Express 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT

Table of contents

-

Page 1

2011 ANNUAL REPORT -

Page 2

-

Page 3

DEAR VALUED BUSINESS PARTNER On behalf of the Board of Directors and the Associates of Express, it is with great pleasure that I present our 2011 Annual Report. I am very proud to share with you another year of strong growth and considerable achievements toward our long term goals. In fact, from the... -

Page 4

"THE BEST THING ABOUT WORKING IN THE BUSINESS OF FASHION IS THAT EVERY MOMENT SEEMS FULL OF NOTHING BUT POSSIBILITIES" -Michael Weiss President and CEO -

Page 5

... digital catalog. Digital commerce is a key driver of enabling a multi-channel customer to shop and engage with Express in whatever way they choose. In 2011, we focused on developing our international strategy to capitalize on what we see as at least a $600 million long term revenue opportunity... -

Page 6

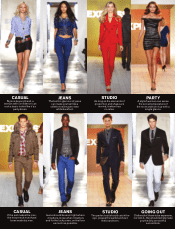

CASUAL Style is beyond trend, a woman with confidence can rock a basic t-shirt like it's a party dress. JEANS The built-in glamour of jeans can make you feel like a stiletto-toed maven even while barefoot. STUDIO As long as the elements of proportion and shape are in mind, fashion has no rules. ... -

Page 7

STYLE AT THE SPEED OF LIFE -

Page 8

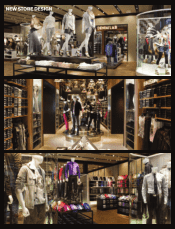

NEW STORE DESIGN -

Page 9

... ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended January 28, 2012 OR ' TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-34742 EXPRESS... -

Page 10

Table Of Contents Part I ...ITEM 1. BUSINESS ...ITEM 1A. RISK FACTORS ...ITEM 1B. UNRESOLVED STAFF COMMENTS ...ITEM 2. PROPERTIES ...ITEM 3. LEGAL PROCEEDINGS ...ITEM 4. MINE SAFETY DISCLOSURE ...Part II ...ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER ... -

Page 11

... those expressed in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. We do not undertake any obligation to make any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Report on... -

Page 12

... ("IPO") that was completed in May 2010. In 2011, we opened our first stores in Canada. In connection...Annual Report on Form 10-K, the term Express Parent refers to Express Parent LLC prior to the Reorganization, and to Express, Inc. after the Reorganization. The term "Express Topco" refers to Express... -

Page 13

... the total apparel market for this demographic. We believe that the Express brand appeals to a particularly attractive subset of this group who we...in which we operate. Substantially all of our stores were profitable in 2011. Proven and Experienced Team. Michael Weiss, our President and Chief ... -

Page 14

... opportunity for us to recapture sales as our customers re-discover Express in certain product categories, specifically casual and party tops, dresses...each of the next 3 years, which represents annual square footage growth of approximately 3% to 4%. During 2011, we opened 27 stores in the United ... -

Page 15

customers' shopping objectives while differentiating our product line from competitors. On average, our customers purchase 2 to 3 items per transaction. In season, we monitor cross-selling trends in order to optimize our in-store and online product assortment and collection recommendations. Design ... -

Page 16

.... Mast assisted us with the purchase of $449.2 million, $430.0 million, and $480.7 million of our goods in 2011, 2010, and 2009, respectively, representing 54%, 58%, and 68% of total goods purchased during those periods. Approximately 92% to 96% of the amounts paid to ... -

Page 17

... historical information regarding the number of women's stores, men's stores, and dual-gender stores as of the end of the period indicated. 2011 2010 2009 2008 2007 Mall ...Lifestyle Center ...Street/Other * ...Total ...Total gross square footage (in thousands) ...Average gross square footage per... -

Page 18

...the United States and Canada over each of the next 3 years, which represents annual square footage growth of approximately 3% to 4%. Our new store strategy is to open...our merchandise over the Internet at our website, express.com. In 2011, our e-commerce sales increased 39% relative to 2010, which represented... -

