Equifax 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 ANNUAL REPORT

THE EQUIFAX DIFFERENCE

INFORMATION SERVICES MARKETING SERVICES CONSUMER DIRECT FRAUD, SAFETY & SECURITY

Table of contents

-

Page 1

2 0 0 2 A N N U A L R E P O R T THE EQUIFAX DIFFERENCE INFORMATION SERVICES MARKETING SERVICES CONSUMER DIRECT FRAUD, SAFETY & SECURITY -

Page 2

...enables and empowers consumers to manage and protect their financial health with consumer direct services offered at www.equifax.com. Equifax employs approximately 5,000 people in 13 countries: the United States, Canada, England, Ireland, Italy, Spain, Portugal, Argentina, Brazil, Chile, El Salvador... -

Page 3

...a leading source of consumer and commercial financial information in the United States, Canada, England, Ireland, Italy, Spain, Portugal, Argentina, Brazil, Chile, El Salvador, Peru and Uruguay. We enable customers to manage risk and reduce costs. MARKETING SERVICES The Business Equifax Marketing... -

Page 4

... who are subscribers to receive alerts about inquiries or changes to their credit file, which may be an indication of fraud or identity theft. Markets Served • More than 220 million credit-active consumers in the United States and Canada • Website Link Partners • Private Label Distributors We... -

Page 5

... balance sheet Strengthened our senior management team with the addition of a new president and chief operating officer, Mark E. Miller, and a new chief financial officer, Donald T. Heroman Expanded the scope, improved the performance and enhanced the capabilities of every Equifax business unit 1 -

Page 6

... affiliate, Credit Bureau of Columbus (CBC), an independent credit reporting agency. The benefits of this purchase are twofold: the expectation of increased profitability and the opportunity to offer our customers seamless service. The Equifax Decision Power ® product suite has been another key... -

Page 7

... only, to build a proprietary database on small businesses; and the first to bring unique products to market in the emerging fraud, safety and security arena. They all demonstrate how Equifax has evolved from a data-centric company into a technology-centric enterprise. The value proposition in our... -

Page 8

...data providers online and information on 16 of the 25 million small businesses in the United States. We also have unique data attributes that enable our customers to make better decisions. As a result, Equifax is the only information services provider to produce credit reports (and ultimately scores... -

Page 9

... of the Fair Credit Reporting Act that maintain national standards for credit reporting. Preserving our current national credit reporting system is critical to providing our customers with the basis for making consistent and reliable risk decisions; to providing consumers fair and objective... -

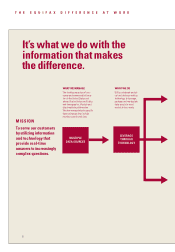

Page 10

... WE MANAGE The leading repository of consumer and commercial information in the United States and abroad that includes credit data and demographic, lifestyle and direct marketing information. We also manage industry-specific data exchanges that include member-contributed data. WHAT WE DO Utilize... -

Page 11

... SERVICES Risk management products for financial, retail, telecommunications, utilities, mortgage, brokerage, government, automotive, insurance and healthcare companies. â-² â-² HOW WE GROW PRODUCTS Develop information-based products for specific markets that enhance monitoring, screening... -

Page 12

...knowledge that translates into better risk management and increased profitability. In addition to enhanced decisioning products, Equifax Information Services was among the first to develop a suite of solutions that addresses the key issues of fraud, risk, bankruptcy and debt collection that face our... -

Page 13

... Small Business Credit Report TM gives lenders access to previously unavailable banking and lease payment information, combined with trade credit history, maximizing their ability to assess risk and make informed lending decisions. Products such as eIDverifier ®, PinnacleSM and Bankruptcy Navigator... -

Page 14

...I C E S Opportunity best summarizes this area of our business. A key acquisition in 2002 has vastly expanded the scope of our marketing products and services to encompass a full range of eMarketing solutions. With the largest body of consumer addresses, demographic information and lifestyle data in... -

Page 15

... List Select provides clients with 24/7 access to Equifax data, instantaneous count results, cross-selection and file scoring, online user reports, and the ability to rapidly download lists they have customized to their liking. industry's most sophisticated technology to offer direct marketers... -

