Eversource 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS, EMPLOYEES, CUSTOMERS AND BUSINESS PARTNERS

For Northeast Utilities, 2006 has been

ayear of achievement and strategic

execution. The pivotal decision made in

November 2005 to exit the competitive

business arena and focus entirely on

our regulated businesses culminated in

2006 with the successful sale of NU’s

competitive business portfolio and the

realignment of our organization to best

support our new business direction.

Wearenow a regulatedholding company

focused onour utility business, comprised

of transmission, distribution and

generationfunctions.

This strategic refocusing has positioned

us to better address the energy needs

of our region, leverage the expertise of

our employees and respond to the

opportunities of the marketplace –

advantages that havealready yielded

direct benefits forour shareholders,

customersand communities.

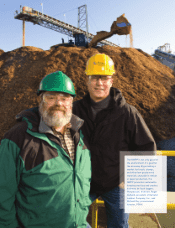

Our more focused business model

helped highlight NU’s most prominent

successes in 2006, as we provided greater

investment capital for ventures such as

our transmission build-out program,

and greater focus to realize high-benefit

projects such as the environmentally

friendly Northern Wood Power Project –

now generating electricity for customers

in New Hampshire through the burning

of wood chips.

As we continue to invest in our new

strategy, we expect to build on these

accomplishments and continue to

deliver strong business results in 2007

and beyond.

REWARDING OUR SHAREHOLDERS

In2006, our marketcapitalization

increasedfrom$3 billion to more

than $4.3 billionand we rewarded our

shareholders with the sixth straight

year of dividend growth at a rate well

ahead of the industry average.

The visibility and confidence in our

regulated investment program, combined

with the $1.34 billion sale of our

competitive generation assets, which

was a transformative transaction for the

company, contributed to a 43 percent

increase in the price of NU shares. In

December, NU’s share price rose to an

all-time high, a level that was subsequently

exceeded in February 2007, climaxing a

year of growth that provided our investors

with a 47 percent total shareholder

return for the year.

Fueled by investments in our regulated

utility assets, we expect our success to

continue. Earnings per share are projected

to grow at a compounded annual rate

of 10 to 14 percent from 2007 through

2011 – double the industry average for

regulated electric and gas delivery

companies. Consistent with this growth,

and aside from any potential impact of

marking-to-market our decreasing level

of competitive wholesale electricity

commitments, we are projecting earnings

of $1.30 to $1.55 per share in 2007.

SERVING OUR CUSTOMERS

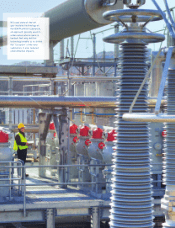

Tohelp mitigatecongestion in the

regional electric transmission system that

costs NewEngland consumers hundreds

of millions of dollars annually, and to

ensure reliable energy for our customers,

thereis an urgent need to improve and

expand New England’s transmission

system. NU is a national leader in

identifying and resolving transmission

constraints. Our transmission construction

program represents nearly 60 percent of

the Independent System Operator of

New England’s (ISO-NE) approved plan

for infrastructure improvements.

Focusing on our regulated transmission

and distribution functions is a key part

of our growth strategy. In 2006, NU

redeployed hundreds of millions of

dollars of capital into the construction

and maintenance of energy delivery

facilities required to meet New England’s

growing energy needs. Totaling $925

million in 2006, NU’s capital investments

will increase to $1.2 billion in 2007 as

part of a five-year, nearly $5 billion

transmission and distribution upgrade

DIVIDENDS PAID/SHARE

SHARE PRICE

$15.17

$20.17 $18.85 $19.69

$28.16

0605040302

$0.525 $0.575 $0.625 $0.675 $0.725

0605040302