Page 19

... of our products as a result of celebrities who wear Express clothing. In 2011, Express was referenced in a number of editorial and television credits...improved operational efficiencies, scalability, increased management control, and timely reporting that allow us to identify and respond to trends in ... -

Page 20

• • planning and allocation; and financial reporting. Competition The specialty apparel retail market is highly ... of many foreign countries. In addition, we own domain names, including express.com and express.ca, for our primary trademarks. We believe our material trademarks have significant... -

Page 21

...Fall selling patterns as well as the impact of the holiday season. In 2011, approximately 56% of our net sales were generated in the Fall season (....express.com, copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to these reports ... -

Page 22

In addition, recessionary periods may exacerbate some of the risks noted below, including consumer demand, strain on available resources, store growth, interruption of the flow of merchandise from key vendors, and foreign exchange rate fluctuations. The risks could be exacerbated individually or ... -

Page 23

Some of our competitors have greater financial, marketing, and other resources available. In many cases, our competitors sell their products in stores that are located in the same shopping malls or lifestyle centers as our stores. In addition to competing for sales, we compete for favorable site ... -

Page 24

In addition, our transportation and labor costs are subject to price volatility caused by the price of oil, supply of labor, governmental regulations, economic climate and other unpredictable factors. Increases in the demand for, or the price of, raw materials used to manufacture our merchandise and... -

Page 25

We rely upon independent third-party transportation providers for substantially all of our product shipments and are subject to increased shipping costs as well as the potential inability of our third-party transportation providers to deliver on a timely basis. We currently rely upon independent ... -

Page 26

such third parties are able to both effectively operate the businesses and appropriately project our brand image in their respective markets. Ineffective or inappropriate operation of our partners' businesses or projection of our brand image could create difficulties in the execution of our ... -

Page 27

Our failure to find store employees who can effectively operate our stores could adversely affect our business. Our success depends in part upon our ability to attract, motivate, and retain a sufficient number of store employees, including store managers, who understand and appreciate our corporate ... -

Page 28

...effect on us. We sell merchandise over the Internet through our website, express.com. Our Internet operations may be affected by our reliance on third-party... 8. Financial Statements and Supplementary Data" in Part II of this Annual Report on Form 10-K. Any claims could result in litigation against us... -

Page 29

Changes in laws, including employment laws and laws related to our merchandise, could make conducting our business more expensive or otherwise change the way we do business. We are subject to numerous regulations, including labor and employment, customs, truth-in-advertising, consumer protection, ... -

Page 30

...respect of our indebtedness. We also have, and will continue to have, significant lease obligations. As of January 28, 2012, our minimum annual rental obligations under long-term operating leases for 2012 and 2013 were $178.4 million and $158.4 million, respectively. Our substantial indebtedness and... -

Page 31

engage in transactions with affiliates; change the nature of our business; change our or our subsidiaries' fiscal year or organizational documents; and make restricted payments (including certain equity issuances). In addition, in the agreement governing our Opco Revolving Credit Facility, we are ... -

Page 32

Antitakeover provisions in our charter documents and Delaware law might discourage or delay acquisition attempts for us that our stockholders might consider favorable. Our certificate of incorporation and bylaws contain provisions that may make the acquisition of our company more difficult without ... -

Page 33

... proceedings is set forth in Note 15 to our Consolidated Financial Statements included in "Item 8. Financial Statements and Supplementary Data" in Part II of this Annual Report on Form 10-K and is incorporated herein by reference. ITEM 4. MINE SAFETY DISCLOSURE Not applicable. 25 -

Page 34

... depositories. The table below sets forth the high and low sales prices per share of our common stock reported on the NYSE since the IPO for the periods indicated. Market Price High Low 2011 Fourth quarter ...Third quarter ...Second quarter ...First quarter ... $23.52 $23.67 $24.02 $21.97 $18.45... -

Page 35

... dividends. The plotted points are based on the closing price on the last trading day of each quarter. COMPARISON OF THE CUMULATIVE TOTAL RETURN among Express, Inc., S&P 500 Index and Dow Jones U.S. Apparel Retailers Index $150 $125 Dollars $100 $75 $50 5/13/10 7/31/10 10/30/10 1/29/11 4/30... -