Page 16

... consumer email notifications within 24 hours of key inquiries, or changes in his or her credit file. This product was enhanced this year to offer Identity Theft Insurance to its subscribers through a partnership with AIG eBusiness Risk Solutions, a global leader in Internet-related risk management... -

Page 17

...consumers' financial health. IDENTITY PROTECTION We expanded our Consumer Direct business to address critical consumer issues, such as identity theft. Concern with this increasing problem is a key reason that renewal rates for Equifax Credit Watch, which alerts subscribers within 24 hours of changes... -

Page 18

.... KNOW YOUR CUSTOMER Equifax has developed online and offline solutions to provide customers with a "one-stop shop" for addressing regulatory and business requirements to mitigate risks. We offer consultative services to assist customers in selecting from a number of identity verification and fraud... -

Page 19

..., Equifax was selected to manage and consolidate thousands of global lists of high-risk individuals as well as develop delivery systems for this important tool in the fight against terrorism. GRID provides the largest single source of publicly available global risk information. With daily monitoring... -

Page 20

... good communications with our shareholders and the investing public, we have made available on our corporate Website the board's Mission Statement and Governance Guidelines, the charters of each of the key board committees, and our code of business conduct and ethics. We continue to closely monitor... -

Page 21

.... D. Raymond Riddle Retired Chairman and Chief Executive Officer National Service Industries, Inc., 1989 Jacquelyn M. Ward Outside Managing Director Intec Telecom Systems, 1999 Steven J. Heyer President and Chief Operating Officer The Coca-Cola Company, 2002 Louis W. Sullivan, M.D. President... -

Page 22

...Cash Flows Consolidated Balance Sheets Consolidated Statements of Shareholders' Equity and Comprehensive Income Notes to Consolidated Financial Statements Report of Independent Auditors Report of Independent Public Accountants Executive Officers and Contacts Shareholder Information IFC 19 36 38 39... -

Page 23

... statements. OVERVIEW As a leading source of consumer and commercial credit information, we collect, organize and manage various types of ï¬nancial, demographic, and marketing information. Our products and services enable businesses to make credit and service decisions, manage their portfolio risk... -

Page 24

... we sold our City Directory business and, in the fourth quarter of 2000, we sold our risk management collections businesses in the United States, Canada, and the United Kingdom, our vehicle information businesses in the United Kingdom, and a direct marketing business in Canada. Combined revenues for... -

Page 25

... operations of the City Directory that we no longer own; - a combined $12.1 million of pre-tax income ($16.3 million in operating income less a $4.2 million loss on sale included in other income (expense net) from the risk management collections and vehicle information businesses ($8.0 million after... -

Page 26

.... As adjusted, cost of services declined 3%, driven by our decision to exit our commercial credit reporting business in Spain, lower personnel expense and professional service fees partially offset with higher royalties and data purchases expense on higher unit volumes in Equifax North America. SG... -

Page 27

... Marketing Services product line, and reported in our Equifax North America segment. Cost of services in 2001 of $451.0 million declined $62.2 million or 12%, driven by the sale of our risk management collections business in the United States, Canada and the United Kingdom, our vehicle information... -

Page 28

... Information Services. • Canadian Operations, which are comprised of the Consumer Services, Commercial Services and Credit Marketing Services that we provide in Canada; • Credit Marketing Services that we provide in the U.S.; • Direct Marketing Services, are comprised of the direct and email... -

Page 29

...our fourth quarter 2001 restructuring plan focused on rightsizing our United Kingdom operations and driving productivity. During the third quarter of 2002, we made the decision to exit the commercial credit reporting business in Spain due to local market conditions, and this business is now held for... -

Page 30

... revenue declines in our United Kingdom and Spain commercial credit reporting services. Operating income, as adjusted, in 2001 of $5.8 million declined $11.4 million from 2000 on lower revenues in the United Kingdom and Spain. E Q U I FA X L AT I N A M E R I C A YEAR 2002 COMPARED WITH 2001 and... -

