Emerson 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Emerson 200916

improvements. Price increases and materials cost

containment were substantially offset by higher

wage costs.

Process Management segment sales were

$6.7 billion in 2008, an increase of $953 million, or

17 percent, over 2007, reecting higher volume and

favorable foreign currency translation. These results

reect the Company’s continued investment in next-

generation technologies and expanding the global reach

of the solutions and services businesses, as well as the

strong worldwide growth in energy and power markets.

All of the Process businesses reported higher revenues,

with sales particularly strong for the valves, measure-

ment and systems businesses. Underlying sales increased

approximately 14 percent, reecting 13 percent from

volume, which includes an estimated 3 percent from

penetration gains, and 1 percent from higher pricing.

Foreign currency translation had a 4 percent ($225 million)

favorable impact and the Brooks divestiture, net of

acquisitions, had an unfavorable impact of 1 percent

($35 million). The underlying sales increase reects

growth in all geographic regions compared with the prior

year, including Asia (21 percent), the United States

(12 percent), Europe (7 percent), Latin America

(22 percent), Canada (13 percent) and Middle East/Africa

(14 percent). Earnings increased 23 percent to

$1,306 million from $1,066 million in the prior year,

reecting higher sales volume, savings from cost reduc-

tions and materials cost containment and the benet

from foreign currency translation. The margin increase

primarily reects leverage on the higher volume, price

increases and cost containment actions, which were

partially offset by higher wage costs, unfavorable product

mix and strategic investments to support the growth of

these businesses.

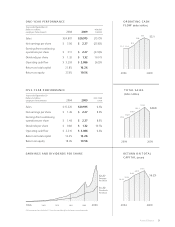

C h A n G e c h a n g e

(d o l l A R s in m i l l i o n s ) 2007 2008 2009 ‘07-‘08 ‘08 - ‘09

Sales $4,269 4,852 14%

Earnings $ 665 727 9%

Margin 15.6% 15.0%

Industrial Automation segment sales

decreased 24 percent to $3.7 billion in 2009, compared

with $4.9 billion in 2008. Sales results reect steep

declines for all businesses due to the slowdown in

the capital goods markets. Underlying sales declined

22 percent, unfavorable foreign currency translation

subtracted 4 percent ($236 million) and the System Plast

and Trident Power acquisitions contributed 2 percent

($97 million). Underlying sales decreased 25 percent

in the United States and 19 percent internationally,

including decreases in Europe (22 percent) and Asia

(15 percent). Underlying sales reect a 23 percent decline

in volume and an approximate 1 percent positive impact

from higher selling prices. Earnings decreased 51 percent

to $354 million for 2009, compared with $727 million

in 2008, primarily reecting the lower sales volume.

The margin decrease of 5.4 percentage points reects

deleverage on the lower sales volume (approximately

4 points) with signicant inventory reduction (approxi-

mately 1 point) and higher rationalization costs of

$28 million, partially offset by savings from cost reduction

actions and price increases.

Industrial Automation sales increased

14 percent to $4.9 billion in 2008, compared with

$4.3 billion in 2007. Sales grew in all lines of business and

in nearly all geographic regions, reecting strength in the

power generating alternator, uid automation, electronic

drives, electrical distribution and materials joining busi-

nesses. Underlying sales growth was 7 percent, including

8 percent in the United States and 6 percent internation-

ally, and favorable foreign currency translation added

7 percent ($278 million). The U.S. growth particularly

reects the alternator business, which was driven by

increased demand for backup generators. The interna-

tional sales growth primarily reects increases in Europe

(4 percent) and Asia (17 percent). The underlying growth

reects 6 percent from volume, as well as an approximate

1 percent positive impact from price. Earnings increased

9 percent to $727 million for 2008, compared with

$665 million in 2007, reecting higher sales volume

and the benet from foreign currency translation. The

margin decrease reects a lower payment received by the

power transmission business for dumping duties under

the U.S. Continued Dumping and Subsidy Offset Act. The

Company received only $3 million in 2008 versus

$24 million received in scal 2007. The Company does

not expect to receive any signicant payments in the

future. Margin was positively impacted by leverage on the

higher sales volume and benets from prior cost reduc-

tion efforts. Higher sales prices were substantially offset

by higher material and wage costs, as well as unfavorable

product mix, which negatively impacted margin.

C h A n G e c h a n g e

(d o l l A R s in m i l l i o n s ) 2007 2008 2009 ‘07-‘08 ‘08 - ‘09

Sales $5,150 6,312 23%

Earnings $ 645 794 23%

Margin 12.5% 12.6%

Sales in the Network Power segment

decreased 15 percent to $5.4 billion in 2009 compared

with $6.3 billion in 2008, reecting declines in the