henderson mine Other molybdenum operations and eliminationsb Molybdenum North America copper mines South... -

Page 66

... costs, projected operating cash ï¬,ows, projected capital expenditures, exploration efforts and results, mine production and development plans, the impact of deferred intercompany proï¬ts on earnings, liquidity, other ï¬nancial commitments and tax rates, the impact of copper, gold, molybdenum and... -

Page 67

... or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the ï¬nancial statements. Richard C. Adkerson President and Chief Executive Ofï¬cer Kathleen L. Quirk Executive Vice President, Chief Financial Ofï¬cer and Treasurer... -

Page 68

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Freeport-McMoRan Copper & Gold Inc. as of December 31, 2012 and 2011 and the related consolidated statements of income, comprehensive income, equity and cash ï¬,ows for each of... -

Page 69

... BOARD OF DIRECTORS AND STOCKHOLDERS OF FREEPORT- M C M OR AN COPPER & GOLD INC. We have audited the accompanying consolidated balance sheets of Freeport-McMoRan Copper & Gold Inc. as of December 31, 2012 and 2011, and the related consolidated statements of income, comprehensive income, equity and... -

Page 70

... amounts) 2012 2011 2010 Revenues Cost of sales: Production and delivery Depreciation, depletion and amortization Total cost of sales Selling, general and administrative expenses Exploration and research expenses Environmental obligations and shutdown costs Gain on insurance settlement Total... -

Page 71

... Years Ended December 31, (In millions) 2012 2011 2010 Net income Other comprehensive loss, net of taxes: Defined benefit plans: Actuarial losses arising during the period Amortization of unrecognized amounts included in net periodic benefit costs Adjustment to deferred tax valuation allowance... -

Page 72

... America copper mines South America Indonesia Africa Molybdenum Other Investment in McMoRan Exploration Co. Other, net Net cash used in investing activities Cash flow from financing activities: Repayments of debt Proceeds from debt Cash dividends paid: Common stock Preferred stock Noncontrolling... -

Page 73

...) 2012 2011 ASSETS Current assets: Cash and cash equivalents Trade accounts receivable Income taxes receivable Other accounts receivable Inventories: Mill and leach stockpiles Materials and supplies, net Product Other current assets Total current assets Property, plant, equipment and development... -

Page 74

CONSOLIDATED STATEMENTS OF EQUITY FCX Stockholders' Equity Mandatory Convertible Preferred Stock Number of Shares At Par Value Common Stock Number of Shares At Par Value Capital in Excess of Par Value Common Stock Retained Accumulated Held in Treasury Earnings Other (Accumulated Comprehensive ... -

Page 75

....64 percent-owned subsidiary PT Freeport Indonesia and its wholly owned subsidiaries, Freeport-McMoRan Corporation (FMC) and Atlantic Copper, S.L.U. (Atlantic Copper). FCX's unincorporated joint ventures with Rio Tinto plc (Rio Tinto) and Sumitomo Metal Mining Arizona, Inc. (Sumitomo) are reï¬,ected... -

Page 76

... copper cathodes, copper rod, copper wire, molybdenum oxide, highpurity molybdenum chemicals and other metallurgical products). Finished goods are valued based on the weighted-average cost of source material plus applicable conversion costs relating to associated process facilities. Property, Plant... -

Page 77

... long-lived assets and measure the fair value of FCX's mining operations are derived from current business plans, which are developed using near-term price forecasts reï¬,ective of the current price environment and management's projections for long-term average metal prices. Estimates of future cash... -

Page 78

... of Tenke Fungurume Mining S.A.R.L. (TFM or Tenke) in the Democratic Republic of Congo (DRC), income taxes are provided on the earnings of FCX's material foreign subsidiaries under the assumption that these earnings will be Asset Retirement Obligations. FCX records the fair value of estimated... -

Page 79

... month quoted by the applicable publication. FCX's remaining molybdenum sales generally have pricing that is either based on the current month published prices or a ï¬xed price. PT Freeport Indonesia concentrate sales and TFM metal sales are subject to certain royalties, which are recorded as... -

Page 80

... the DRC, and copper and molybdenum conversion facilities. At December 31, 2012, FMC's operating copper mines in North America were Morenci, Bagdad, Safford, Sierrita and Miami located in Arizona, and Tyrone and Chino located in New Mexico. FCX has an 85 percent interest in Morenci (refer to "Joint... -

Page 81

...Puncakjaya Power's receivable from PT Freeport Indonesia as provided for in FCX's joint venture agreement with Rio Tinto. Work, and, after 2021, a 40 percent interest in all production from Block A. All of PT Freeport Indonesia's proven and probable reserves and its mining operations are located in... -

Page 82

... follow: December 31, 2012 a 2011 Mining operations: Raw materials Finished goodsb Atlantic Copper: Raw materials (concentrates) Work-in-process Finished goods Total product inventories Total materials and supplies, net c $ 2 904 $ 1 769 Proven and probable reserves VBPP Development and other... -