Page 31

... associated with the sale of our City Directory business in 2001 and the sale of our risk management collections and vehicle information businesses in 2000. FINANCING ACTIVITIES with the spin-off. During 2001, we invested $42.3 million to repurchase 2.2 million shares of our common stock, up from... -

Page 32

...analysis of the value of the business, current market conditions, and other factors, all of which are subject to constant change. If CSC were to exercise its option, we would have to obtain additional sources of funding. We believe that this funding would be available from sources such as additional... -

Page 33

... on several factors, including their relative size to our projected beneï¬t obligation and market related value of plan assets. The discount rate we utilize for determining future pension obligations is based on the yield associated with Moody's Long-Term Aa-rated Corporate Bond Index. The discount... -

Page 34

... stock-based employee compensation on reported net income and earnings per share in annual and interim ï¬nancial statements. SFAS No. 148 does not amend SFAS No. 123 to require companies to account for their employee stockbased awards using the fair value method. However, the disclosure provisions... -

Page 35

... - - - 24.4 GAAP Revenue City Directory Risk Management U.K. Vehicle Information Adjusted Revenue GAAP Cost of Services City Directory Risk Management U.K. Vehicle Information Adjusted Cost of Services GAAP SG&A City Directory Risk Management U.K. Vehicle Information Adjusted SG&A GAAP Depreciation... -

Page 36

... units of accounting. Each product line does not impact the value or usage of other deliverables in the arrangement, and each can be sold alone or purchased from another vendor without affecting the quality of use or value to the customer of the remaining deliverables. Delivery of product lines... -

Page 37

... 31, 2002. We consider accounting for retirement plans critical to all of our operating segments because our management is required to make signiï¬cant subjective judgments about a number of actuarial assumptions, which include discount rates, health care cost trends rates, salary growth, long... -

Page 38

... but not limited to, our Annual Report on Form 10-K for the year ended December 31, 2002. Q U A N T I TAT I V E A N D Q U A L I TAT I V E DISCLOSURE ABOUT MARKET RISK In the normal course of our business, we are exposed to market risk, primarily from changes in foreign currency exchange rates and... -

Page 39

... synthetic lease for our Atlanta corporate headquarters. This derivative instrument is designated as a cash ï¬,ow hedge, was documented as fully effective under SFAS 133, and was valued on a mark-to-market basis as a liability totaling $4.7 million at December 31, 2002. This interest rate swap... -

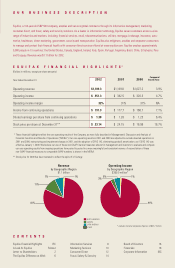

Page 40

....4 $ 1.38 $ 0.080 138.5 December 31, BALANCE SHEET DATA Total assets Long-term debt Total debt Shareholders' equity Common shares outstanding OTHER INFORMATION Stock price per share(3) Market capitalization(3) Employees - continuing operations 2002 $1,506.9 $ 690.6 $ 924.5 $ 221.0 135.7 $ 23.14... -

Page 41

SELECTED FINANCIAL DATA 2001 2000 1999 1998 $1,139.0 $ 253.8 $ 117.3 $ 32.3 $ 0.84 $ 0.225 139.0 $1,189.2 $ 308.6 $ 141.1 $ 52.3 $ 1.04 $ 0.370 136.0 $1,092.7 $ 286.3 $ 147.7 $ 52.0 $ 1.06 $ 0.363 139.6 $1,... -

Page 42

... Discontinued operations Net income Shares used in computing basic earnings per share Per common share (diluted): Income from continuing operations Discontinued operations Net income Shares used in computing diluted earnings per share Dividends per common share 2002 $1,109.3 2001 $1,139.0 2000... -

Page 43

... companies Proceeds from sale of businesses Proceeds from sale of assets Deferred payments on prior year acquisitions Cash used by investing activities Financing activities: Net short-term (payments) borrowings Additions to long-term debt Payments on long-term debt Treasury stock purchases Dividends... -

Page 44

... 69.2 26.4 32.2 358.0 Property and Equipment: Land, buildings and improvements Data processing equipment and furniture Less accumulated depreciation 29.3 115.9 145.2 94.6 50.6 32.3 134.9 167.2 112.0 55.2 Goodwill, net Purchased Data Files, net Other Assets Assets of Discontinued Operations 650... -

