Freddie Mac 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

available for us to purchase and the mix of available loan products are also affected by several factors, including the volume

of mortgages meeting the requirements of our charter and the mortgage purchase and securitization activity of other financial

institutions.

At December 31, 2008, our total mortgage portfolio, which includes our mortgage-related investments portfolio and the

unpaid principal balance of all other loans and securities that we guarantee, was $2.2 trillion, while the total U.S. residential

mortgage debt outstanding, which includes single-family and multifamily loans, was approximately $12.1 trillion. See

“MD&A — PORTFOLIO BALANCES AND ACTIVITIES” for further information on the composition of our mortgage

portfolios.

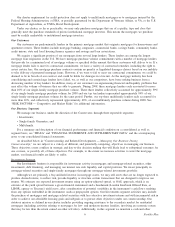

Table 1 provides important indicators for the U.S. residential mortgage market.

Table 1 — Mortgage Market Indicators

2008 2007 2006

Year Ended December 31,

Home sale units (in thousands)

(1)

....................................................... 4,833 5,715 6,728

Home price appreciation (depreciation)

(2)

................................................. (12.1)% (4.3)% 2.2%

Single-family originations (in billions)

(3)

................................................. $ 1,485 $ 2,430 $ 2,980

Adjustable-rate mortgage share

(4)

..................................................... 7% 10% 22%

Refinance share

(5)

............................................................... 49% 46% 43%

U.S. single-family mortgage debt outstanding (in billions)

(6)

.................................... $11,167 $11,168 $10,456

U.S. multifamily mortgage debt outstanding (in billions)

(6)

..................................... $ 890 $ 840 $ 743

(1) Includes sales of new and existing homes in the U.S. and excludes condos/co-ops. Source: National Association of Realtors news release dated

February 25, 2009 (sales of existing homes) and U.S. Census Bureau news release dated February 26, 2009 (sales of new homes).

(2) Calculated internally using estimates of changes in single-family home prices by state, which are weighted using the property values underlying our

single-family mortgage portfolio to obtain a national index. The appreciation or depreciation rate for each year presented incorporates property value

information on loans purchased by both Freddie Mac and Fannie Mae through December 31, 2008 and will be subject to change based on more recent

purchase information.

(3) Source: Inside Mortgage Finance estimates of originations of single-family first-and second liens dated January 30, 2009.

(4) Based on the number of conventional one-family home purchase mortgages and represents the annual averages of monthly figures using data provided

by FHFA.

(5) Refinance share of the number of conventional mortgage applications. Source: Mortgage Bankers Association’s Mortgage Applications Survey. Data

reflect annual average of weekly figures.

(6) Source: Federal Reserve Flow of Funds Accounts of the United States dated December 11, 2008. The outstanding amounts for 2008 presented above

reflect balances as of September 30, 2008.

In general terms, the U.S. residential mortgage market consists of a primary mortgage market that links homebuyers and

lenders and a secondary mortgage market that links lenders and investors. In the primary mortgage market, residential

mortgage lenders such as mortgage banking companies, commercial banks, savings institutions, credit unions and other

financial institutions originate or provide mortgages to borrowers. They obtain the funds they lend to mortgage borrowers in

a variety of ways, including by selling mortgages or mortgage-related securities into the secondary mortgage market. Our

charter does not permit us to originate loans in the primary mortgage market.

The secondary mortgage market consists of institutions engaged in buying and selling mortgages in the form of whole

loans (i.e., mortgages that have not been securitized) and mortgage-related securities. We participate in the secondary

mortgage market by purchasing mortgage loans and mortgage-related securities for investment and by issuing guaranteed

mortgage-related securities, principally those we call PCs. We do not lend money directly to homeowners.

4Freddie Mac