Epson 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Epson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Seiko Epson Annual Report 2006 9

Q4. Please elaborate on how Epson plans

to streamline costs.

One major reason for lackluster earnings was inadequate

capacity to curb costs in response to falling prices. We have long

taken steps to pare back costs, but these have essentially been

cancelled out by the impact of falling prices and other factors. If

we’re going to adequately respond to market changes and still

recover to strengthen our earnings capabilities, then we have to

raise the bar when it comes to cost reductions. In terms of pro-

curement costs, product design departments are working closely

with other sections to introduce a design-to-cost approach, and

are shifting to a cost-oriented mindset. Regarding logistics costs,

we are reviewing and optimizing product delivery routes and the

ordering system for production bases, including those of Group

companies. In addressing so-called quality costs, our efforts involve

striving to address quality issues at the production source and

introducing stringent measures to prevent the recurrence of qual-

ity issues. And as far as service support costs go, we remain

committed to steps to boost quality based on feedback from our

customers, as we work to enhance efficiency in the drive to reduce

costs. We’re also improving efficiency by moving forward with the

consolidation and integration of domestic production and staffing

bases. These measures are all being developed in conjunction with

detailed action plans in place at the business unit and divisional

level. Since the key to spurring definitive earnings growth is internal

diligence, the entire Epson Group is taking part in the push to en-

hance cost efficiency.

Q5. Why did reforming Epson’s governance

system require such a drastic reduction in the

number of directors?

Reforming our system of governance is vital to reaching the

goals of our mid-range business plan. We reduced the number

of directors by such a large number, from a previous maximum

of 25 to a maximum of 10, both to strengthen Epson’s

management framework and to facilitate ongoing reforms. This

move reflects our intent to forge a structure that better exem-

plifies the checks and balances crucial to sound management.

It brings greater speed to decision-making, while simulta-

neously encouraging more vigorous debate of issues by the

board of directors. The introduction of an executive officer

system has also enabled us to separate management

functions, dividing them among directors responsible for

decision-making and oversight, and executive officers

responsible for divisional operations. In parallel, we shortened

the term of office for directors from two years to one, so

directors can be better assessed each year on the results of

the missions they have been assigned. Another decision we

made was to abolish our system of retirement benefits for

directors and corporate auditors and adopting a remunera-

tion system for senior management pegged to Epson’s share

price. Aside from strengthening the commitment of directors

to reaching their targets, these changes create a stronger

connection between compensation packages and shareholder

value. Through this renewed dedication and common stake

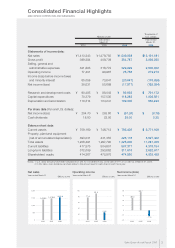

Fixed-Cost Restructuring—Details and Effect of Reductions*

* Figures based on forecasts made at the announcement of the mid-range business plan in March 2006.

(Billions of yen)

Extraordinary loss Effect of fixed-cost reductions

2006 2007 Total 2007 2008 2009 Total

Total restructuring charges in electronic devices

Site and line reorganization

One-time write-off of

technical acquisition cost

Subtotal

MD-TFD asset impairment

Production equipment

impairment/disposal

Subtotal

Line reorganization

Reduce contingent workforce by 3,000 over 3 years

IC

LCD

HTPS

Workforce

streamlining

Total

Other

(reduction in force in European area, etc.)

44.7 3.0 47.7 12.0 14.0 11.0 37.0

17.5 3.0 20.5

24.6 3.0 27.6

7.1 – 7.1 8.0 10.0 7.5 25.5

15.7 – 15.7

17.1 – 17.1

2.9 – 2.9

1.6 – 1.6

46.3 3.0 49.3

1.3 – 1.3 4.0 3.0 2.5 9.5

1.5

–1.01.02.0

1.5 1.5 4.5

2.5 7.5 12.5 22.5

16.0 23.0 25.0 64.0

(Years ending March 31)