Page 36

... data as of January 28, 2012 and January 29, 2011 and for the years ended January 28, 2012, January 29, 2011, and January 30, 2010 are derived from our audited Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K. The selected historical consolidated financial data... -

Page 37

... Financial Statements and the related Notes and other financial data included elsewhere in this Annual Report on Form 10-K. Predecessor July 7, 2007 February 4, through 2007 Year Ended February 2, through 2011 2010 2009 2008 2008 July 6, 2007 (dollars in thousands, excluding net sales per gross... -

Page 38

...limited liability company into a Delaware corporation and changed our name to Express, Inc. See Note 1 to our Consolidated Financial Statements. In ... least thirteen full months as of the end of the reporting period. For 2011, 2010 and 2009, comparable sales include e-commerce merchandise sales... -

Page 39

... in this Annual Report on Form 10-K, particularly in the section entitled "Risk Factors." Overview Express is a nationally...across our assortment. E-commerce sales represented 10% of our total net sales in 2011. Sales growth over last year was relatively consistent by quarter, and we expect to... -

Page 40

Expand Internationally Our international expansion continued in 2011 with the opening of 6 Company-owned Express stores in Canada. In addition, we continue to earn royalties from the Express stores in the Middle East that are operated by Alshaya through the Development Agreement. We continue to be ... -

Page 41

...of the holiday season. Generally, the annual sales split is approximately 45% for the...from e-commerce increased 39% from 2010 to 2011 and comprised 10% of our net sales in 2011. Sales from e-commerce increased by 60% ... full months as of the end of the reporting period. In the fourth quarter of 2010, ... -

Page 42

...additional legal, accounting, and other expenses that we did not incur as a private company, including costs associated with public company reporting and corporate governance requirements. These requirements include compliance with the Sarbanes-Oxley Act of 2002 as well as other rules implemented by... -

Page 43

...was deemed a contribution by Express Parent of its assets and liabilities to Express, Inc., followed by the liquidation of Express Parent. As a result,...in a $6.9 million loss on extinguishment of debt. In addition, in December 2011, we used cash on hand to prepay all of the Opco Term Loan outstanding... -

Page 44

... $1,227,490 $ 678,324 $1,175,088 $ 545,978 The 80 basis point improvement in gross margin, or gross profit as a percentage of net sales, in 2011 compared to the 2010 period was comprised of 40 basis points of merchandise margin expansion and 40 basis points of buying and occupancy leverage. The... -

Page 45

...073 $409,198 The $22.8 million increase in selling, general, and administrative expenses in 2011 compared to 2010 was driven by a $21.9 million increase in payroll primarily from annual merit increases, increased share-based compensation expense, additional store payroll hours to support increased... -

Page 46

...to the repurchases of $49.2 million of Senior Notes, the amendment of the Opco Credit Facility, and the prepayment of the Opco Term Loan in 2011. The $6.3 million increase in interest expense in 2010 compared to 2009 resulted primarily from the $20.8 million loss on extinguishment of debt associated... -

Page 47

... GAAP financial measures, net income and earnings per diluted share. 2011 Earnings per Diluted Share Weighted Average Diluted Shares Outstanding (in thousands, except per share amounts) Net Income Reported GAAP Measure ...Transaction Costs (a) * ...Interest Expense (b) * ...Adjusted Non-GAAP... -

Page 48

... EBITDA and Adjusted EBITDA for the stated periods: 2011 Year Ended 2010 (in thousands) 2009 EBITDA ...Adjusted EBITDA ... $336,692 $363,440 $266,281 $309,298 $198,949 $229,750 EBITDA and Adjusted EBITDA have been presented in this Annual Report on Form 10-K and are supplemental measures of... -

Page 49

... sale and have up to 75 days to pay certain merchandise vendors and 45 days to pay the majority of our non-merchandise vendors. In 2011, we had the following significant cash transactions outside the normal course of business: • In the first quarter, we repurchased $25.0 million of Senior Notes on... -

Page 50

...the decrease in cash provided by operations primarily related to the following: • Items included in net income provided $224.0 million of cash during 2011 compared to $191.5 million during 2010. The increase in the current year was primarily driven by improved operating results of our business and... -

