Freddie Mac 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293

|

|

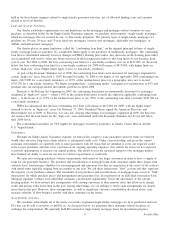

The following diagram illustrates how we create PCs through mortgage securitizations that can be sold to investors or

held by us to provide liquidity to the mortgage market:

Cash

Mortgage

Homeowners Our Customers:

Originate Loans with

Homeowners

Sell or Exchange

Mortgages for PCs or Cash

Invest in PCs or Sell

to Investors

Investors

Freddie Mac:

Guarantees PCs

Retains Investments

in PCs and Mortgages

Sells PCs to

Investors

Cash

PC

PC or Cash

Mortgage

PC

Mortgage

PC Trusts

Mortgage Securitizations

Cash

PC

We guarantee the payment of principal and interest of PCs created in this process in exchange for a combination of

monthly management and guarantee fees and initial upfront cash payments referred to as delivery fees. Our guarantee

increases the marketability of the PCs, providing liquidity to the mortgage market. Various other participants also play

significant roles in the residential mortgage market. Mortgage brokers advise prospective borrowers about mortgage products

and lending rates, and they connect borrowers with lenders. Mortgage servicers administer mortgage loans by collecting

payments of principal and interest from borrowers as well as amounts related to property taxes and insurance. They remit the

principal and interest payments to us, less a servicing fee, and we pass these payments through to mortgage investors, less a

fee we charge to provide our guarantee (i.e., the management and guarantee fee). In addition, private mortgage insurance

companies and other financial institutions sometimes provide third-party insurance for mortgage loans or pools of loans. Our

charter generally requires third-party insurance or other credit protections on some loans that we purchase. Most mortgage

insurers increased premiums and tightened underwriting standards during 2008. These actions may impair our ability to

purchase loans made to borrowers who do not make a down payment at least equal to 20% of the value of the property at

the time of loan origination.

Our charter generally prohibits us from purchasing first-lien conventional (not guaranteed or insured by any agency or

instrumentality of the U.S. government) single-family mortgages if the outstanding principal balance at the time of purchase

exceeds 80% of the value of the property securing the mortgage unless we have one of the following credit protections:

• mortgage insurance from a mortgage insurer that we determine is qualified on the portion of the outstanding principal

balance above 80%;

• a seller’s agreement to repurchase or replace (for periods and under conditions as we may determine) any mortgage

that has defaulted; or

• retention by the seller of at least a 10% participation interest in the mortgages.

In addition, on February 18, 2009, the Obama Administration announced the HASP, which includes an initiative

pursuant to which FHFA allowed mortgages currently owned or guaranteed by us to be refinanced without obtaining

additional credit enhancement in excess of that already in place for that loan. For more information, see “Conservatorship

and Related Developments — Homeownership Affordability and Stability Plan.”

5Freddie Mac