Fifth Third Bank 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CORPORATE PROFILE

Fifth Third Bancorp is a diversified financial

services company headquartered in

Cincinnati, Ohio. Fifth Third operates

17 affiliates with 952 full-service locations in

Ohio, Kentucky, Indiana, Michigan, Illinois,

Florida, West Virginia and Tennessee. We serve

5.7 million customers through our affiliate

banking network and feature four primary

businesses: Commercial Banking, Retail

Banking, Investment Advisors and Fifth Third

Processing Solutions. With approximately

$91 billion in assets, Fifth Third is among the

15 largest bank holding companies in the

United States, and its market capitalization of

$33 billion places it among the 10 largest

bank holding companies in the United States

at year end.

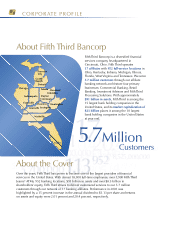

About Fifth Third Bancorp

Traverse

City

Detroit

Grand

Rapids

Chicago Toledo Cleveland

Columbus

Dayton

Cincinnati

Florence

Lexington

Louisville

Indianapolis

Evansville Huntington

Naples

Nashville

About the Cover

5.7Million

Customers

Over the years, Fifth Third has grown to become one of the largest providers of financial

services in the United States. With almost 18,900 full-time employees, over 1,900 Fifth Third

Jeanie®ATMs, 952 banking locations, $91 billion in assets and over $8.5 billion in

shareholders’ equity, Fifth Third strives to deliver customized services to our 5.7 million

customers through our network of 17 banking affiliates. Performance in 2003 was

highlighted by a 15 percent increase in the annual dividend to $1.13 per share and returns

on assets and equity were 2.01 percent and 20.4 percent, respectively.