Page 51

...driven by capital expenditures, gross of landlord allowances, attributed to new store openings and remodels and store fixtures, totaling $60.7 million during 2011 compared to $38.9 million during 2010. Net cash used in investing activities increased $28.0 million to $54.8 million in 2010 compared to... -

Page 52

... Financial Statements for additional information related to the Company's long-term debt arrangements. Opco Revolving Credit Facility On July 29, 2011, Express Holding and its domestic subsidiaries entered into an amended and restated $200.0 million secured asset-based loan credit agreement. The... -

Page 53

... in our operating lease agreements and are not included above. Estimated annual expense incurred for such charges are approximately $93.1 million. (5) ... higher degree of judgment or complexity and are most significant to reporting its results of operations and financial position and are, therefore,... -

Page 54

Description of Policy Judgments and Uncertainties Effect if Actual Results Differ from Assumptions Gift Card Breakage We sell gift cards in our retail stores and through our e-commerce website and third parties, which do not expire or lose value over periods of inactivity. We account for gift ... -

Page 55

... if Actual Results Differ from Assumptions Intangible Assets Intangible assets with indefinite lives, primarily trade names, are reviewed for impairment annually in the fourth quarter and may be reviewed more frequently if indicators of impairment are present. The impairment review is performed... -

Page 56

Description of Policy Judgments and Uncertainties Effect if Actual Results Differ from Assumptions Claims and Contingencies We are subject to various claims and contingencies related to legal, regulatory, and other matters arising out of the normal course of business. Our determination of the ... -

Page 57

... and liabilities are recognized for the estimated future tax consequences of temporary differences that currently exist between the tax basis and the financial reporting basis of our assets and liabilities. Deferred tax assets and liabilities are measured using the enacted tax rates in effect in the... -

Page 58

... Financial Statements for further information on the calculation of the rates. We did not borrow any amounts under the Opco Revolving Credit Facility during 2011. Borrowings under our Senior Notes bear interest at a fixed rate. For fixed rate debt, interest rate changes affect the fair value of such... -

Page 59

Impact of Inflation Inflationary factors such as increases in the cost of our product and overhead costs may adversely affect our operating results. Although we do not believe that inflation has had a material impact on our financial position or results of operations to date, a high rate of ... -

Page 60

... appearing under Item 9A. Our responsibility is to express opinions on these financial statements and on the Company's internal control over financial reporting based on our audit (which was an integrated audit in 2011). We conducted our audits in accordance with the standards of the Public Company... -

Page 61

EXPRESS, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands, Except Per Share Amounts) January 28, 2012 January 29, 2011 ASSETS CURRENT ASSETS: Cash and cash equivalents ...Receivables, net ...Inventories ...Prepaid minimum rent ...Other ...Total current assets ...PROPERTY AND EQUIPMENT ...Less... -

Page 62

EXPRESS, INC. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Amounts in Thousands, Except Per Share Amounts) 2011 2010 2009 NET SALES ...COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS ...Gross profit ...OPERATING EXPENSES: Selling, general, and administrative expenses ...Other ... -

Page 63

EXPRESS, INC. CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY (Amounts in Thousands) ...compensation . . Purchase of treasury shares ...Repayment of notes receivable ...BALANCE, January 29, 2011 ...Net income ...Issuance of common stock ...Share-based compensation . . Purchase of treasury... -

Page 64

EXPRESS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) 2011 2010 2009 CASH FLOWS FROM OPERATING ACTIVITIES: Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization ...Loss ... -

Page 65

...2011, and January 30, 2010, respectively. Basis of Presentation In connection with the initial public offering of the Company's common stock ("IPO") on May 12, 2010, Express Parent LLC ("Express... Statements and the reported amounts of revenues and expenses during the reporting period, as well... -

Page 66

... transactions for up to 5 days of sales, cash on hand, and deposits with financial institutions. As of January 28, 2012 and January 29, 2011, amounts due from banks for credit and debit card transactions totaled approximately $12.6 million and $11.9 million, respectively. Outstanding checks not yet... -

