Exxon 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Exxon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPETITIVE ADVANTAGES:

Disciplined Investing

A disciplined approach to investing combines effective project assessment and development with technical

and commercial expertise. It also involves identification of market trends and divestment of assets that no longer

meet our criteria to ensure the most advantageous use of capital.

ROBUST PROCESSES

In 2011, our Upstream business undertook capital and exploration expenditures of more

than $33 billion. These expenditures are justified through careful consideration of each

opportunity and the use of robust management processes. Project economics are carefully

assessed, budgets are closely monitored, and reappraisals are routinely done to further

improve future investment decisions.

Exploration investments are drawn from a diverse portfolio of prospects, allowing us to

effectively manage exploration risk. Our extensive portfolio of more than 120 upstream

projects spans a wide range of environments, resource types, and geographies.

This scale and diversity provide us with the ability to selectively invest in those projects

that are most likely to deliver robust financial performance and profitable volumes growth.

All opportunities are carefully reviewed, and our worldwide experience is brought to bear in their development.

We also consider the role of technology to plan the most innovative and capital-efficient approaches.

An example of the application of our processes is the Kearl oil sands project in Canada. Before we pursued this effort, we

assessed the size and quality of the resource that is expected to exceed 4 billion barrels of bitumen, the costs of mining the

sands and extracting the oil, future production levels, pipeline and refining capacity, and regulatory aspects. Initial production

at Kearl will begin in late 2012 at 110 thousand oil-equivalent barrels per day with plans to expand to more than triple that level.

KEY MARKETS

In addition to disciplined processes, we identify key growth markets and assess demand trends to help guide investment

decisions. For example, the forecasted growth in energy demand in developing countries, such as China and India, is expected

to drive increases in demand for petroleum and petrochemical products. Furthermore, an increase in global demand for

heavy-duty transportation will result in the need to supply more diesel fuel.

Our Singapore petrochemical plant expansion provides a salient example of how we identify and approach new capital

commitments. The expansion is the largest in the history of our Chemical business. It will double steam-cracking capacity at

the site, add unparalleled feedstock flexibility, and be energy and cost efficient. The manufacturing capacity of premium products

will also grow significantly as a result of the expansion,

including some products never previously produced

by us in this important region.

The Singapore petrochemical plant expansion,

along with other investments, including our integrated

facility at Fujian, China, were undertaken because

petroleum and chemical demand is expected to

rise rapidly in the Asia Pacific region. For example,

China’s petrochemical demand has grown by

15 percent per year over the last two decades

and is expected to double by the end of this decade.

The Singapore petrochemical plant expansion will

triple polyethylene production capacity at the site.

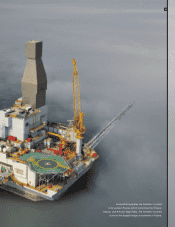

Projects by Geographic Region

Americas

Europe

Asia

Africa

Australia/Oceania

Eric Whetstone • Whetstone Design

ofce: 214-583-6118 • cell:

EDITOR

Neil Hansen • Investor Relations

Exxon Mobil Corporation, Irving, TX

ofce: 972-444-1135 • cell:972-890-5469

Carol Zuber-Mallison • ZM Graphics, Inc.

studio/cell: 214-906-4162 • fax: 817-924-7784

ATTENTION: OWNER VERSION

APPROVED BY

Feb. 16, 2012

FILE INFO

LAST FILE CHANGE MADE BY

S14A 11XOMSAR-

.ai

IN F&O ON PAGE

IN SAR ON PAGE

Note:

Includes link le

IS IN

SAR and F&O

Different content

in separate les

14 ExxonMobil • 2011 Summary Annual Report