Fannie Mae 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

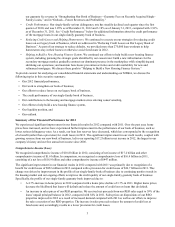

Table 2: Selected Credit Characteristics of Single-Family Conventional Loans Held, by Acquisition Period

As of December 31, 2012

% of

Single-Family Current Current

Conventional Estimated Mark-to-Market Serious

Guaranty Book Mark-to-Market LTV Ratio Delinquency

of Business(1) LTV Ratio >100%(2) Rate(3)

New Single-Family Book of Business . . . . . . . . . . . . . . . 66 % 71 % 6 % 0.35 %

Legacy Book of Business:

2005-2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 98 41 9.92

2004 and prior . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 57 6 3.62

Total Single-Family Book of Business. . . . . . . . . . . . . . 100 % 75 % 13 % 3.29 %

__________

(1) Calculated based on the aggregate unpaid principal balance of single-family loans for each category divided by the aggregate unpaid

principal balance of loans in our single-family conventional guaranty book of business as of December 31, 2012.

(2) The majority of loans in our new single-family book of business as of December 31, 2012 with mark-to-market LTV ratios over 100%

were loans acquired under the Administration’s Home Affordable Refinance Program. See “Credit Risk Characteristics of Loans

Acquired under HARP” for more information on our recent acquisitions of loans with high LTV ratios.

(3) The serious delinquency rates for loans acquired in more recent years will be higher after the loans have aged, but we do not expect

them to approach the levels of the December 31, 2012 serious delinquency rates of loans in our legacy book of business. The serious

delinquency rate as of December 31, 2012 for loans we acquired in 2009, the oldest vintage in our new book of business, was 0.97%.

More detailed information on the risk characteristics of loans in our single-family book of business appears in “Table 41:

Risk Characteristics of Single-Family Conventional Business Volume and Guaranty Book of Business.”

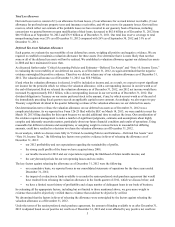

Guaranty Fees on Recently Acquired Single-Family Loans

Table 3 below displays information regarding our average charged guaranty fee on single-family loans we acquired in each of

the last three years, as well as the volume of our single-family Fannie Mae MBS issuances, which is indicative of the volume

of single-family loans we acquired.

Table 3: Single-Family Acquisitions Statistics

For the Year Ended December 31,

2012 2011 2010

Single-family average charged guaranty fee on new acquisitions (in basis

points)(1)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39.9 28.8 25.7

Single-family Fannie Mae MBS issuances (in millions)(3) . . . . . . . . . . . . . . . . $ 827,749 $ 564,606 $ 603,247

__________

(1) Pursuant to the TCCA, effective April 1, 2012, we increased the guaranty fee on all single-family residential mortgages delivered to us

on or after that date for securitization by 10 basis points; and the incremental revenue is remitted to Treasury. The resulting revenue is

included in guaranty fee income, and the expense is included in other expenses. This increase in guaranty fee is included in the single-

family charged guaranty fee.

(2) Calculated based on the average contractual fee rate for our single-family guaranty arrangements entered into during the period plus the

recognition of any upfront cash payments ratably over an estimated average life, expressed in basis points.

(3) Reflects unpaid principal balance of Fannie Mae MBS issued and guaranteed by the Single-Family segment during the period. Includes

Housing Finance Agency (“HFA”) new issue bond program issuances, none of which occurred in 2012 or 2011. There were HFA new

issue bond program issuances of $3.1 billion during 2010.

The guaranty fee income we receive depends on the volume of our single-family acquisitions, the charged guaranty fee at

acquisition, and the life of the loans. As a result of increases in the charged guaranty fee and the larger volume of single-

family loans we acquired in 2012, we expect to receive significantly more guaranty fee income on the single-family loans we

acquired in 2012, over their lifetime, than on the single-family loans we acquired in 2011. The average charged guaranty fee

on newly acquired single-family loans increased by approximately 25.2 basis points over the course of 2012, from 27.9 basis

points for the month of December 2011 to 53.1 basis points for the month of December 2012. The change was primarily

attributable to a 10 basis point increase on April 1, 2012 mandated by the TCCA, an average increase of 10 basis points

implemented during the fourth quarter of 2012 and lender-specific contractual fee increases implemented throughout the year.

These changes to guaranty fee pricing represent a step toward encouraging greater participation in the mortgage market by