Page 45

... earnings Accumulated other comprehensive (loss) Treasury stock, at cost, 38.1 shares in 2002 and 35.2 shares in 2001 (Note 8) Stock held by employee beneï¬ts trusts, at cost, 6.3 shares in 2002 and 7.0 shares in 2001 (Note 8) Total shareholders' equity 2002 2001 $ 233.9 16.5 31.0 146.5 427... -

Page 46

... stock transferred to employee beneï¬ts trust Cash dividends Income tax beneï¬t from stock plans Dividends from employee beneï¬ts trusts Balance, December 31, 2000 Net income Other comprehensive loss Shares issued under stock plans Treasury stock purchased Cash dividends Spin-off of Certegy... -

Page 47

...162.2 359.4) Treasury Stock $(816.2) - - 0.4 (6.5) 8.0 35.3 - - - (779.0) - - 0.5 (49.5) - - - - (828.0) - - 0.8 (72.5) - - - $(899.7) Stock Held By Employee Beneï¬ts Trusts $(55...72.5) (11.4) 6.6 0.5 $221.0 Comprehensive Income is as follows: 2002 $178.0 (47.8) (112.4) (2.0) $ 15.8 2001 $122.5 (... -

Page 48

... statements presented have been restated to reï¬,ect the spin-off of Certegy Inc. (Note 2). Nature of Operations We provide information services to businesses to help them grant credit and market to their customers. We also provide products via the Internet to individuals to enable them to manage... -

Page 49

... to common stockholders divided by the weighted average number of common shares outstanding during the period. Diluted EPS is calculated to reï¬,ect the potential dilution that would occur if stock options or other contracts to issue common stock were exercised and resulted in additional common... -

Page 50

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Purchased Data Files Purchased data ï¬les are amortized on a straight-line basis primarily over 15 years. Amortization expense was $26.3 million in 2002, $21.8 million in 2001, and $20.2 million in 2000. As of December 31, 2002 and 2001, accumulated ... -

Page 51

... the Black-Scholes option pricing model. The fair value of options granted in 2002, 2001, and 2000 is estimated on the date of grant using the Black-Scholes option pricing model based on the following weighted average assumptions: Dividend yield Expected volatility Risk-free interest rate Expected... -

Page 52

... to stock-based employee compensation on reported net income and earnings per share in annual and interim ï¬nancial statements. SFAS 148 does not amend SFAS 123 to require companies to account for their employee stock-based awards using the fair value method. However, the disclosure provisions... -

Page 53

...areas), and customer relationships and related businesses of eight independent credit reporting agencies that house their consumer information on our system ("Afï¬liates") located in the United States and three Afï¬liates in Canada to continue to grow our credit data franchise. The consumer credit... -

Page 54

.... In October 2000, we sold our risk management collections businesses located in the U.S., Canada, and the United Kingdom, and in December 2000, sold our vehicle information business in the United Kingdom, as well as a direct marketing business in Canada that was a small component of the CIS group... -

Page 55

... of $23.2 million to write down certain technology investments, including $6.9 million of investments in several third-party technology companies. In the fourth quarter of 2001, we initiated a restructuring plan to align our cost structure with changing market conditions, reduce expenses and improve... -

Page 56

... of notes payable to banks. These notes had a weightedaverage interest rate of 3.24% at December 31, 2002 and 3.30% at December 31, 2001. In October 2001, one of our Canadian subsidiaries entered into a C$100.0 million loan, renewable annually, with a bank. The loan agreement provides interest... -

Page 57

..., the acquisition in the open market of shares constituting control without offering fair value to all shareholders, and other coercive, unfair or inadequate takeover bids and practices that could impair the ability of our Board to represent shareholders' interests fully. Pursuant to the Rights Plan... -

Page 58

...purchase one share of common stock or, under certain circumstances, additional shares of common stock at a discounted price. Treasury Stock and Employee Beneï¬ts Trusts During 2002, 2001, and 2000, we repurchased 2.9 million, 2.2 million, and 0.3 million of our own common shares through open market... -