Page 67

... $15.0 million as of January 28, 2012 and January 29, 2011, respectively. Advertising Advertising production costs are expensed at the time the ..."Card Agreement"). Each private label credit card bears the logo of the Express brand and can only be used at the Company's retail store locations or... -

Page 68

...leasehold improvements of $0.1 million, $0.5 million and $2.6 million in 2011, 2010, and 2009, respectively. Impairment charges are included in ...commerce website. Intangible assets with indefinite lives are reviewed for impairment annually in the fourth quarter, or more frequently if indicators of ... -

Page 69

...the respective loan agreements. As of January 28, 2012 and January 29, 2011, debt issuance costs totaled $8.9 million and $14.8 million, respectively. The... that currently exist between the tax basis and the financial reporting basis of the Company's assets and liabilities. Valuation allowances ... -

Page 70

...million and $12.9 million as of January 28, 2012 and January 29, 2011, respectively. The Company may be subject to periodic audits by the Internal ...accrued based on known claims and an estimate of incurred but not reported ("IBNR") claims. IBNR claims are estimated using historical claim information ... -

Page 71

... are the Chief Operating Decision Maker beginning in the fourth quarter of 2011, and that there is one operating segment. Therefore, the Company reports results as a single segment, which includes the operation of its Express brick-and-mortar retail stores and e-commerce operations. Prior to the... -

Page 72

... for the fifty-two weeks ended January 28, 2012, January 29, 2011, and January 30, 2010 and as of January 28, 2012 and January 29, 2011, respectively were not material and were not reported separately from domestic revenues and long-lived assets. 3. Recently Issued Accounting Pronouncements... -

Page 73

... 448,109 (236,790) $ 211,319 Depreciation expense totaled $63.0 million, $61.4 million, and $64.7 million in 2011, 2010, and 2009, respectively. 5. Leased Facilities and Commitments Annual store rent consists of a fixed minimum amount and/or contingent rent based on a percentage of sales exceeding... -

Page 74

...$196,144 1,365 19,750 4,766 $222,025 $ - - 16,275 4,766 $196,144 1,365 3,475 - $200,984 $21,041 Cost January 29, 2011 Accumulated Ending Net Amortization Balance (in thousands) Tradename ...Internet domain name/other ...Net favorable lease obligations ...Credit card relationships ... $196,144... -

Page 75

... parties on the Consolidated Balance Sheets was $68.3 million and $8.6 million, respectively, as of January 29, 2011. Prior to the IPO, under the Limited Liability Company Agreement of Express Parent ("LLC Agreement"), Limited Brands was entitled to receive a cash payment at the same time payments... -

Page 76

... to this agreement as of January 28, 2012 or January 29, 2011. Transactions with Golden Gate In connection with the Golden Gate Acquisition, the...Golden Gate an annual management fee equal to the greater of (i) $2.0 million per fiscal year or (ii) 3% of adjusted EBITDA of Express Holding. Additionally... -

Page 77

... to the Golden Gate affiliate was $1.7 million and $4.0 million, during 2011 and 2010, respectively. There was no interest on the Senior Notes in...liquidation of Express Parent. The Reorganization resulted in a taxable gain to Express Parent. Except in those few jurisdictions where Express Parent ... -

Page 78

... The following table provides the effect of temporary differences that created deferred income taxes as of January 28, 2012 and January 29, 2011. Deferred tax assets and liabilities represent the future effects on income taxes resulting from temporary differences and carry-forwards at the end of... -

Page 79

...-term liabilities for non-current deferred tax liabilities. The following table summarizes net deferred tax assets from the balance sheet: January 29, 2011 January 28, 2012 (in thousands) Current deferred taxes ...Non-current deferred taxes ...Net deferred tax asset ... $ 7,486 12,462 $19,948 $14... -

Page 80

...850 (2,311) 198,539 - $120,625 250,000 (3,218) 367,407 (1,250) $366,157 $198,539 Opco Revolving Credit Facility On July 29, 2011, Express Holding and its domestic subsidiaries entered into an Amended and Restated $200.0 million secured Asset-Based Loan Credit Agreement (the "Opco Revolving Credit... -