Page 83

...: December 31, 2012 2011 Accounts payable Salaries, wages and other compensation Pension, postretirement, postemployment and other employee beneï¬tsa Deferred revenue Other accrued taxes Accrued interest b Rio Tinto's share of joint venture cash ï¬,ows Other Total accounts payable and accrued... -

Page 84

... Moody's Investors Service. The obligations of FCX and PT Freeport Indonesia under the revolving credit facility are not guaranteed by any subsidiaries and are unsecured; however, FCX may at any time designate any subsidiary (other than PT Freeport Indonesia) as a subsidiary guarantor. FCX recorded... -

Page 85

...contribution plan sponsored by FM Services Company, FCX's wholly owned subsidiary, FCX or its predecessor, but not including accounts funded exclusively by deductions from participant's pay. FCX also has an unfunded pension plan for its directors and an excess beneï¬ts plan for its executives, both... -

Page 86

... the plan based on the asset mix. Based on these factors, PT Freeport Indonesia expects its pension assets will earn an average of 7.5 percent per annum beginning January 1, 2013. retired Spanish national employees. As required by Spanish law, beginning in August 2002, Atlantic Copper began funding... -

Page 87

... funds: Government bonds Emerging markets equity Corporate bonds Mutual funds: Foreign bonds Emerging markets bond Emerging markets equity Fixed income: Government bonds Corporate bonds Private equity investments Other investments Total investments Cash and receivables Payables Total pension plan... -

Page 88

...$ 86 A summary of the fair value hierarchy for pension plan assets associated with the PT Freeport Indonesia plan follows: Fair Value at December 31, 2012 Total Level 1 Level 2 Level 3 Common stocks Government bonds Mutual funds Total investments Cash and receivablesa Total pension plan net assets... -

Page 89

... accrued during the years employees render service. The discount rate for FCX's postretirement medical and life insurance beneï¬t plans was determined on the same basis as FCX's pension plans. Information on the postretirement beneï¬t plans as of December 31 follows: 2012 2011 The assumed medical... -

Page 90

... FCX's operating results, cash ï¬,ows and ï¬nancial position; copper, molybdenum and gold prices; the impact of the proposed acquisitions; the price of FCX's common stock; and general economic and market conditions. FCX's Board of Directors (the Board) authorized increases in the cash dividend on... -

Page 91

... and provide that the FCX executive ofï¬cers will receive the following year's vesting upon retirement provided the performance condition is met. The fair value of these restricted stock unit grants was estimated based on projected operating cash ï¬,ows for the applicable year and was charged to... -

Page 92

...a. In July 2012, Sociedad Minera Cerro Verde S.A.A. (Cerro Verde) signed a new 15-year mining stability agreement with the Peruvian government, which is expected to become effective when the current mining stability agreement expires on December 31, 2013. In connection with the new mining stability... -

Page 93

...and recognized as an income tax benefit in 2012. c. In September 2011, Peru enacted a new mining tax and royalty regime and also created a special mining burden that companies with stability agreements can elect to pay. Cerro Verde elected to pay this special mining burden during the remaining term... -

Page 94

... and health programs. Mining royalty taxes at FCX's El Abra and Candelaria mines were stabilized through 2017 at a rate of 4 percent. However, under the legislation, FCX opted to transfer from its stabilized rate to the sliding scale of 4 to 9 percent (depending on a deï¬ned operational margin... -

Page 95

... site in New York City; historical smelter sites principally located in Arizona, Kansas, New Jersey, Oklahoma and Pennsylvania; and uranium mining sites in the western U.S. Newtown Creek. From the 1930s until 1964, Phelps Dodge Reï¬ning Corporation (PDRC), a subsidiary of FMC, operated a smelter... -

Page 96

... 31, 2012, approximately 60 percent of the properties whose owners agreed to have their soil cleaned up was completed. Historical Smelter Sites. FMC and its predecessors at various times owned or operated copper and zinc smelters in several states, including Arizona, Kansas, New Jersey, Oklahoma... -

Page 97

... the New Mexico Energy, Minerals and Natural Resources Department. Under the Mining Act, mines are required to obtain approval of plans describing the reclamation to be performed following cessation of mining operations. At December 31, 2012, FCX had accrued reclamation and closure Asset Retirement... -

Page 98

...a mine closure guarantee in the form of a time deposit placed in a state-owned bank in Indonesia. In accordance with its Contract of Work, PT Freeport Indonesia is working with the Department of Energy Colorado Reclamation Programs. FCX's Colorado operations are regulated by the Colorado Mined Land... -

Page 99

... Air Act matter). In April 2012, Columbian ï¬led suit in New York state court (Columbian Chemicals Company and Columbian Chemicals Acquisition LLC v. Freeport-McMoRan Corporation f/k/a Phelps Dodge Corporation, County of New York, Supreme Court of the State of New York, Index No. 600999/2010), that... -

