Emerson 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 19

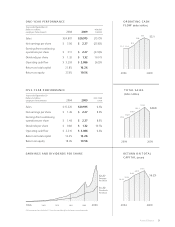

(d o l l A R s in m i l l i o n s ) 2007 2008 2009

Operating Cash Flow $3,016 3,293

Percent of sales 13.4% 13.3% 14.8%

Capital Expenditures $ 681 714

Percent of sales 3.0% 2.9% 2.6%

Free Cash Flow (Operating Cash

Flow less Capital Expenditures) $2,335 2,579

Percent of sales 10.3% 10.4% 12.2%

Operating Working Capital $1,915 2,202

Percent of sales 8.5% 8.9% 8.2%

Emerson generated operating cash ow of $3.1 billion

in 2009, a 6 percent decrease from 2008 due to lower

earnings and increased pension funding, partially offset

by signicant savings from continued improvements

in operating working capital management. The cash

operating working capital reduction of $620 million

included accounts receivable and inventory liquidations

of $1,011 million and $580 million, respectively, partially

offset by an accounts payable reduction of $709 million.

Given the signicant operating working capital reduction

in 2009, the Company expects operating cash ow to

decline in scal 2010. Operating cash ow was $3.3 billion

in 2008, a 9 percent increase from 2007, driven by higher

net earnings. At September 30, 2009, operating working

capital as a percent of sales was 8.2 percent, compared

with 8.9 percent and 8.5 percent in 2008 and 2007,

respectively. Pension contributions were $303 million,

$135 million and $136 million in 2009, 2008 and 2007,

respectively.

Free cash ow (operating cash ow less capital expendi-

tures) was $2.6 billion in both 2009 and 2008, compared

with $2.3 billion in 2007. The 10 percent increase in

free cash ow in 2008 compared with 2007 reects the

increase in operating cash ow, partially offset by higher

capital spending. Capital expenditures were $531 million,

$714 million and $681 million in 2009, 2008 and 2007,

respectively. The decrease in capital expenditures during

2009 compared with the prior year was primarily due

to the overall decline in worldwide business, while the

increase in 2008 compared with 2007 was primarily due

to capacity expansion in the Process Management and

Industrial Automation segments and construction of a

corporate data center. In 2010, the Company is targeting

capital spending of approximately $500 million. Net cash

paid in connection with acquisitions was $776 million,

$561 million and $295 million in 2009, 2008 and 2007,

respectively.

Dividends were $998 million ($1.32 per share, up

10 percent) in 2009, compared with $940 million

($1.20 per share) in 2008 and $837 million ($1.05 per

share) in 2007. In November 2009, the Board of Directors

voted to increase the quarterly cash dividend 1.5 percent

to an annualized rate of $1.34 per share. In 2008, the

Board of Directors approved a program for the repur-

chase of up to 80 million common shares to augment

an existing 2002 plan. In 2009, 21.0 million shares were

repurchased under the scal 2008 authorization; in 2008,

22.4 million shares were repurchased under the scal

2002 and 2008 authorizations; and in 2007, 18.9 million

shares were repurchased under the 2002 authoriza-

tion. 51.4 million shares remain available for repurchase

under the 2008 authorization and zero remain available

under the 2002 authorization. Purchases of Emerson

common stock totaled $695 million, $1,128 million and

$849 million in 2009, 2008 and 2007, respectively, at

an average price paid per share of $33.09, $50.31 and

$44.98, respectively.

(d o l l A R s in m i l l i o n s ) 2007 2008 2009

Total Assets $19,680 21,040

Long-term Debt $ 3,372 3,297

Stockholders’ Equity $ 8,772 9,113

Total Debt-to-Capital Ratio 30.1% 33.1%

Net Debt-to-Net Capital Ratio 23.6% 22.7%

Operating Cash Flow-to-Debt Ratio 79.9% 72.9%

Interest Coverage Ratio 12.9X 15.7X

Total debt, which includes short-term borrowings and

current maturities of long-term debt, was $4.6 billion,

$4.5 billion and $3.8 billion for 2009, 2008 and 2007,

respectively. During 2009, the Company issued

$250 million of 4.125% notes due April 2015, $250 million

of 5.00% notes due April 2019, $250 million of 6.125%

notes due April 2039 and $500 million of 4.875% notes

due October 2019, and repaid $175 million of 5% notes

and $250 million of 5.85% notes that had matured. In

November 2009, the Company issued $300 million of

4.25% notes due November 2020 and $300 million of

5.25% notes due November 2039. During 2008, the

Company issued $400 million of 5.25% notes due

October 2018 and repaid $250 million of 5.5% notes

that had matured. During 2007, the Company issued

$250 million of 5.125% notes due December 2016 and

$250 million of 5.375% notes due October 2017.

The total debt-to-capital ratio was 34.8 percent at year

end 2009, compared with 33.1 percent for 2008 and

30.1 percent for 2007. At September 30, 2009, net debt

(total debt less cash and short-term investments) was

25.7 percent of net capital, compared with 22.7 percent