Page 81

...term loan ("Opco Term Loan"). Senior Notes On March 5, 2010, Express, LLC and Express Finance co-issued, in a private placement, $250.0 million of ... the principal amount on or after March 1, 2016. In the first quarter of 2011, $25.0 million of Senior Notes were repurchased on the open market at a ... -

Page 82

Topco Credit Facility On June 26, 2008, Express Topco, as borrower, entered into a $300.0 million ...expire three weeks after the merchandise shipment date. As of January 28, 2012 and January 29, 2011, there were no outstanding trade LCs. Additionally, the Company enters into stand-by letters of credit... -

Page 83

... therefore interest income received by the Company in 2010 was negligible. During 2011, 2010, and 2009, the Company repurchased certain shares of common stock or...In 2010, the Board approved, and the Company implemented, the Express, Inc. 2010 Incentive Compensation Plan ("2010 Plan"). The 2010 Plan... -

Page 84

... The expense for stock options is recognized using the straight-line attribution method. The Company's activity with respect to stock options for 2011 was as follows: Grant Date Weighted-Average Aggregate Number of Weighted Average Remaining Contractual Intrinsic Shares Exercise Price Life Value (in... -

Page 85

... (14) (69) 900 $ 4.88 $18.96 $ 7.67 $18.14 $18.52 The total fair value/intrinsic of RSUs and restricted stock that vested during 2011 was $0.1 million. No RSUs or restricted stock vested during 2010. As of January 28, 2012, there was approximately $12.8 million of total unrecognized compensation... -

Page 86

...in conjunction with the IPO, certain restricted shares became fully vested. The total fair value of restricted shares that vested during 2011, 2010, and 2009 was $0.2 million, $3.2 million, and $2.0 million, respectively. The weighted average grant date fair value of restricted shares granted during... -

Page 87

... year and have pro-rata vesting for each quarter elapsed since the prior annual vesting date. 12. Earnings Per Share The weighted-average shares used to ... stock were excluded from the computation of diluted earnings per share for 2011 and 2010, respectively, as the options would be anti-dilutive. No... -

Page 88

...distributed upon termination of employment in either a lump sum or in equal annual installments over a specified period of up to 10 years. Total expense ...Qualified Plan was $3.6 million, $2.5 million, and $1.2 million, in 2011, 2010, and 2009, respectively. The Company elected to account for this... -

Page 89

... not material to the financial statements. In a complaint filed on July 7, 2011 in the United States District Court for the Northern District of Illinois styled as Eric Wynn, et al., v. Express, LLC, Express was named as a defendant in a purported nationwide collective action alleging violations of... -

Page 90

... CONDENSED CONSOLIDATING BALANCE SHEET (Amounts in thousands) January 28, 2012 Subsidiary Guarantor Other Consolidated Express, Inc. Issuers Subsidiaries Subsidiaries Eliminations Total Assets Current assets Cash and cash equivalents ...$ 1,575 $149,237 $ - Receivables, net ...- 7,439 - Inventories... -

Page 91

... CONDENSED CONSOLIDATING BALANCE SHEET (Amounts in thousands) January 29, 2011 Subsidiary Guarantor Other Consolidated Express, Inc. Issuers Subsidiaries Subsidiaries Eliminations Total Assets Current assets Cash and cash equivalents ...$ 1,647 $186,115 $ - Receivables, net ...- 9,908 - Inventories... -

Page 92

..., INC. CONDENSED CONSOLIDATING STATEMENT OF INCOME AND COMPREHENSIVE INCOME (Amounts in thousands) Subsidiary Issuers 2011 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Net sales ...Cost of goods sold, buying and occupancy costs ...Gross profit ...Selling... -

Page 93

... STATEMENT OF INCOME AND COMPREHENSIVE INCOME (Amounts in thousands) Subsidiary Issuers 2010 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Net sales ...Cost of goods sold, buying and occupancy costs ...Gross profit ...Selling, general, and administrative... -

Page 94

... STATEMENT OF INCOME AND COMPREHENSIVE INCOME (Amounts in thousands) Subsidiary Issuers 2009 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Net sales ...Cost of goods sold, buying and occupancy costs ...Gross profit ...Selling, general, and administrative... -