Page 59

...of service. Supplemental Retirement Plan: We maintain a supplemental executive retirement program for certain key employees. The plan, which is unfunded, provides supplemental retirement payments based on salary and years of service. Other Beneï¬ts We maintain certain health care and life insurance... -

Page 60

... Net amount recognized Weighted-average assumptions as of December 31 Discount rate Expected return on plan assets Rate of compensation increase For measurement purposes, a 9 percent annual rate of increase in the per capita cost of covered health care beneï¬ts was assumed for 2003. The rate was... -

Page 61

... 31, 2002 and 2001, the plan's assets included 1.76 million shares of the Company's common stock with a market value of approximately $40.9 million and $42.6 million, respectively. Foreign Retirement Plans We also maintain deï¬ned contribution plans for certain employees in the United Kingdom. For... -

Page 62

...be subject to a number of factors, including credit market conditions, the state of the equity markets, general economic conditions, and our ï¬nancial performance and condition. Data Processing and Outsourcing Services Agreements We have separate agreements with IBM, PwCES LLC, Polk/Acxiom, Seisint... -

Page 63

... Denise Miller v. Equifax Inc. and Equifax Credit Information Services, Inc., which alleges that we violated the Fair Credit Reporting Act by failing to follow reasonable procedures to assure maximum possible accuracy with respect to the reporting of accounts included in a bankruptcy. All parties... -

Page 64

... are primarily organized in ï¬ve reportable segments, with three segments based on the provision of our three core product lines (Information Services, Marketing Services, and Consumer 60 Direct) within geographic regions (Equifax North America, Equifax Europe, and Equifax Latin America), and two... -

Page 65

... in the fourth quarter of 2001 and 2000 (City Directory, the risk management collections businesses in the U.S., Canada, and the United Kingdom, as well as the vehicle information business in the United Kingdom) (Note 4). Segment information for 2002, 2001, and 2000 is as follows (in millions... -

Page 66

... in acquisitions): Equifax North America Equifax Europe Equifax Latin America Other Corporate Divested Operations $ $ Financial information by geographic area is as follows: 2002 Amount Operating Revenue (based on location of customer): United States $ 826.0 Canada 80.4 United Kingdom 97.6 Brazil... -

Page 67

...by the Company as of January 1, 2002. Our audit procedures with respect to the disclosures in Note 1 with respect to 2001 and 2000 included (a) agreeing the previously reported net income to the previously issued ï¬nancial statements, (b) agreeing the adjustments to reported net income representing... -

Page 68

... respect to employee beneï¬t plan information have been revised to disclose additional detail for the Canadian Retirement Plan, Supplemental Retirement Plan, and Other Beneï¬ts with respect to beneï¬t obligations, plan assets, funded status, and amounts recognized in the statement of ï¬nancial... -

Page 69

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS TO EQUIFAX INC.: We have audited the accompanying consolidated balance sheets of Equifax Inc. (a Georgia corporation) and subsidiaries as of December 31, 2001 and 2000 and the related consolidated statements of income, changes in shareholders' equity and ... -

Page 70

...Dodge [email protected] P U B L I C R E L AT I O N S Mitchell J. Haws [email protected] TRANSFER AGENT AND REGISTRAR SunTrust Bank Stock Transfer Department P.O. Box 4625 Atlanta, Georgia 30302 Telephone (800) 568-3476 AUDITORS Ernst & Young LLP 600 Peachtree Street Suite 2800 Atlanta, Georgia 30308... -

Page 71

..., Bankruptcy Navigator Index and Score Power are registered trademarks of Equifax Inc. The Equifax Difference, Equifax Credit Report, "enlighten | enable | empower," Decision Power Insight, Equifax Credit Watch, OFAC Alert, Equifax Small Business Credit Report, Equifax List Select, Equifax Email... -

Page 72

... Difference is made daily by nearly 5,000 Equifax employees who work on behalf of consumers and customers in 13 countries. We extend our gratitude to this team for their talent and dedication. You are what keeps Equifax the vibrant, dynamic and innovative 104-year-old enterprise that it is. We...