Federal Express 2000 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2000 Federal Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FedEx

Corp.

1

Percent

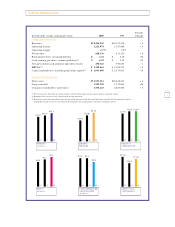

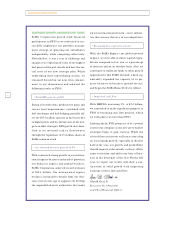

In thousands, except earnings per share 2000 1999 Change

OPERATIN G RESULTS

Revenues $18,256,945 $16,773,470 + 9

Operating incom e 1,221,074 1,163,086 + 5

Operating margin 6.7% 6.9%

N et incom e 688,336 631,333 + 9

Earnings per share, assuming dilution $ 2.32 $ 2.10 +10

Cash earnings per share, assum ing dilution(1) $ 6.22 $ 5.54 +12

Average com m on and comm on equivalent shares 296,326 300,643 – 1

EBITDA(2) $ 2,398,663 $ 2,194,373 + 9

Capital expenditures, including equivalent capital(3) $ 1,991,600 $ 2,330,613 –15

FIN AN CIAL POSITION

Total assets $11,527,111 $10,648,211 + 8

Long-term debt 1,782,790 1,374,606 +30

Comm on stockholders’ investm ent 4,785,243 4,663,692 + 3

(1) Net income plus depreciation and amortization divided by average com m on and common equivalent shares.

(2) Earnings before interest, taxes, depreciation and am ortization.

(3) Represents actual cash expenditures plus the equivalent am ount of cash that would have been expended for the acquisition of assets

(principally aircraft), whose use was obtained through long-term operating leases entered into during the period.

SELECTED FINANCIAL DATA

$18.3

$15.9 $16.8

98 99 00

REVENUES

(in billions)

EARNINGS

PER SHARE

$2.10

$1.69

$2.32

98 99 00

RETURN ON

AVERAGE EQUITY

13.5% 14.6%14.6%

98 99 00

$2.2

$2.0

$2.4

EBITDA

(in billions)

(2)

98 99 00

CAPITAL EXPENDITURES

AND EQUIVALENTS

(in billions)

$2.3

$2.3

$2.0

(3)

98 99 00

DEBT TO TOTAL

CAPITALIZATION

29.3% 27.1%

22.8%

98 99 00