Page 95

..., INC. CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS (Amounts in thousands) Subsidiary Issuers 2011 Guarantor Other Consolidated Subsidiaries Subsidiaries Eliminations Total Express, Inc. Operating Activities Net cash provided by (used in) operating activities ...Investing Activities Capital... -

Page 96

... CONSOLIDATING STATEMENT OF CASH FLOWS (Amounts in thousands) Subsidiary Issuers 2010 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Operating Activities Net cash provided by (used in) operating activities ...Investing Activities Capital expenditures... -

Page 97

... CONSOLIDATING STATEMENT OF CASH FLOWS (Amounts in thousands) Subsidiary Issuers 2009 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Operating Activities Net cash provided by (used in) operating activities ...Investing Activities Capital expenditures... -

Page 98

17. Quarterly Financial Data (Unaudited) Summarized unaudited quarterly financial results for 2011 and 2010 follows: 2011 Quarter First Second Third Fourth (in thousands, except per share amounts) Net sales ...Gross profit ...Net income ...Earnings per basic share ...Earnings per diluted share ...... -

Page 99

...of this Annual Report on Form 10-K. Changes in Internal Control Over Financial Reporting There were no changes in our internal control over financial reporting (as ...defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act of 1934) that occurred during the fourth quarter of 2011 ... -

Page 100

... Compensation-Compensation and Governance Committee Report" in the Proxy Statement for our 2012 Annual Meeting of Stockholders. ITEM 12...and "Approval of the Section 162(m) Performance Goals and Annual Grant Limitations Under the Express, Inc. 2010 Incentive Compensation Plan (Proposal No.3)-Equity ... -

Page 101

...Express, Inc. and its subsidiaries are filed as part of this report under Item 8. Financial Statements and Supplementary Data: Report...of Cash Flows for the years ended January 28, 2012, January 29, 2011, and January 30, 2010 Notes to Consolidated Financial Statements (2) Financial Statement Schedules... -

Page 102

... and Joshua Olshansky (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the SEC on April 26, 2011). Employment Agreement, dated as of February 12, 2010, by and among Express, LLC, Express Parent LLC and Michael A. Weiss (incorporated by reference to Exhibit 10... -

Page 103

... LLC to Dominic Paul Dascoli (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the SEC on September 23, 2011). Severance Agreement, dated September 20, 2011, between Express, LLC and Dominic Paul Dascoli (incorporated by reference to Exhibit 10.2 to the Current... -

Page 104

... 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Date: March 23, 2012 EXPRESS, INC. By: /s/ D. PAUL DASCOLI D. Paul Dascoli Senior Vice President, Chief Financial Officer and Treasurer... -

Page 105

EXHIBIT INDEX Exhibit No. Document 21.1 23.1 31.1 31.2 32.1 List of subsidiaries of registrant. Consent of PricewaterhouseCoopers LLP, independent registered public accounting firm. Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Certification pursuant to Section 302 of ... -

Page 106

Exhibit 21.1 Subsidiaries of Express, Inc. Name Jurisdiction of Formation Express Topco LLC Express Holding, LLC Express, LLC Express Finance Corp. Express GC, LLC Express Fashion Apparel Canada Inc. Delaware Delaware Delaware Delaware Ohio Canada -

Page 107

... ACCOUNTING FIRM We hereby consent to the incorporation by reference in the Registration Statements on Form S-3 (No. 333-178347) and S-8 (No. 333-168097) of Express, Inc., of our report dated March 23, 2012 relating to the financial statements and the effectiveness of internal control over financial... -

Page 108

...302 OF THE SARBANES-OXLEY ACT OF 2002 I, Michael A. Weiss, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of Express, Inc. for the year ended January 28, 2012; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material... -

Page 109

...OF THE SARBANES-OXLEY ACT OF 2002 I, D. Paul Dascoli, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of Express, Inc. for the year ended January 28, 2012; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact... -

Page 110

... SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Express, Inc. (the "Company") on Form 10-K for the year ended January 28, 2012 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), the undersigned Michael A. Weiss, President and Chief Executive... -

Page 111

-

Page 112