Page 100

... PT Freeport Indonesia has not received a formal assessment and is working with the applicable government authorities to resolve this matter. Tax Matters. Cerro Verde Tax Proceedings. SUNAT, the Peruvian national tax authority, has assessed mining royalties on materials processed by the Cerro Verde... -

Page 101

...December 2012. The insurers agreed to pay an aggregate of $63 million, including PT Freeport Indonesia's joint venture partner's share, for the settlement of the insurance claim for business interruption and property damage relating to the 2011 incidents affecting PT Freeport Indonesia's concentrate... -

Page 102

... Freeport Indonesia charged $39 million in 2012, $50 million in 2011 and $64 million in 2010 to cost of sales for this commitment. During 2006, the Peruvian government announced that all mining companies operating in Peru would be required to make annual contributions to local development funds for... -

Page 103

..., 2012 and 2011, FCX had no price protection contracts relating to its mine production. A summary of FCX's derivative contracts and programs follows. Derivatives Designated as Hedging Instruments - Fair Value Hedges Copper Futures and Swap Contracts. Some of FCX's U.S. copper rod customers request... -

Page 104

... 31 follows: 2012 2011 2010 hedging gains or losses recorded in cost of sales. At December 31, 2012, Atlantic Copper held net forward copper purchase contracts for 13 million pounds at an average contract price of $3.62 per pound, with maturities through February 2013. A summary of the realized... -

Page 105

... Equity securitiesa,c Total investment securities Trust assets (long-term):a,c U.S. core fixed income fund Government mortgage-backed securities Corporate bonds Government bonds and notes Asset-backed securities Money market funds Municipal bonds Total trust assets Derivatives:a Embedded derivatives... -

Page 106

... 72 - 1 73 Investment securities (current and long-term): MMR investmentb Equity securitiesa,c Money market fundsa,c Total investment securities Trust assets (long-term):a,c Government mortgage-backed securities U.S. core fixed income fund Government bonds and notes Corporate bonds Asset-backed... -

Page 107

...copper mines - Bagdad, Safford, Sierrita, Miami, Tyrone and Chino. In addition to copper, certain of these mines (Sierrita, Bagdad and Chino) also produce molybdenum concentrates. South America. South America mining includes four operating copper mines - Cerro Verde in Peru, and El Abra, Candelaria... -

Page 108

... copper mines - El Abra, Candelaria and Ojos del Salado. In addition to copper, the Candelaria and Ojos del Salado mines also produce gold and silver. Product Revenue FCX revenues attributable to the products it produced for the years ended December 31 follow: 2012 2011 2010 Indonesia. Indonesia... -

Page 109

... tables. Business Segments North America Copper Mines Morenci Other Mines Total Cerro Verde South America Other Mines Total Indonesia Grasberg Africa Tenke Rod & Molybdenum Refining Atlantic Copper Corporate, Smelting Other & & Refining Eliminations FCX Total Year Ended December 31, 2012 Revenues... -

Page 110

... extracted or produced at the time of the reserve determination. Recoverable Proven and Probable Reserves December 31, 2012 Coppera (billion pounds) Gold (million ounces) Molybdenum (billion pounds) North America South America Indonesia Africa Consolidated basisb Net equity interestc 38.8 38.8 31... -

Page 111

... (%) Copper (billion pounds) Recoverable Proven and Probable Reserves a Gold (million ounces) Molybdenum (billion pounds) Year-End 2008 2009 2010 2011 2012 By Area at December 31, 2012: North America Developed and producing: Morenci Bagdad Safford Sierrita Miami Tyrone Chino Henderson Climax... -

Page 112

... OM Group, Inc. to acquire a large-scale cobalt reï¬nery located in Kokkola, Finland, and the related sales and marketing business. The acquisition would provide direct end-market access for the cobalt hydroxide production at Tenke. FCX will be the operator of the joint venture with an effective 56... -

Page 113

... Also on February 14, 2013, FCX and PT Freeport Indonesia entered into a new senior unsecured revolving credit facility, which will reï¬nance and replace FCX's existing revolving credit facility upon completion of the proposed acquisition of PXP. No amounts are currently available to FCX under the... -

Page 114

... 2008 through 2012. Our comparative peer group is the S&P 500 Materials Index, which closely mirrors the benchmarks of other large metals producers. This comparison assumes $100 invested on December 31, 2007, in (a) Freeport-McMoRan Copper & Gold Inc. common stock, (b) the S&P 500 Stock Index and... -

Page 115

... Department can be contacted as follows: Freeport-McMoRan Copper & Gold Inc. Investor Relations Department 333 North Central Avenue Phoenix, Arizona 85004 Telephone (602) 366-8400 www.fcx.com Below is a summary of dividends on FCX common stock for 2012 and 2011: 2012 AMOUNT PER SHARE RECORD... -

Page 116

333 North Central Avenue Phoenix, Arizona 85004 602.366.8100 www.fcx.com